Street Calls of the Week

Asian stocks are continuing their rebound as overnight markets had solid starts, as traders position for tonight’s German and US inflation prints. The Australian dollar is basically unchanged as it remains slightly below the 69 cent level while in commodity land, oil prices are pulling back slowly with Brent crude slightly above the $94USD per barrel level. Meanwhile gold is still stuck around recent weekly resistance at the $1720USD per ounce level but is trying to breakout of this funk:

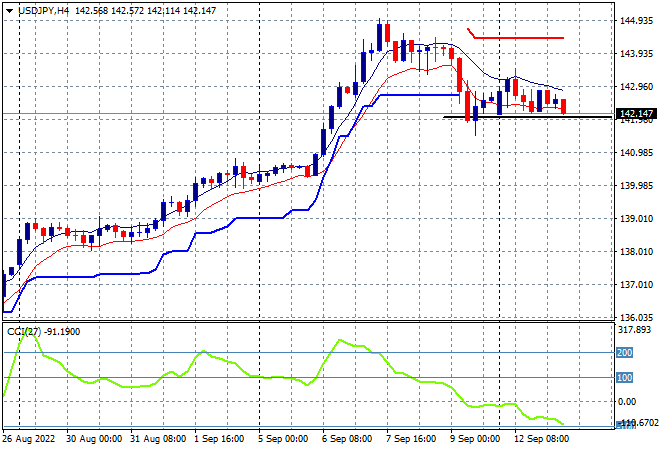

Mainland and offshore Chinese share markets returned from their holiday with the Shanghai Composite up slightly to 3264 points while the Hang Seng Index is up 0.3%, currently at 19412 points. Japanese stock markets continue to add to their previous gains, but with more modest returns as the Nikkei 225 closes just 0.2% higher at 28606 points with the USDJPY pair starting to trend lower again as it precariously heads towards the 142 level:

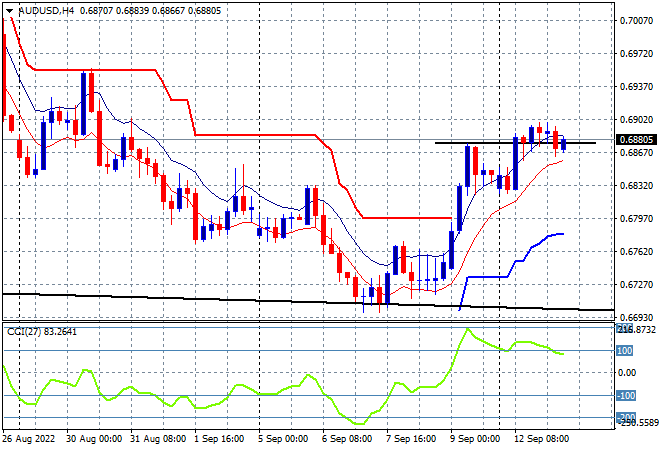

Australian stocks have also continued their solid start to the week, with the ASX200 finally pushing back above the 7000 point level, closing 0.7% higher at 7013 points. The Australian dollar is trying to hold on to its Friday night gains just below the 69 level but has gone nowhere through the session:

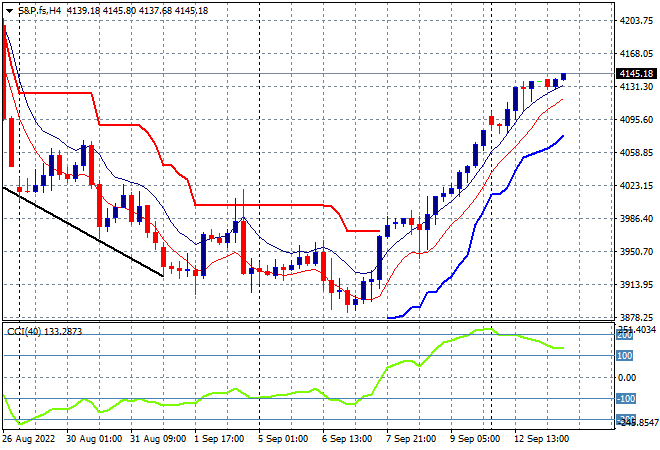

Eurostoxx and US futures are slowly edging higher after some very solid returns overnight, with the S&P500 four hourly futures chart showing price action wanting to extend above the 4100 point level as four hourly momentum remains nicely overbought as overhead resistance dissipates:

The economic calendar will focus squarely tonight on the US August core inflation print, but don’t forget the German inflation print, UK unemployment and the closely watched German ZEW survey. Busy night!