Street Calls of the Week

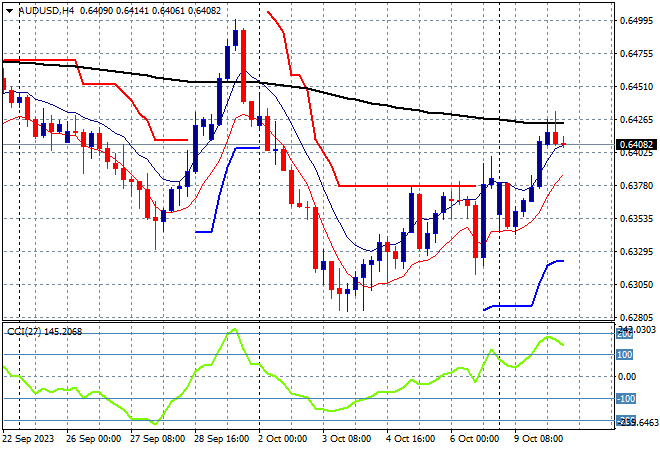

Asian share markets are trading higher after the return of markets in Japan and Hong Kong, although mainland Chinese markets remain dour as risk markets overall absorb the attacks on Israel over the weekend. The Australian dollar stabilised at the 64 cent level, running out of steam in the post-NFP uptrend while other majors are more cautious.

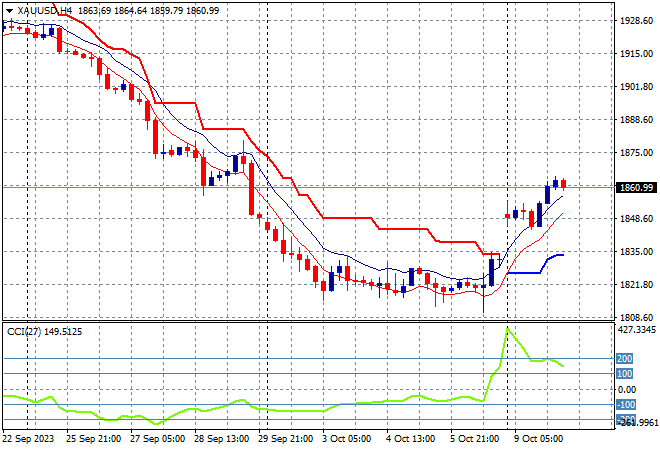

Oil prices are slipping slightly after gapping nearly 4% higher over the weekend, with Brent crude consolidating at the $87USD per barrel level while gold is moving slightly higher throughout the session, currently trading above the $1860USD per ounce level:

Mainland Chinese share markets are falling again going into the close with the Shanghai Composite down 0.6% to 3078 points while in Hong Kong the Hang Seng Index reopened to lift some 1.2% as Japanese stock markets also returned from their holiday with the Nikkei 225 closing some 2.6% higher in strong support. Trading in the USDJPY was mixed with a modest gain towards the 149 level:

Australian stocks were also quite positive on merger news with the ASX200 closing some 1% higher at 7040 points while the Australian dollar tried to push above the 64 cent level but is meeting resistance with momentum moderating in the short term below the recent weekly high at the 65 cent level:

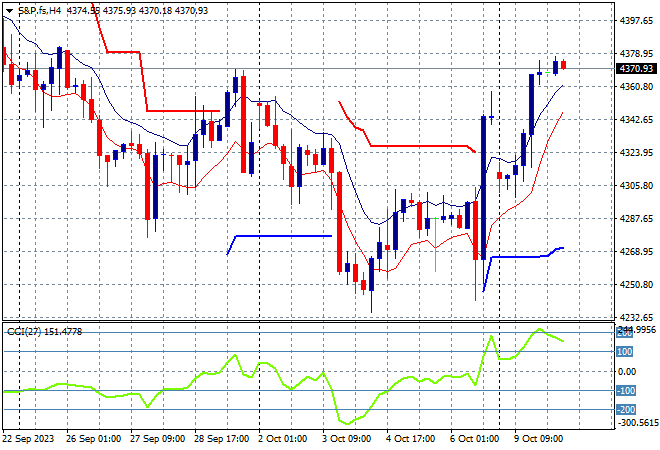

S&P futures are holding on to their gains while European markets are looking to claw back the mild losses overnight as the S&P500 four hourly chart shows consolidation at the previous weekly high at the 4370 point level, surpassing the Friday night close:

The economic calendar includes yet more Fed and ECB central bank speeches plus the latest US wholesale inventories report.