Street Calls of the Week

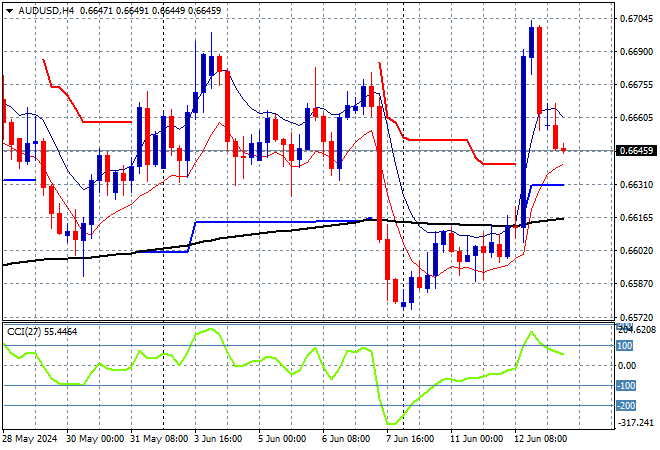

Asian stocks are mixed as markets continue to digest the overnight US CPI print with the followup PPI print tonight possibly muddying the waters on how dovish the Fed will be with its rate cuts. The Australian dollar had almost zero reaction to the latest unemployment print locally and is stuck at the mid 66 cent level.

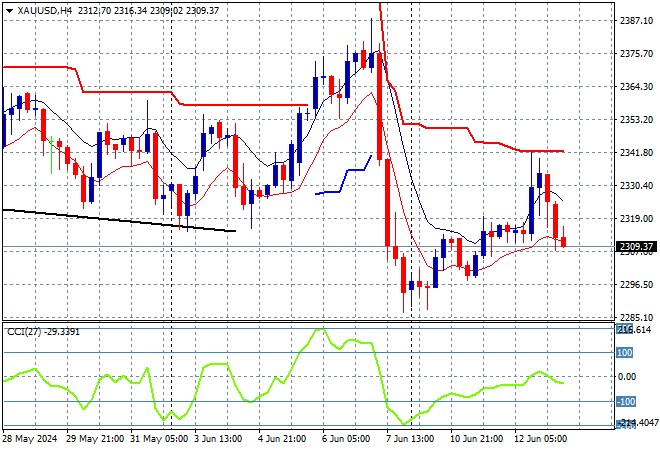

Oil prices have fallen marginally with Brent crude holding on its post weekend gains to stay above the $82USD per barrel level while gold has fallen back towards the $2300USD per ounce level still reeling after its Friday night slump.

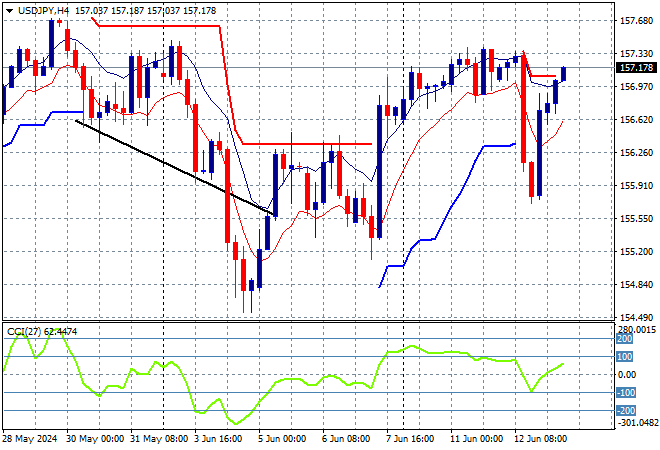

Mainland Chinese share markets are looking hesitant again with the Shanghai Composite down by 0.2% while the Hang Seng Index has stopped its breakdown, but is up only 0.4% to 18002 points. Meanwhile Japanese stock markets are stuck in a holding pattern with the Nikkei 225 up 0.1% to 38828 points as the USDJPY pair holds steady above the 157 level:

Australian stocks have rebounding after their slump with the ASX200 up nearly 0.5% to 7750 points even while the Australian dollar has barely moved following the unemployment print as it remains stuck at the mid 66 cent handle:

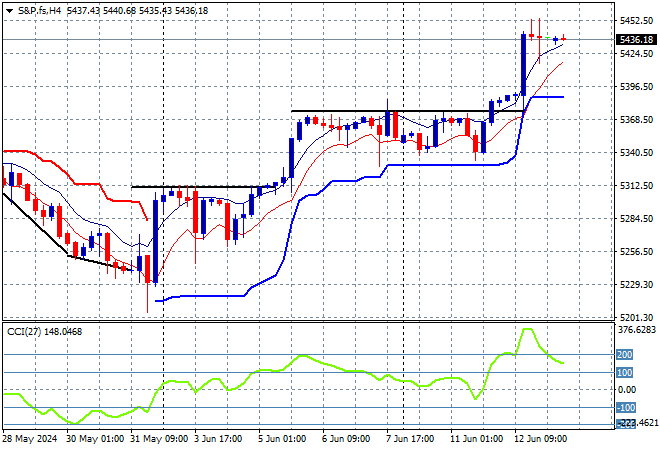

S&P and Eurostoxx futures are both down marginally as we head into the London session with the S&P500 four hourly chart showing price action holding well above the breakout level from last night as short term momentum remains well into overbought mode:

The economic calendar tonight will focus on the latest US PPI print.