While the headline Dow Jones is up for the 8th session in a row, more broadly Wall Street didn’t like the slump in consumer sentiment and further inflation fears despite some solid earnings. The USD ended the week slightly lower but Euro and Pound Sterling didn’t make large gains on Friday night, with the Australian dollar stalling again right on the 66 cent level.

10 year Treasury yields moved higher again to remain above the 4.5% level, while oil prices couldn’t stabilise with Brent crude pushed below the $83USD per barrel level. Meanwhile gold held on to its recent gains to remain above the $2350USD per ounce level.

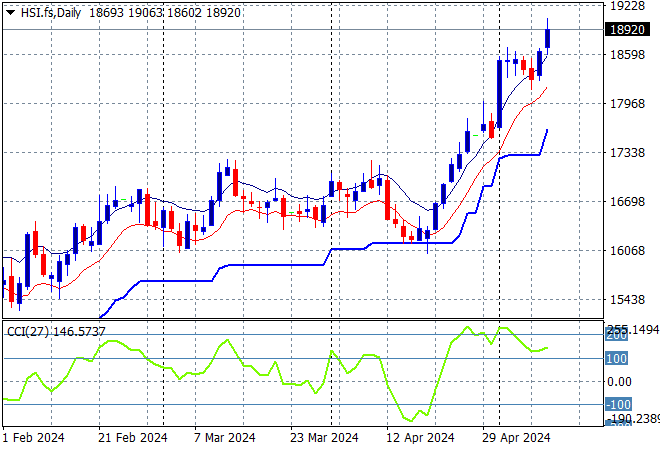

Looking at markets from Friday’s session in Asia, where mainland Chinese share markets saw a small lift with the Shanghai Composite up more than 0.2% while the Hang Seng Index had a super strong session, closing up more than 2% at 18963 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. Price action looks way overextended without any retracement to take heat out of the market, but this looks very optimistic indeed:

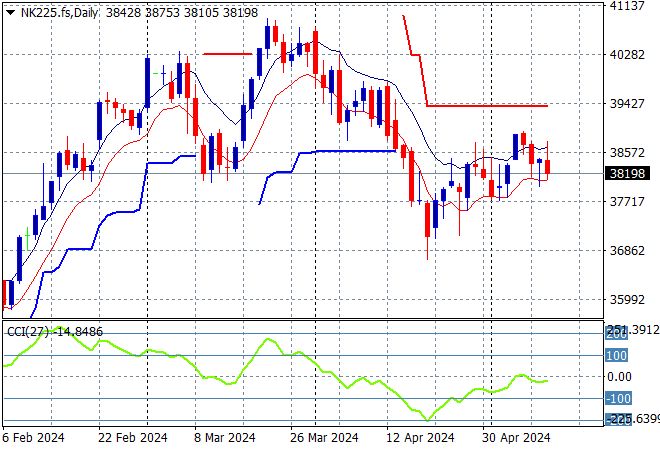

Meanwhile Japanese stock markets were able to make some small gains with the Nikkei 225 up more than 0.4% at 38229 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance has been defended with short term price action now retracing to support at the 39000 point level. Watch the 38000 support level to remain solid here:

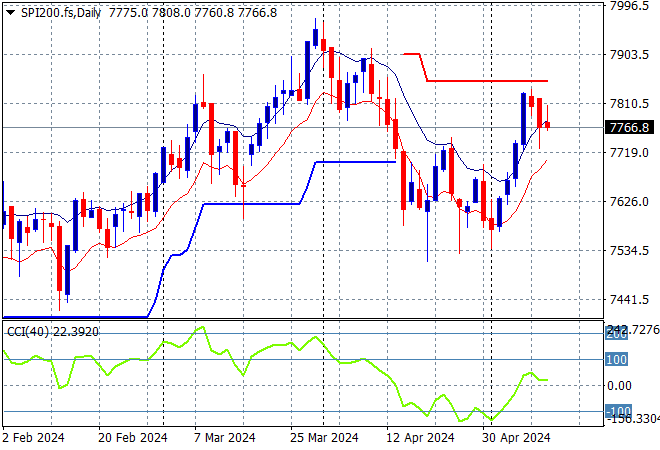

Australian stocks had better returns than most with the ASX200 closing 0.3% higher at 7748 points.

SPI futures are down 0.2% due to the less than stellar finish on Wall Street from Friday night. The daily chart was showing a potential bearish head and shoulders pattern forming with ATR daily support tentatively broken, taking price action back to the February support levels. Momentum is finally getting out of its oversold condition with this breakout setting up for potential upside:

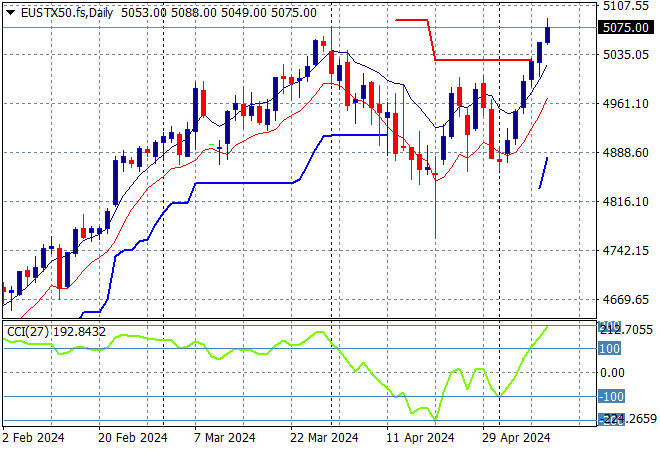

European markets put in a more positive finish to the trading week across the continent, as the Eurostoxx 50 Index closed some 0.6% higher at 5085 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This is looking to turn into a larger breakout with support at the 4900 point level quite firm f0r now:

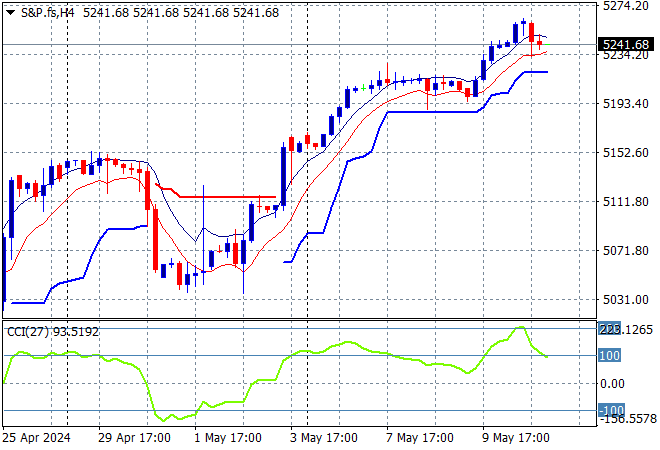

Wall Street lost its mojo yet again with mixed results as the headline Dow advanced while the NASDAQ fell back slightly and the S&P500 eked out just a minor gain, finishing 0.1% higher at 5222 points.

The four hourly chart was showing a fairly wide trend channel forming after bottoming out at support at 5000 points but lost significant momentum following Friday’s rebound, and thus a full retracement through trailing ATR support at the 5100 point level. Price action was stalled at the 5200 point area with momentum now getting back into nicely overbought settings:

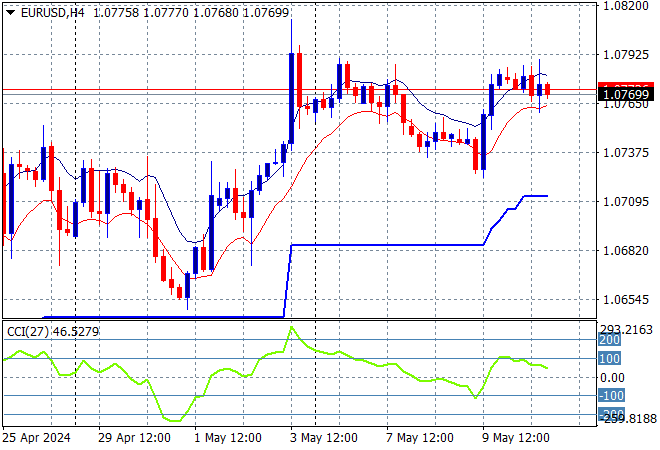

Currency markets remain somewhat against USD with the drop in consumer sentiment helping the majors hold fast against King Dollar, led by Euro as it finished the week where it started well above the 1.07 handle.

The union currency had previously bottomed out at the 1.07 level at the start of April as medium term price action with a reprieving reversal in price action back towards the 1.09 level before last week’s inflation print. Short to medium term support at the 1.0630 level has been respected so far, with a breakout now back to the 1.08 level although momentum is not quite overbought:

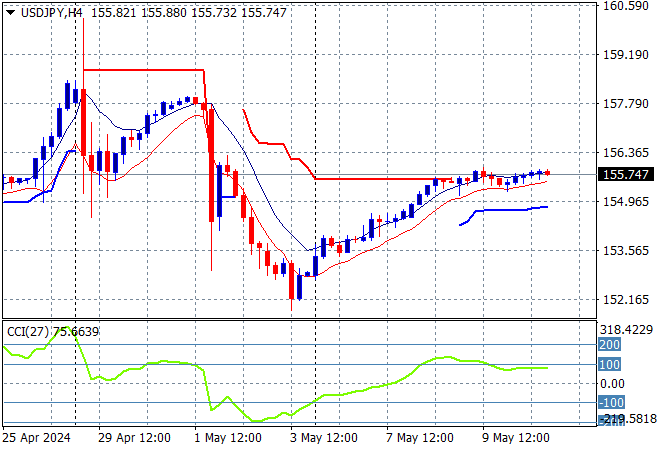

The USDJPY pair is stalling out a little after climbing back higher after its wild ride last week, last night time steadying at the mid 155 handle to nearly complete a rebound from its weekly low on Friday night.

This is not looking good in the short term for a lot of traders but looking through the volatility I thought we’d see some stability return around the 155 handle but not yet – watch for a potential breakout above trailing ATR at the 155 handle next:

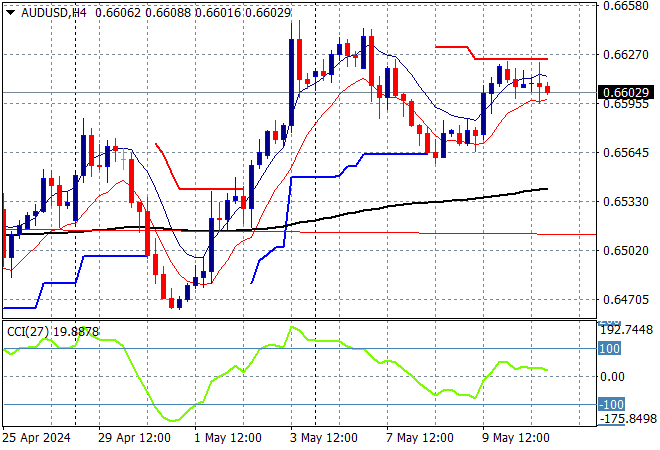

The Australian dollar got some relief in the previous session but has been unable to extend further above the 66 cent handle to finish the week below the previous weekly highs.

The Aussie has been under medium and long term pressure for sometime before the RBA and Fed meetings and while the previous temporary surge looked strong, it wasn’t overbought on the four hourly chart and had not surpassed support from last week’s consolidation phase. This tentatively looks good for the Pacific Peso but I’m watching the mid 66 handle next:

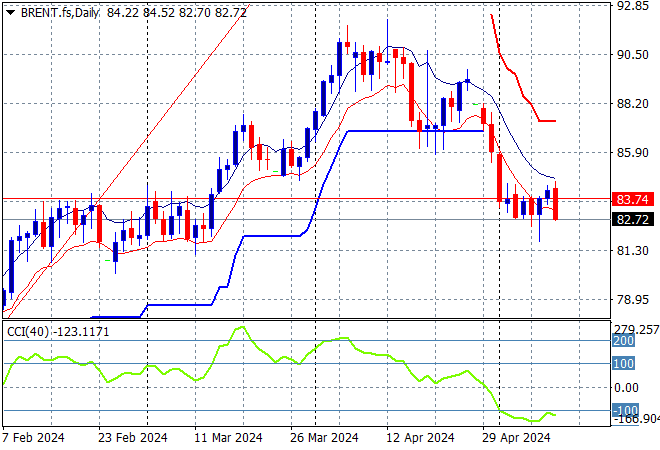

Oil markets are barely holding on after a lot of intrasession volatility despite the latest round of Middle East conflicts with volatility seeing Brent crude lift fall back below the $83USD per barrel level after briefly touching the $81 area in the previous session.

After breaking out above the $83 level last month, price action has stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Watch daily ATR support here at the $86 level which is still broken and will likely be resistance for sometime:

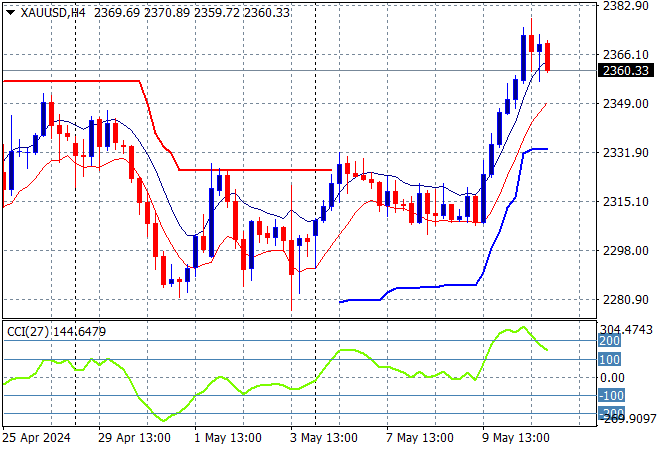

Gold finally got back on trend following the inflation talk from the Fed overnight with a big surge that has seen it recover all of its retracement earlier in the month with a return to well above the $2340 level.

While the recent rebound was not enough to get over shorter term ATR resistance this one has surpassed this and taken the shiny metal back up to but not above the late April highs at the $2350 level with momentum now fully overbought: