A less hawkish than expected RBNZ that held fire at today’s meeting was the only major economic release outside of China to move markets today with the Middle Kingdom’s latest inflation figures not having much of an impact. Local stocks are flat while the USD remains relatively strong against the majors as Wall Street prepares for another round of earnings tonight. The Australian dollar lifted against Kiwi but is holding against King Dollar just above the 67 cent level.

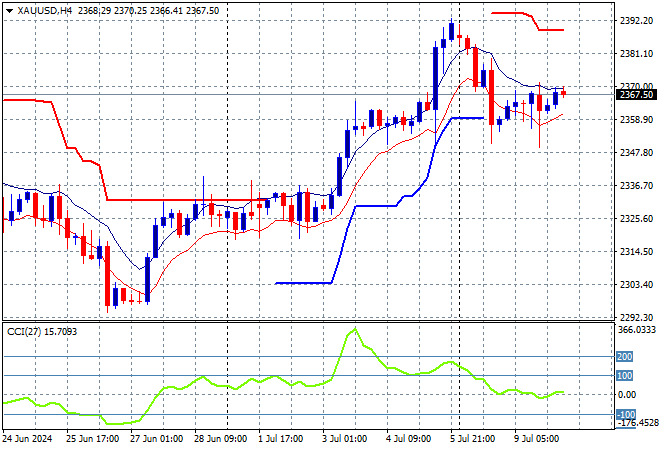

Oil prices are failing to hold at their recent highs with Brent crude now below the $85USD per barrel level while gold is trying to comeback after its poor start to the week, climbing slightly above the $2360USD per ounce level:

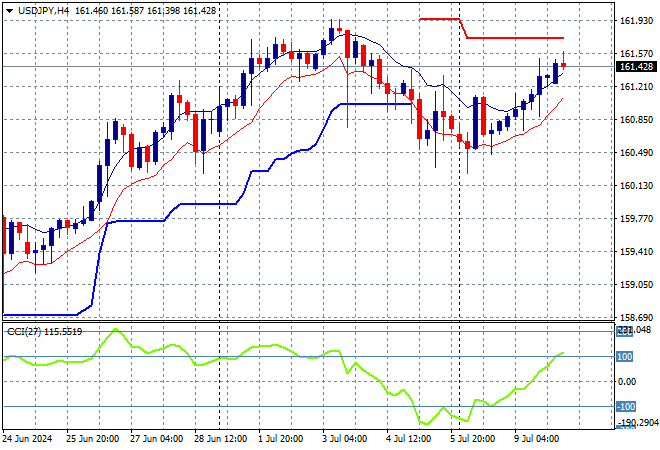

Mainland Chinese share markets are heading lower later in the session with the Shanghai Composite down some 0.3% while the Hang Seng Index is catching a small bid, up 0.2% at 17570 points. Meanwhile Japanese stock markets are flat with the Nikkei 225 unchanged at 41564 points as the USDJPY pair continues its overnight lift above the 161 level to almost get back to last week’s closing level:

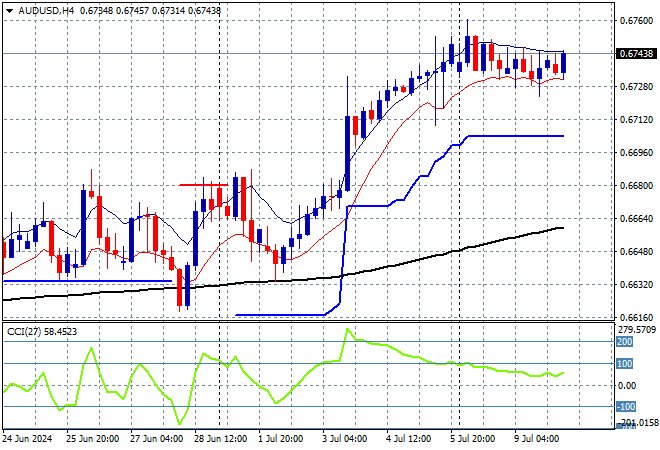

Australian stocks are pulling back with the ASX200 losing some 0.2% to 7829 points while the Australian dollar is holding steady above the 67 cent level, wanting to hold on to its recent breakout:

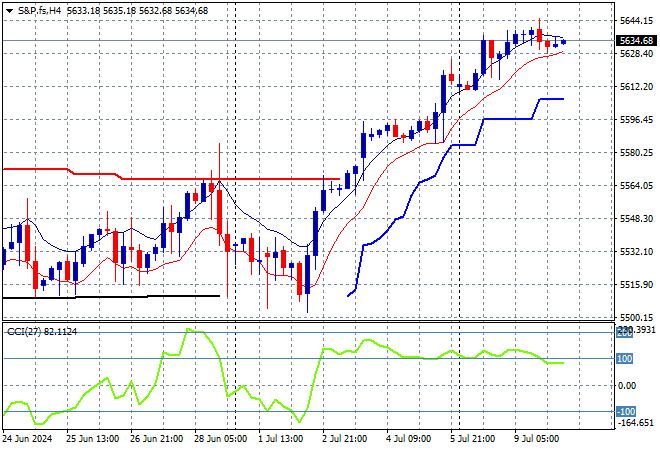

S&P and Eurostoxx futures are down slightly as we head into the London session with the S&P500 four hourly chart showing price action wanting to advance above the 5500 point level which continues to act as support:

The economic calendar includes more Fedspeak tonight from the Chair himself, followed by some wholesale inventory reports.