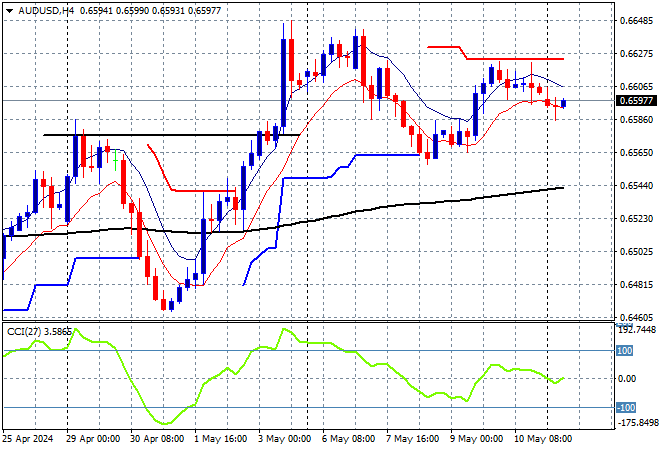

A slow start to the new trading week with local markets putting in scratch sessions as the forthcoming Federal Budget looms large on risk taking. The USD is still in a weak phase although both the Euro and Pound Sterling are trying to lift going into the London open. The Australian dollar is failing to hold above the 66 cent level as it gave up more ground this afternoon.

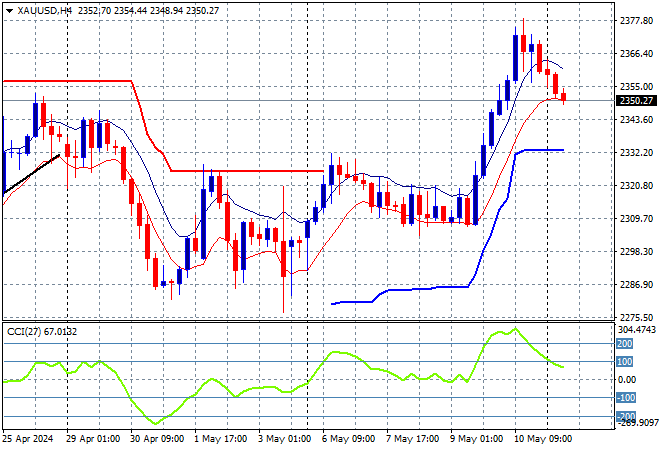

Oil prices are failing to stabilise after their recent sharp falls with Brent crude now falling below the $82USD per barrel level while gold was unable to hold on to its Friday night gains over the weekend, but still in a good position here just above the $2350USD per ounce level this afternoon:

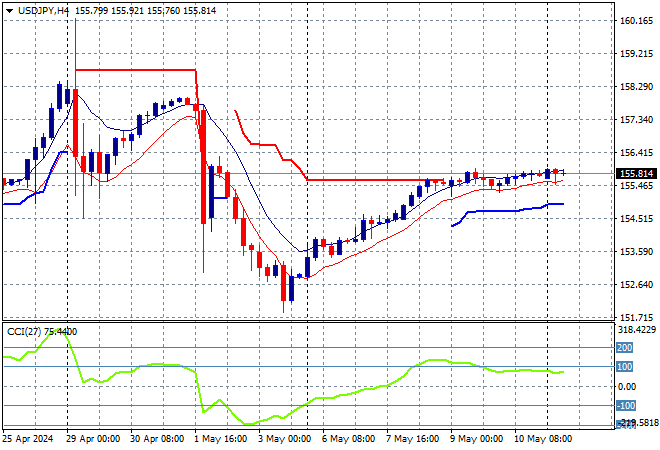

Mainland Chinese share markets are seeing a small pullback with the Shanghai Composite down more than 0.3% while the Hang Seng Index is continuing its advance, currently up 0.4% to 19046 points. Meanwhile Japanese stock markets have slipped back slightly, with the Nikkei 225 down 0.1% at 38179 points with the USDJPY pair still pausing here above the mid 155 level:

Australian stocks are barely moving with the ASX200 closing with a scratch session at 7751 points while the Australian dollar is also largely unchanged, creeping just below the 66 cent level as it remains unable to breach the early May high:

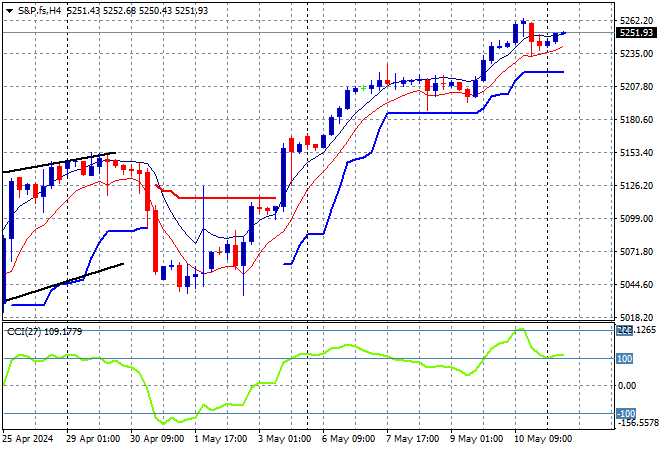

S&P and Eurostoxx futures are rising slightly as we head into the London session with the S&P500 four hourly chart showing price action wanting to extend its breakout above the 5200 point level:

The economic calendar starts the trading week slowly with a few Fed speeches and some US Treasury auctions.