Risk markets were unable to make substantive moves higher overnight despite a solid session on Wall Street and a slightly weaker USD as ECB concerns of a European recession pushed most European shares lower. The weaker USD meant some relief for Euro while the Australian dollar retraced back below the 67 cent level.

10 year Treasury yields had another roundtrip to remain around the 4% level while oil prices pulled back alongside a reversal in natural gas prices with Brent crude finishing more than 1% lower to just below the $77USD per barrel level. Gold continued its mild decline following its post weekend slump to remain below the $2030USD per ounce level.

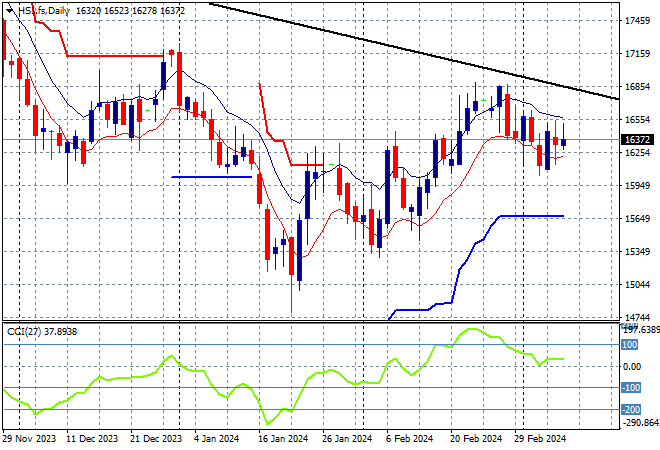

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets were up initially but have fallen back in afternoon trade as the Shanghai Composite again remains below the 2900 point barrier, closing some 0.5% lower at 2857 points while in Hong Kong the Hang Seng Index was down a similar amount to 16097 points.

The daily chart was showing a significant downtrend that had gone below the May/June lows with the 19000 point support level a distant memory as medium term price action remained stuck in the 17000 point range before this new losing streak. Daily momentum readings are retracing back to oversold settings as price action wants to return to the October lows, with little chance of stabilising here:

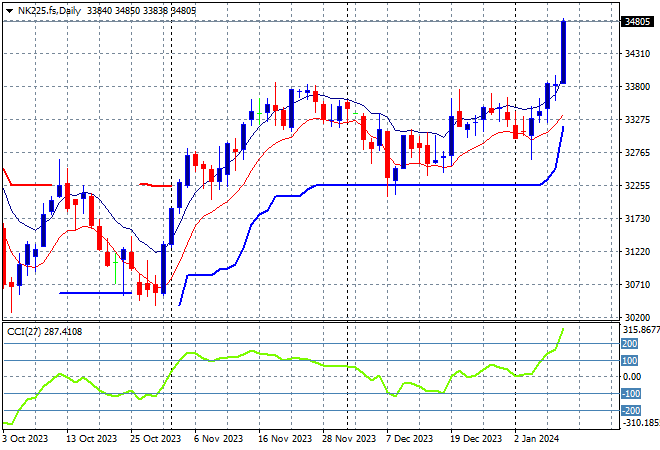

Japanese stock markets were able to re-engage to the upside with the Nikkei 225 up exactly 2% to 34441 points.

Trailing ATR daily support was being threatened by price action after this bounce went beyond the September highs at the 33000 point level with daily momentum now returning to the overbought zone. Correlations with a stronger Yen are breaking down here with a selloff back to ATR support at 32000 points unlikely as the November highs are wiped out in this breakout:

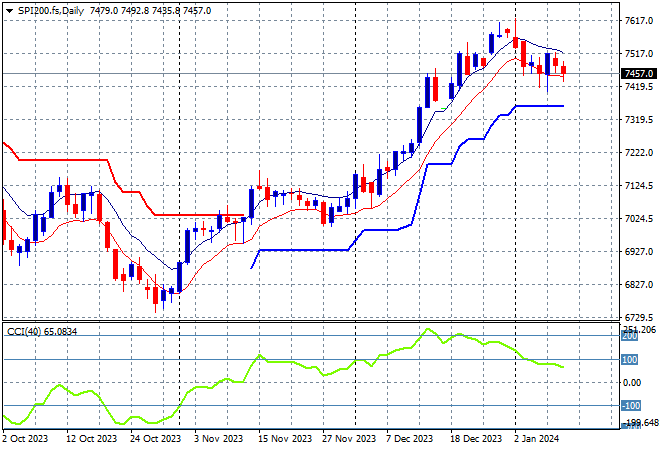

Australian stocks didn’t like the November CPI print, with the ASX200 down more than 0.6% at 7468 points.

SPI futures are up approximately 0.2% after the solid returns on Wall Street overnight. The daily chart is still looking very optimistic here in the medium term with short term price action however suggesting a possible reversal underway as daily momentum starts to wane and resistance at the 7600 point level builds. Watch for any dip below the low moving average:

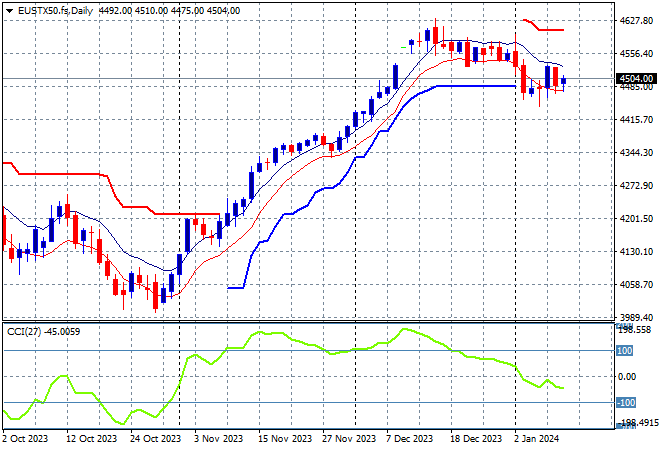

European markets were unable to push higher after the solid start to the week with mixed returns across the continent as the Eurostoxx 50 Index finished just 0.1% higher at 4468 points.

The daily chart shows weekly support remaining firm at the 4480 point level but a failure to make a new high above the early December 4600 point level is starting to drag overall momentum down with a full retracement now below overbought settings. Futures are indicating a neutral session ahead so watch daily support which should remain strong here:

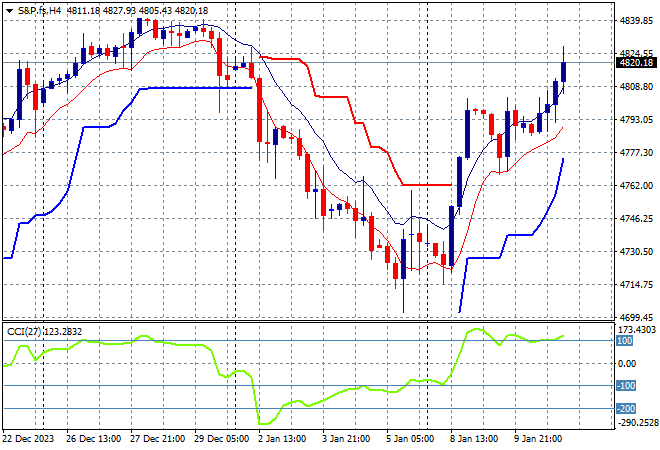

Wall Street however was able to follow through with solid sessions across the board as the NASDAQ put on 0.7% while the S&P500 closed some 0.5% higher at 4783 points.

Short term momentum is now retracing out of oversold territory on the four hourly chart, with a very strong breakout pushing through trailing ATR resistance. Support has been strong at the 4700 point level proper as more trading volume and an absorption of the NFP print into macro considerations give rise to a new rally here:

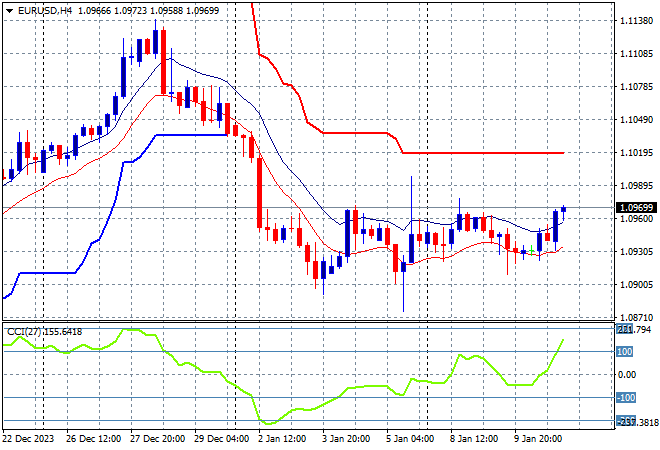

Currency markets are still in thrall to the USD following Friday night’s NFP print despite a small weekend gap lower and some weakness overnight. Euro remains anchored near the 1.09 handle with a small breakout overnight although nominally just back to last week’s intrasession high.

The union currency was looking weak but with the potential for a swing trade higher before the print but short term momentum has switched to positive even though price action is still well below trailing ATR resistance after bouncing off the December lows:

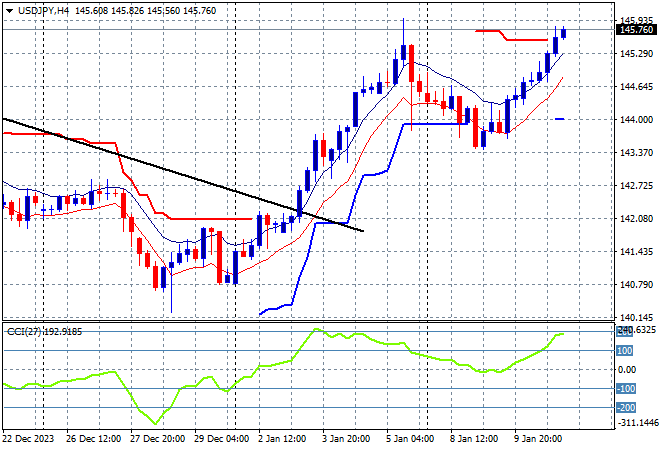

The USDJPY pair continues to rebound from its post Friday night small consolidation to soar through the 145 handle as Yen continues to weaken substantially.

Four hourly momentum is now back into well overbought readings as the medium term trend (sloping black line) remains broken here with price action almost exceeding last week’s high, but I think this move was a little too fast so watch for a possible retracement:

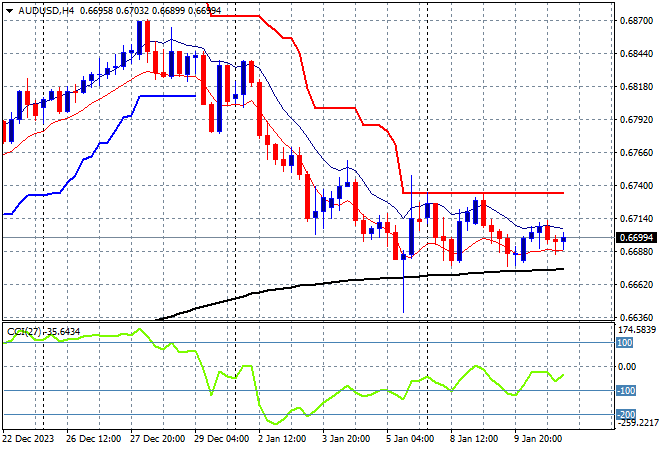

The Australian dollar had a wide range on Friday night but is again threatening to break below the 67 handle which is still proving too tough to climb over despite recent USD weakness.

The Aussie has been under medium and long term pressure for sometime with the latest rally just a relief valve being let off with short term momentum returning to oversold territory as traders positioned for the NFP print and still have another month for the RBA to come back from holidays:

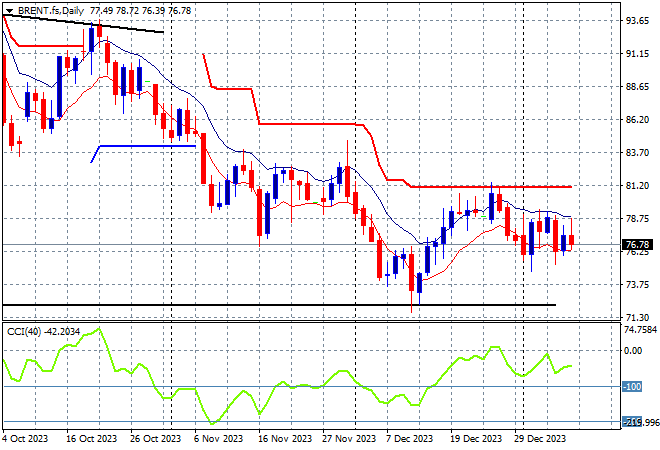

Oil markets saw a small retracement overnight due to the big reversal in natural gas futures, as Brent crude remains contained well below the key $80USD per barrel level with the downtrend also entrenched.

After almost reaching $100 in mid September, price was looking to return to the August levels around the $85 area where a point of control had been established before the recent breakout failed to push above trailing resistance at the $80 level. Daily momentum failed to get out of negative settings but is having another go here despite a possible retest of the December lows nearer the $70USD per barrel level soon:

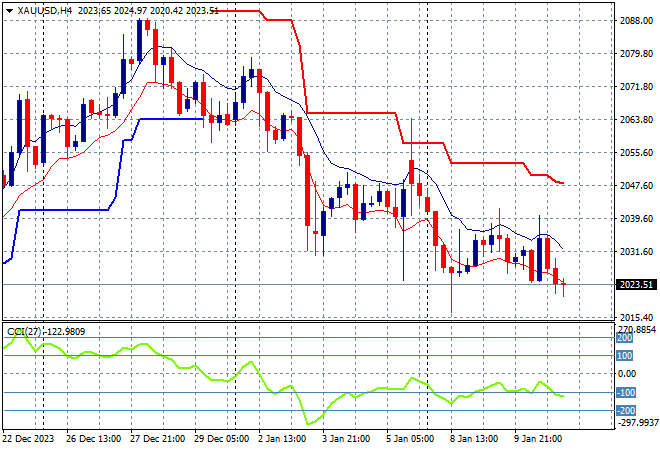

Gold is not finding much support in comparison with other undollars as it continues to flirt with a return to the $2000USD per ounce level as current price action remains anchored near the early December levels, closing slightly lower and below the $2030 level again.

Profit taking will continue here so watch the low moving average on the daily chart for signs of another possible dip with daily momentum still in the oversold zone: