The latest US CPI print overnight spooked risk markets as it came in a little harder than expected with the USD reversing its recent losses and Wall Street pushed down on higher interest rate worries. European shares joined in on the worry, giving back their recent gains while the Australian dollar fell sharply, pushed down more than 100 pips to almost breakthrough the 63 cent level.

US bond markets of course saw a rise in yields across the curve with 10 year Treasuries back up to the 4.6% level, flattening the curve while oil prices fell slightly after their recent retracement as Brent crude remained around the $86USD per barrel level. Gold paused is strong breakout with a minor consolidation to the $1868USD per ounce level.

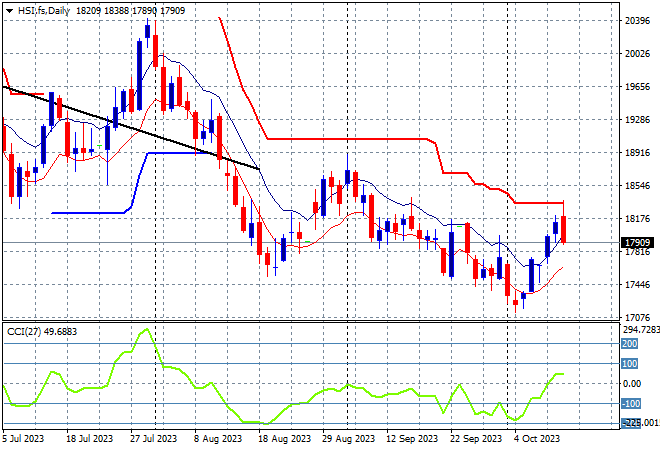

Looking at share markets in Asia from yesterday’s session where it was a very positive session across the region as mainland Chinese share markets lifted nearly 1% as the Shanghai Composite finished at 3107 points while in Hong Kong the Hang Seng Index followed through on its bounceback to gain over 1.9% to 18238 points.

The daily chart is still showing a significant downtrend that has gone below the May/June lows with the 19000 point support level a distant memory as medium term price action stays well below the dominant downtrend (sloping higher black line) following the previous month long consolidation. Daily momentum readings are now well out of oversold mode and while this bounce is turning into a breakout, I remain cautious here:

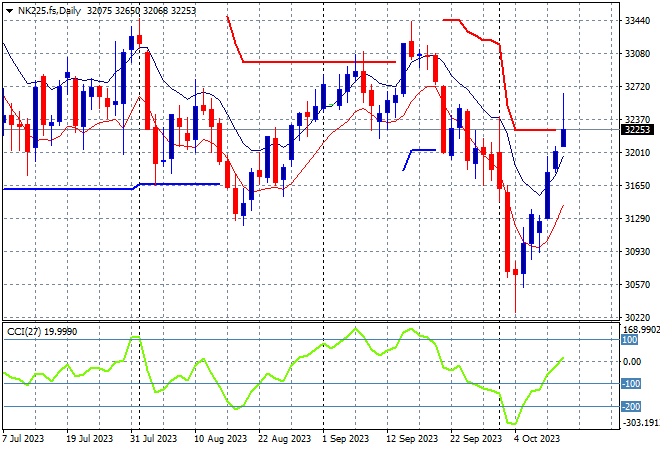

Japanese stock markets also did well with the Nikkei 225 closing 1.7% higher at 32494 points.

Trailing ATR daily resistance is now coming under threat in this very fast bounceback and while daily momentum has retraced back from oversold settings its not yet positive so just like Chinese markets I’m wary of a dead cat bounce pattern forming here:

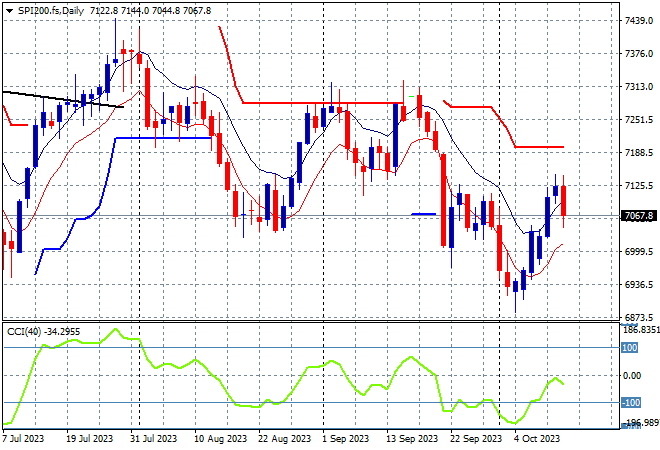

Australian stocks however were quite flat with the ASX200 closing with a scratch session at 7090 points.

SPI futures are down more than 0.8% in response to the CPI print overnight with the 7000 point level now under pressure as either strong short term resistance or support. The daily chart is not looking optimistic here with medium term price action continuing to move sideways at best:

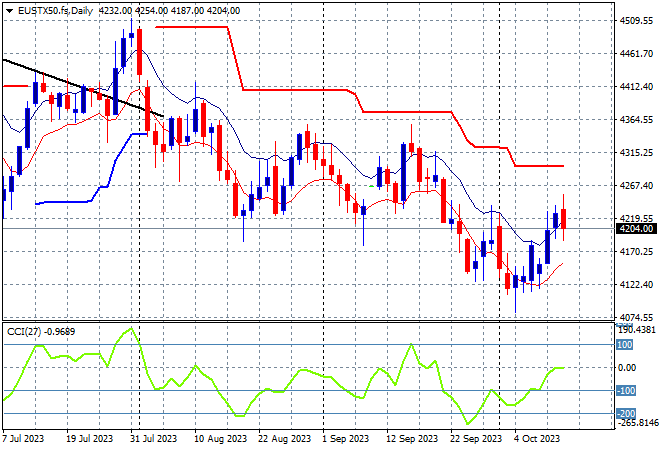

European markets also put in flat results at the end of the session, despite the FTSE lifting as peripheral bourses continued to drag the Eurostoxx 50 Index down, ending slightly lower at 4198 points even.

The daily chart still shows an overall decline with weekly support at 4100 points barely defended, as weekly resistance firms at the 4300 point resistance level. There are signs this bounce is running out of steam as daily momentum remains neutral at best and futures indicate more downside on the open tonight:

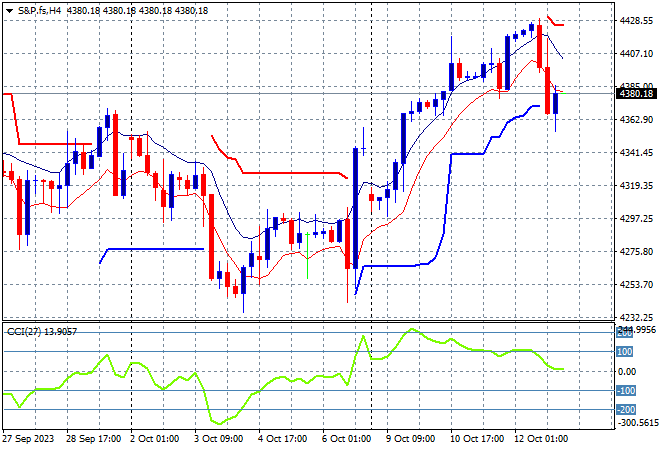

Wall Street didn’t like the CPI print however with losses across the three main bourses as the NASDAQ and the S&P500 both retracing more than 0.6% with the latter finishing at 4349 points.

While the recent PPI print gave a late boost to the market with a clearance of the 4400 point area this has been pulled back and more, almost down to the start of week position as interest rate worries continue to increase. The four hourly chart shows ATR support broken with short term momentum about to cross over into negative territory:

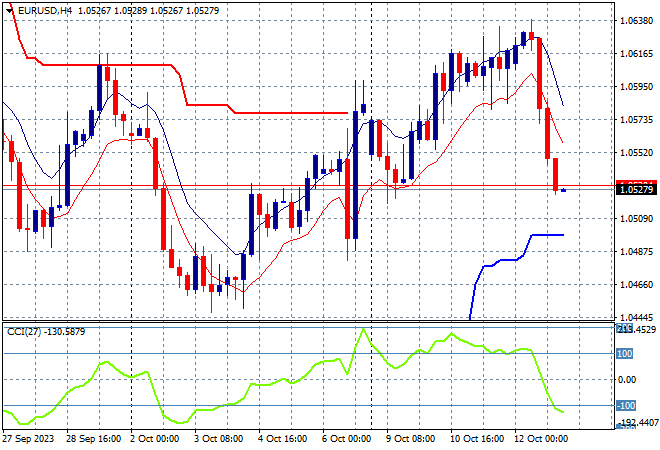

Currency markets have seen their recent fight back against USD thwarted in one fell swoop with the CPI print overnight as King Dollar reasserted itself against most of the major currency pairs. Euro was one of the biggest hitters alongside Pound Sterling with the union currency returning back to the 1.05 level at its start of week position.

In the medium term its apparent on the four hourly chart that the union currency is wanting to break above short/medium term resistance at the 1.06 handle and while short term momentum was well overbought price action had started to bunch up and pause in preparation for the CPI print, falling sharply on its release. This could result in further losses back to the previous weekly lows around the 1.04 mid area:

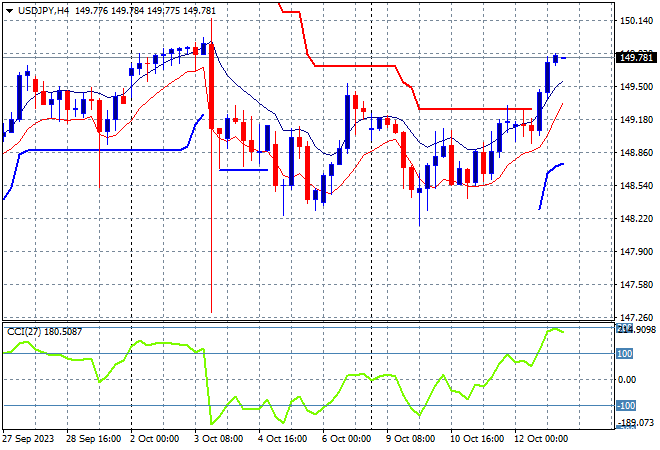

The USDJPY pair was able to breakout after recently stabilising with a push through the 149 level overnight and almost a new weekly high after a recent successful test and rejection of last week’s low at the mid 148 level.

Four hourly momentum shows a return to extremely overbought settings so I expect some further moderation in today’s session but setting up for another attempt at getting through the 150 level soon:

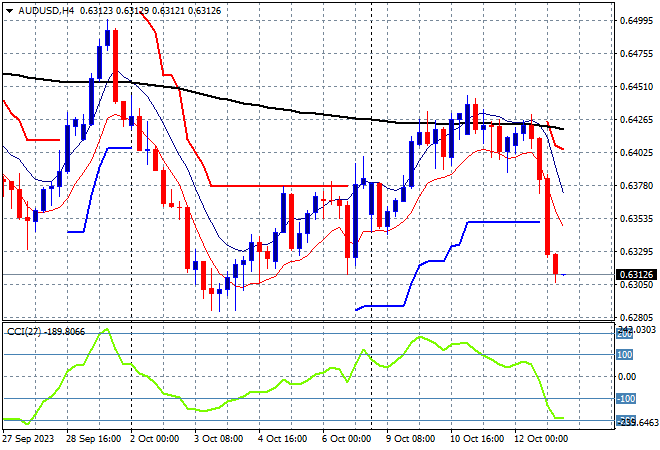

The Australian dollar was the biggest loser overnight after stalling mid week following the release of the FOMC minutes, the CPI print pushed it over the edge, causing a 100 pip plus reversal down to the 63 handle and back to the recent weekly lows.

The Pacific Peso as been under medium and long term pressure despite the recent slow climb out of the doldrums that has now turned into an elevator ride as price action already had broken the low moving average on the four hourly chart, with oversold readings likely to continue into the final sessions of the trading week:

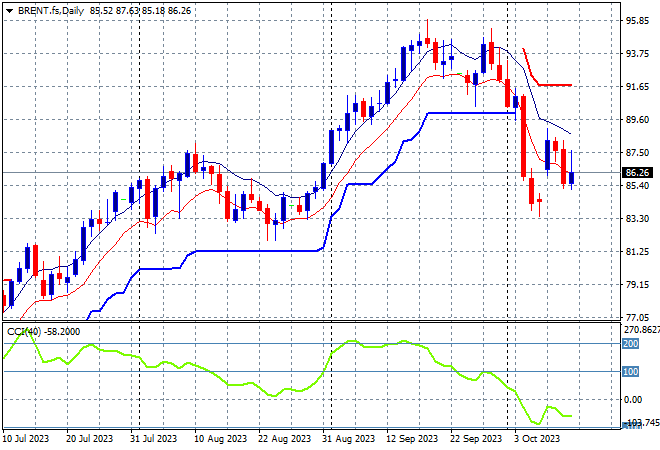

Oil markets continue their pullback with the inability to create any new session highs weighing on both markets despite growing concerns of a wider conflagration in the Middle East. Brent crude eventually finished at the $86USD per barrel level level.

After almost reaching $100 in mid September, price is looking to return to the August levels where a point of control was established before the breakout at the $87USD per barrel area. Daily momentum has nearly returned to oversold readings, so beware of a dead cat bounce completion and follow through here:

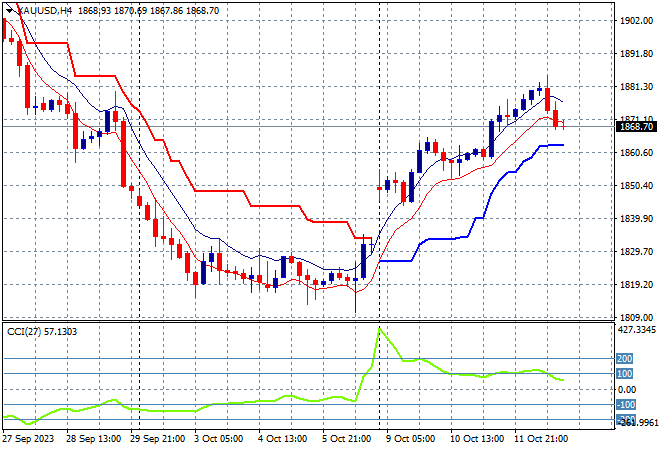

Gold was the best undollar performer overnight in reaction to the CPI print with only a modest pushback to the $1868USD per ounce level after a steady uptrend since the weekend gap higher as momentum remains positive in the short term.

The daily chart was showing a potential bottoming action before Friday’s NFP print with this breakout firming to a new two week high as short term momentum remains heavily overbought but not in extreme condition as yet: