Another solid night of improving risk sentiment on stock markets, with European bourses up 2% or more across the continent, while Wall Street also continued its rally as traders begin to anticipate tonight’s latest US inflation print. The USD Index continued to pull back, down another 0.6% mainly due to Euro surging above parity while the Australian dollar also tried to get back above the 69 cent level. On bond markets, 10 year Treasury yields lifted further above the 3.3% level with interest rate expectations firming again, now up to a 90% chance of a 75bps rise at the next Fed meeting. Crude oil lifted out of its depressed state with Brent up nearly 2% while iron ore lost about the same as gold tried to get out of its funk, pushing back above the $1720USD per ounce level.

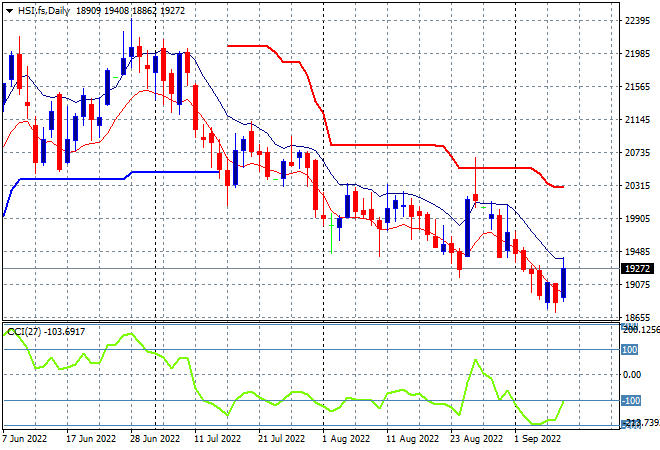

Looking at share markets in Asia from yesterday’s session, where Chinese share markets were closed for a holiday. The Hang Seng Index daily chart was looking over bearish before the Friday session, with daily momentum extremely oversold and price action at the lower edge of the moving average channel. As I warned this looked over extended and may result in a sharp swing rally soon, but there’s a distinct lack of buying support here to follow through so watch the high moving average for signs of a proper breakout:

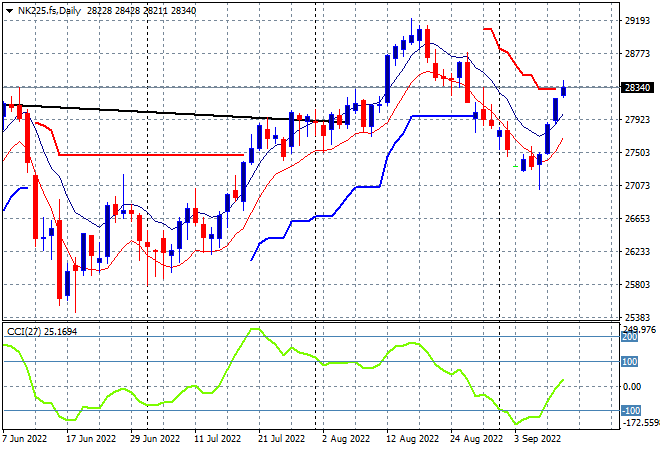

Japanese stock markets continued to add to their previous gains, with the Nikkei 225 closing some 1.1% higher at 28542 points. The daily chart is showing a return back above previous trailing ATR support level at the 28000 point area as price heads back to the early August highs. Daily momentum has now inverted from extremely oversold to nominally positive settings, which is setting up nicely for a swing play here that should extend into the new trading week. Futures are suggesting more upside potential here:

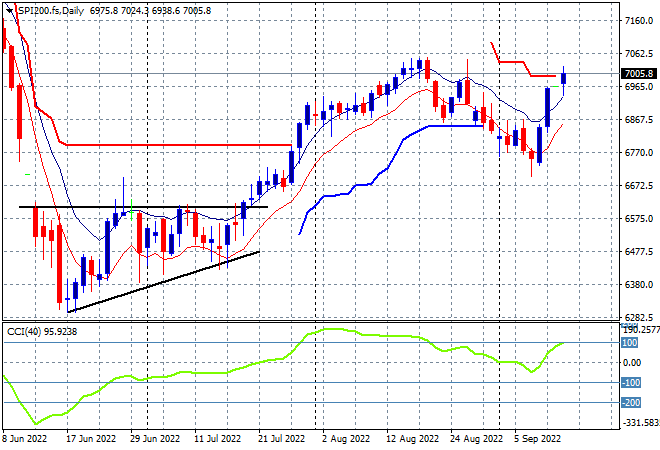

Australian stocks had a very solid start to the week, with the ASX200 closing more than 1% higher at 6964 points. SPI futures are up more than 0.6% on the continued bounce on Wall Street overnight and some stabilization in commodity prices. The daily chart shows price action also pushing well through previous trailing ATR support at the 6900 point level, with the potential rising to get back to the 7000 point former high:

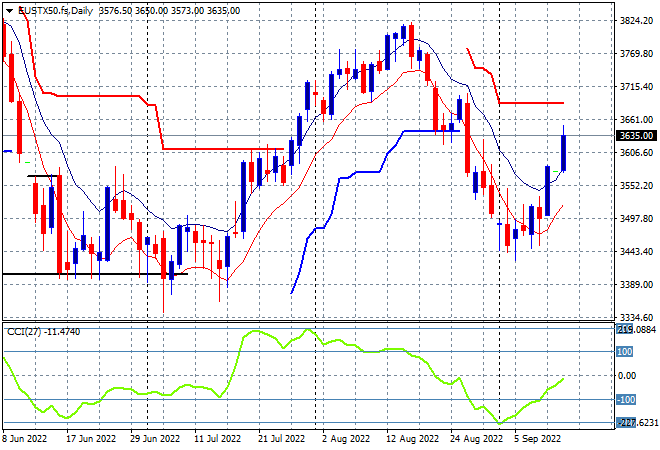

European stocks had very solid gains across the continent as risk sentiment continued to improve with the Eurostoxx 50 Index finishing more than 2.1% higher at 3646 points. The daily chart shows an obvious swing higher, bouncing solidly after price action slid down into the June lows at the 3300 level. Another market where daily momentum got slightly overextended and is now signally a good chance of a swing trade back up to the 3700 point level:

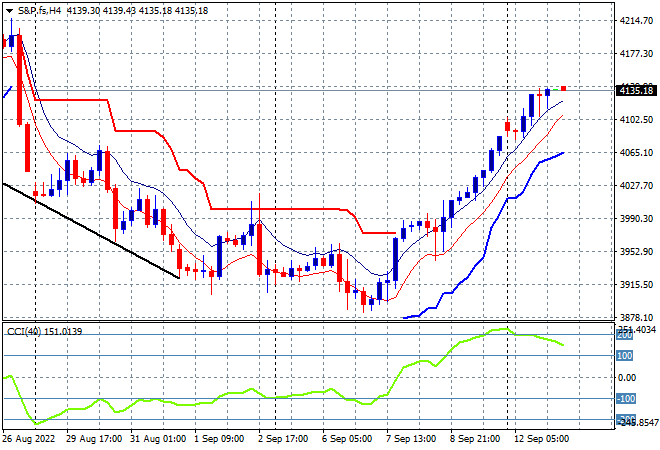

The good fortune continued on Wall Street with a near 1% increase across the board, the NASDAQ leading the way up 1.3% while the S&P500 finished 1% higher, building above the 4000 point level to close at 4110 points. The four hourly chart shows a nice bottoming cup picture to European and Japanese stocks with a proper rebound underway. Short term momentum is nicely overbought and ready to engage higher here:

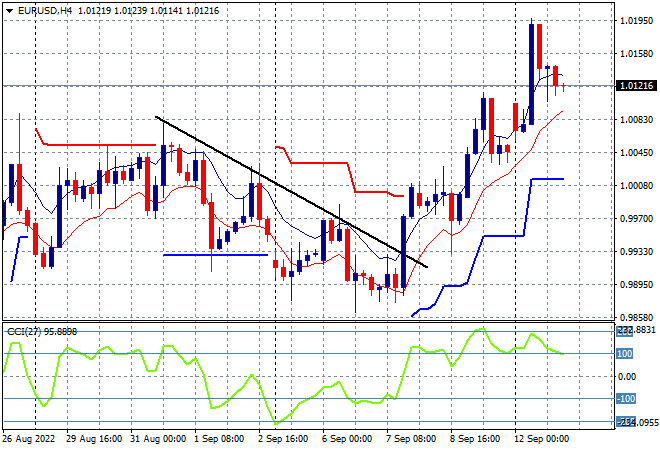

Currency markets are still seeing a reversal against the perennially strong USD with another solid move above parity for Euro in the wake of last week’s ECB rate hike before tonight’s US CPI print. While the USD is still in a strong medium term position against most of the currency pairs, this bounce has been quite fast so far, pushing through the 1.01 level after breaking through the short term downtrend line from the previous week’s highs. I still contend that parity is permanent resistance, but am watching for any breakout above that level:

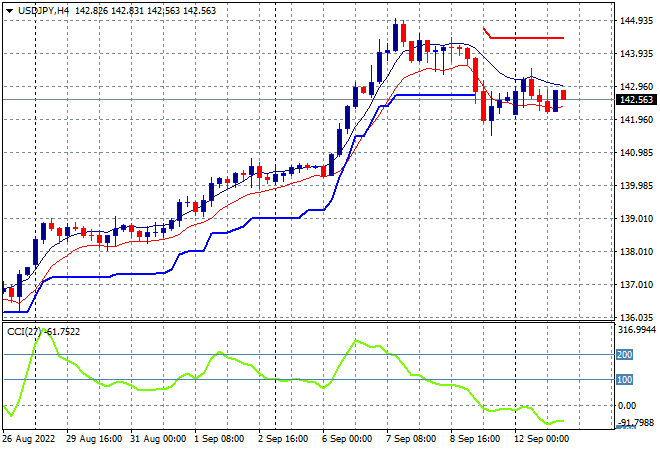

The USDJPY pair paused its pullback and remains just below previous trailing ATR support level at the 142 handle. This move was not unusual given the very low volatile trading environment after a big blowoff early in the week as price was unable to get back above the high moving average on the four hourly chart. Four hourly momentum had reverted from its overbought status and is now in negative but not yet oversold territory, so I expect price action to test around the 140 level that equates to the previous breakout level before the blowoff:

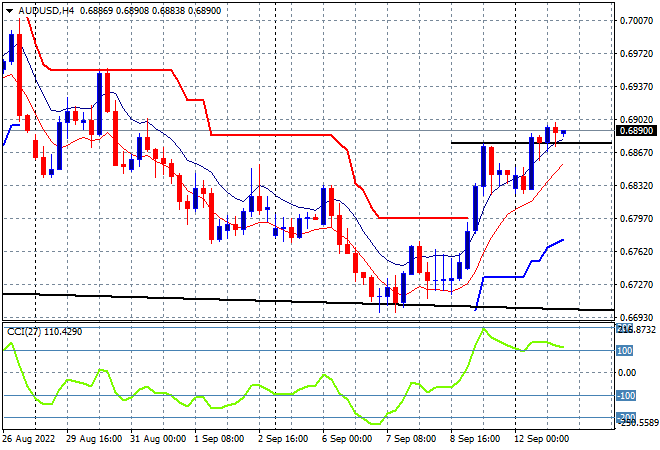

The Australian dollar had another solid move higher after looking very weak against USD heading last week, almost finishing above the 69 cent level earlier this morning after a good gap higher yesterday morning. I still contend that resistance is just too strong at all the previous levels with the 68 handle the area to watch in the week ahead to see if it too becomes the next medium term resistance level, with the upcoming US CPI print the catalyst:

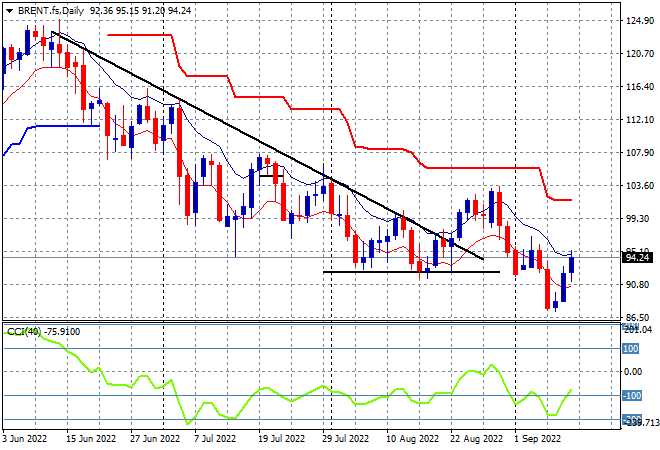

Oil markets are getting more bottom feeders here, building on the success of the Ukrainian counter-offensive over the weekend, with Brent crude gaining a little over 1% to get back above the $94USD per barrel level overnight. Daily momentum is swinging back from being somewhat oversold as price action wants to get off the floor here at the recent weekly lows:

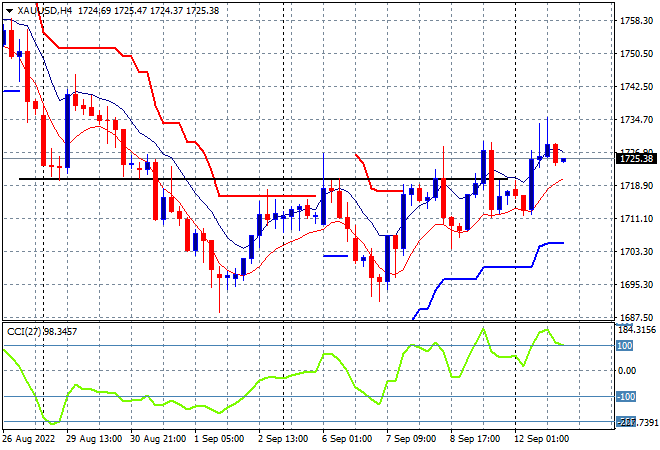

Gold is trying to get out of its funk with a series of new higher lows pushing it back up above the $1720USD per ounce level overnight. Short term resistance remains a bit strong however, note the upper tails on the four hourly chart below, so while this bounce off the $1700 level maybe promising, it could still be short lived as the USD remains too strong: