Asian share markets are somewhat adrift due to the closure of Chinese markets for the Chinese New Year break despite a strong lead from Wall Street on Friday night, with reduced volatility in bond and currency markets not helping either. The USD is steady after some lost ground while the Australian dollar is still looking very weak at just above the 65 cent level.

Oil prices are gaining slightly with Brent crude about to move beyond the $82USD per barrel level while gold is failing to push higher in Asian trade as it begins to stumble at the $2020USD per ounce level:

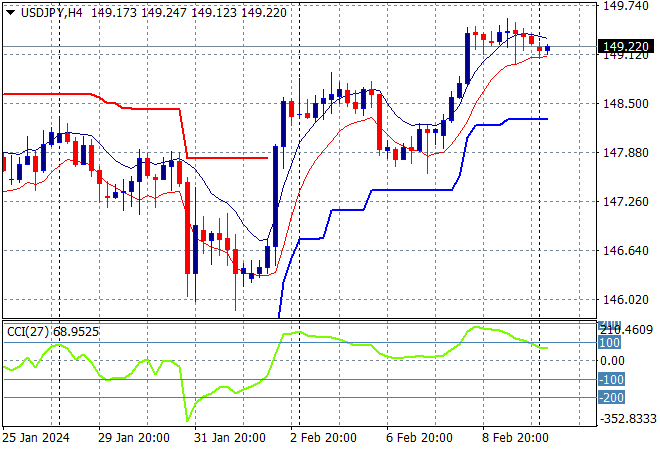

Mainland Chinese share markets remain closed while in Hong Kong the Hang Seng Index has also closed. Japanese stock markets are putting in scratch sessions with the Nikkei 225 about to close nearly 0.1% higher at 36897 points while the USDJPY pair has retreated slightly from its Friday night close just above the 149 level:

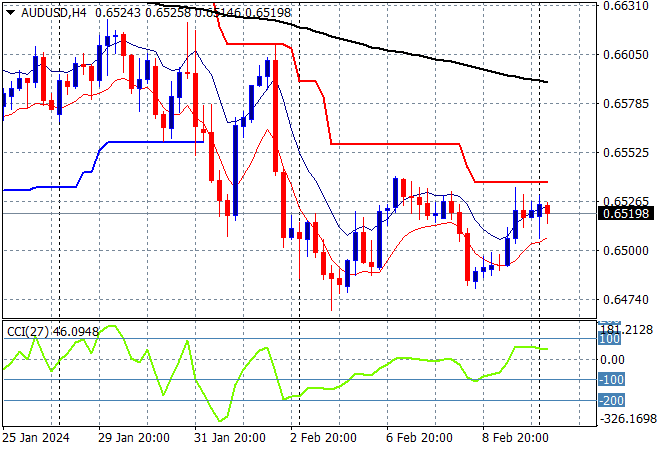

Australian stocks are not doing well in the first session of the trading week with the ASX200 down 0.3% at 7619 points while the Australian dollar is dead flat after the weekend gap following the recent half hearted bounce above the 65 cent level from last week’s RBA meeting:

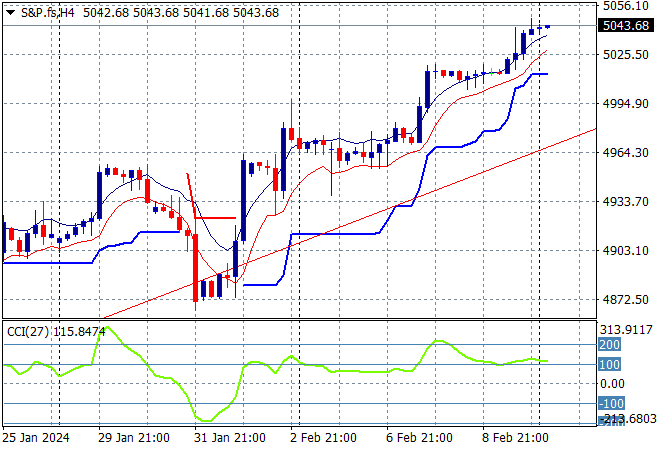

S&P and Eurostoxx futures are holding on to their Friday night positions going into the London session although European stocks will be playing catchup as the S&P500 four hourly chart shows price action zooming well above the 5000 point level:

The economic calendar starts the trading week quietly with a few minor Fed speeches.