A lot of easing in China has seen Asian share markets generally move higher, helped by a buoyant Wall Street overnight as well as a slightly weaker USD as traders await tonight’s latest US CPI print. The Australian dollar remains a bit cautious however, having squandered its small gains on the November inflation print to only just remain above the 67 cent level in afternoon trade.

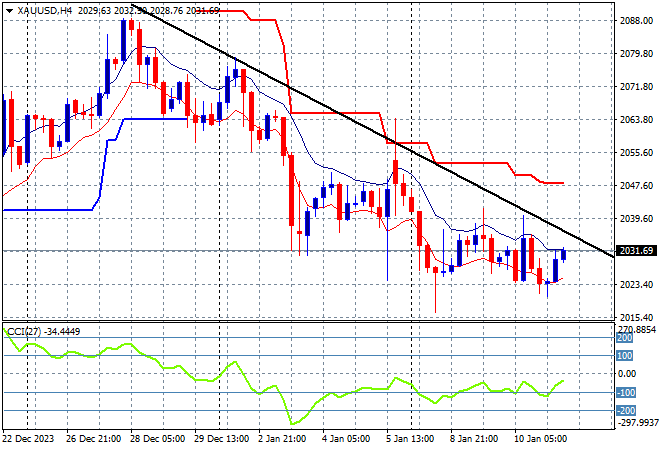

Oil prices are inching slightly higher with Brent crude heading above the $77USD per barrel level while gold is still looking weak, currently hovering just below the $2030USD per ounce level:

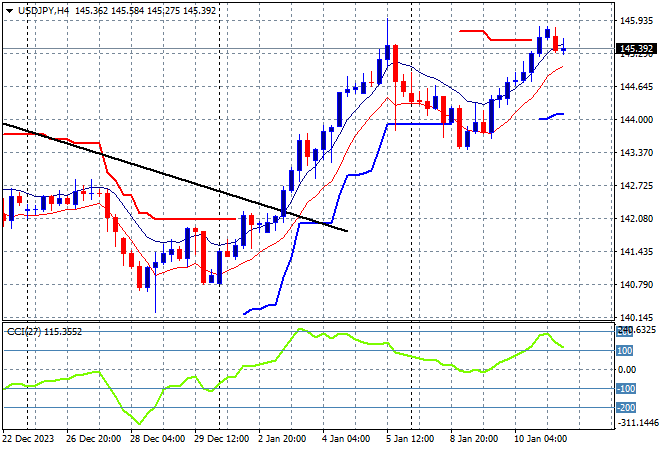

Mainland Chinese share markets are up in afternoon trade as the Shanghai Composite again remains below the 2900 point barrier, currently some 0.4% higher at 2890 points while in Hong Kong the Hang Seng Index is up nearly 2% to 16414 points. Japanese stock markets are still moving to the upside with the Nikkei 225 up nearly 2% to 35105 points just before the close while the USDJPY pair lifts above the 145 level:

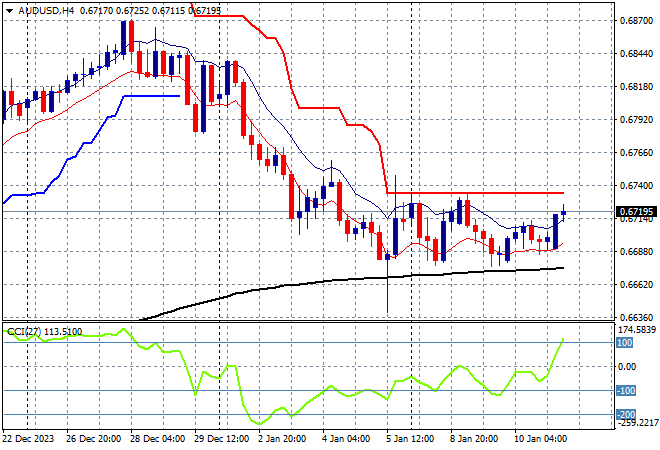

Australian stocks took back most of their recent losses, with the ASX200 up more than 0.5% at 7506 points while the Australian dollar has firmed slightly above the 67 handle in afternoon trade, but remains under resistance at the 67.40 level:

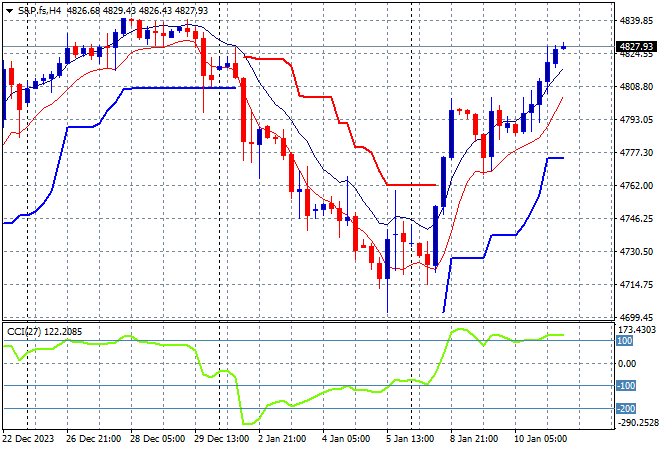

S&P and Eurostoxx futures are looking to extend their overnight gains with the S&P500 four hourly chart showing an attempt to get back to the start of year position above the 4800 point level with short term momentum continuing its overbought mode:

The economic calendar ramps up tonight with the latest US core inflation numbers plus initial weekly jobless claims.