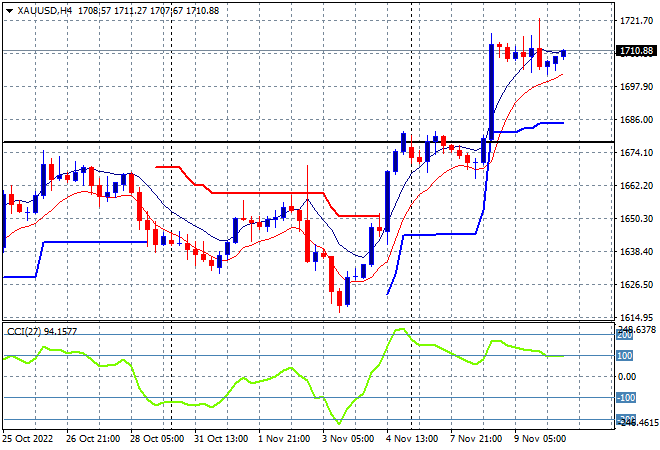

A sea of red across Asian stock markets today in reaction to the steep falls on Wall Street overnight as the risk complex looks through a deadlocked or at least hamstrung US Congress following the mid term elections. The USD is slightly mixed against the currency majors with Euro getting back above parity as the Australian dollar moves further below the 65 handle. Oil prices are still looking weak with Brent crude just above the $92USD per barrel level while gold is surprisingly holding on to its recent big surge, currently at the $1710USD per ounce level:

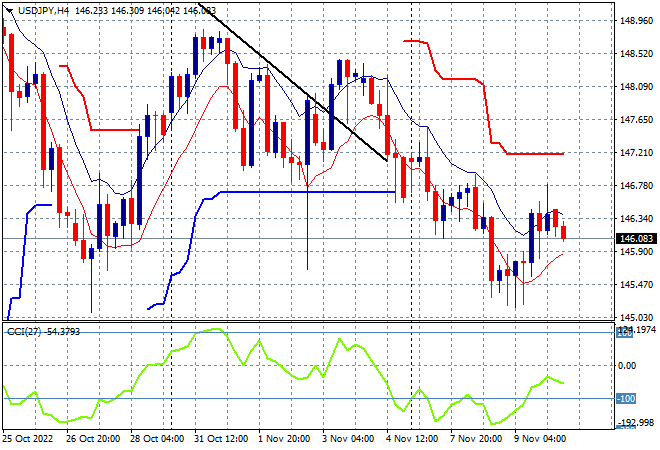

Mainland Chinese share markets are still pulling back as the Shanghai Composite look set to finish down 0.6% to 3027 points while the Hang Seng Index has slumped again, down more than 1.8% to be just above the 16000 point level, currently at 16066 points. Japanese stock markets are also in sell mode, with the Nikkei 225 closing 1% lower at 27461 points, while the USDJPY pair has stabilised but is looking very weak at the 146 handle:

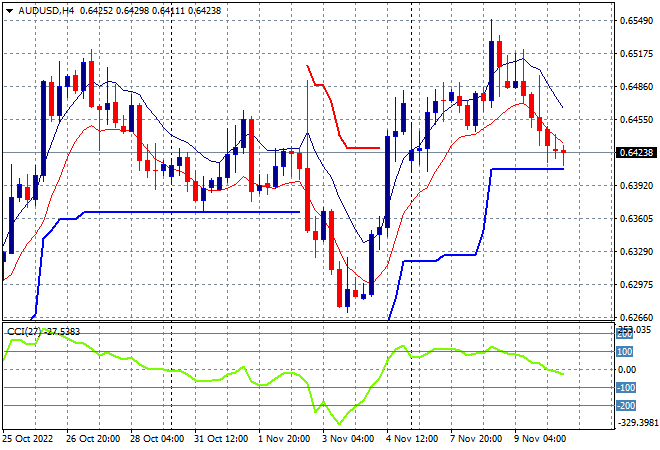

Australian stocks couldn’t escape the selling with the ASX200 closing 0.5% lower, again failing to breaking into the 7000 point level to finish at 6956 points. The Australian dollar was also pushed lower but is trying to stabilise here above the 64 handle with the four hourly chart rejecting the October high position above seemingly out of reach in the wake of the hawkish Fed:

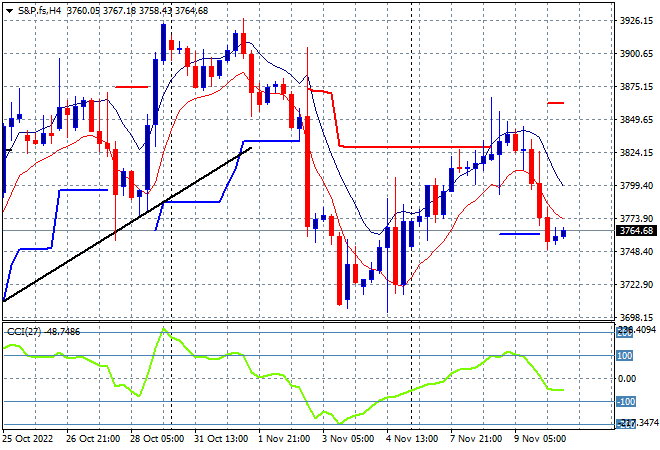

Eurostoxx and US futures are flat and facing internal resistance as we head into the London session with the S&P500 four hourly chart showing price action anchored at the 3750 point level. This market is well contained and steadily below the recent uptrend line, so watch for another breakdown here back to last week’s lows at the 3700 points level:

The economic calendar will focus squarely on the latest US core inflation print later tonight, with a slew of individual Fed banker speeches that may merit listening to as well.