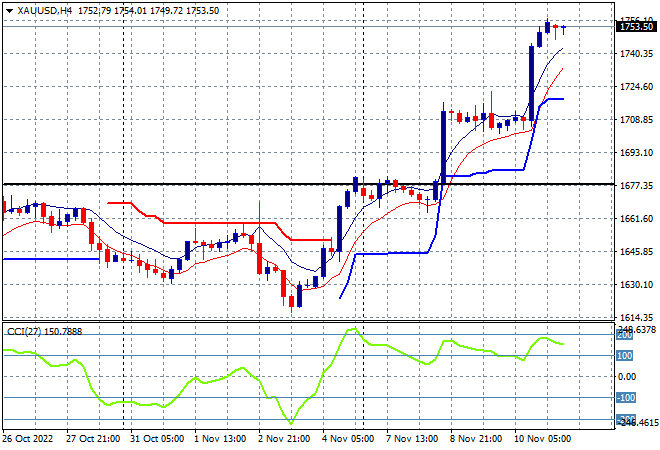

A sea of sweet blue/green across Asian stock markets today in reaction to the mammoth rises on Wall Street overnight as the risk complex does a 180 degree turn on the latest US inflation print, having tossed aside concerns about a hamstrung US Congress following the mid term elections. The USD is still down against almost all the currency majors with Euro almost getting back above the 1.02 level while the Australian dollar moves further above the 66 handle. Oil prices are still looking weak however with Brent crude just below the $94USD per barrel level while gold is surprisingly holding on to its recent big surge, currently at the $1753USD per ounce level:

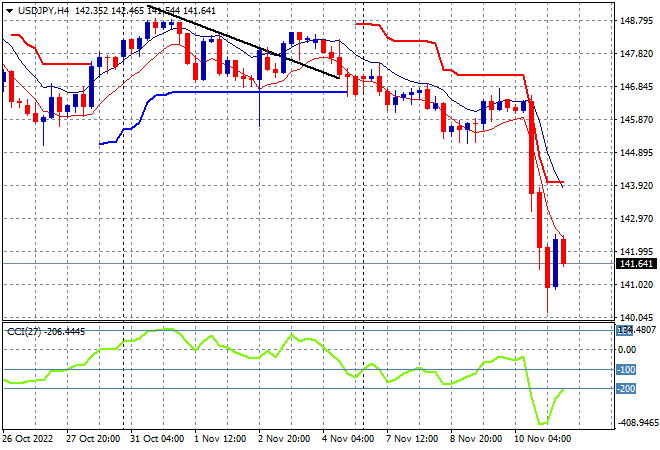

Mainland Chinese share markets are surging with the Shanghai Composite looking to finish up 1.3% to 3063 points while the Hang Seng Index has skyrocketed over 5%, currently at 16962 points. Japanese stock markets are also in buy mode, with the Nikkei 225 closing nearly 3% higher at 28250 points, despite the USDJPY pair slumping 500 pips overnight and now trying to stabilise but looking very weak at just above the 141 handle:

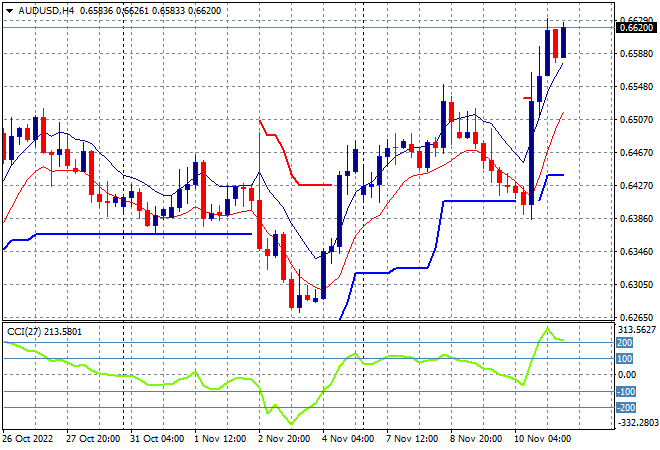

Australian stocks couldn’t escape the buying frenzy with the ASX200 closing 2.7% lower, this time well and truly breaking above the 7000 point level to finish the trading week at 7154 points. The Australian dollar was also pushed higher, now advancing beyond the 66 handle with the four hourly chart looking to put former resistance at the October high position behind it:

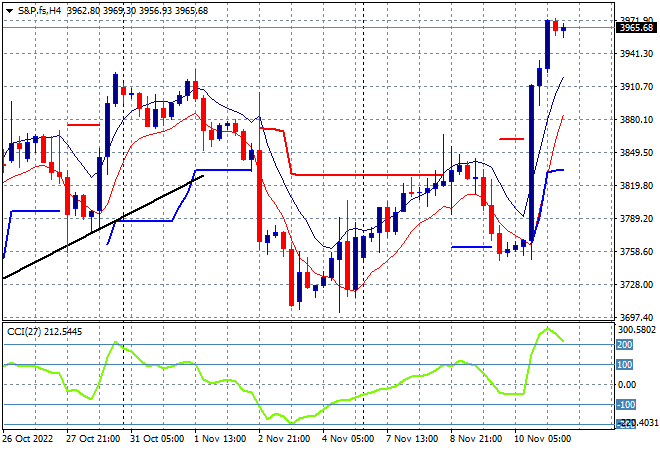

Eurostoxx and US futures are wanting to build on last nights huge gains but may find some buying fatigue here, although the S&P500 four hourly chart shows price action definitely above the former highs. This market was well contained before the inflation print, and wants to get on to the 4000 point level and put behind the recent volatiltiy!

The economic calendar will finish the week with more inflation prints, this time in Germany, then UK GDP followed by the closely watched Michigan consumer sentiment survey.