Despite the headline unemployment rate rising on Friday night, the latest US jobs number – the non farm payroll or NFP – came in much stronger than expected, with Wall Street disappointed with a very mild selloff while the USD soared back into strength, smashing all the currency majors down a handle or more. The Australian dollar suffered one of its biggest moves in months, heading straight to the 65 cent level.

10 year Treasury yields lifted along side everything else on the curve, jumping up 15 points to well above the 4.4% level while oil prices climbed back with Brent crude finishing just above the $80USD per barrel level in a directionless session. Gold however suffered a similar fate to other undollars and fell back nearly $80USD per ounce, finishing the week at a new two month low at the $2290USD per ounce level.

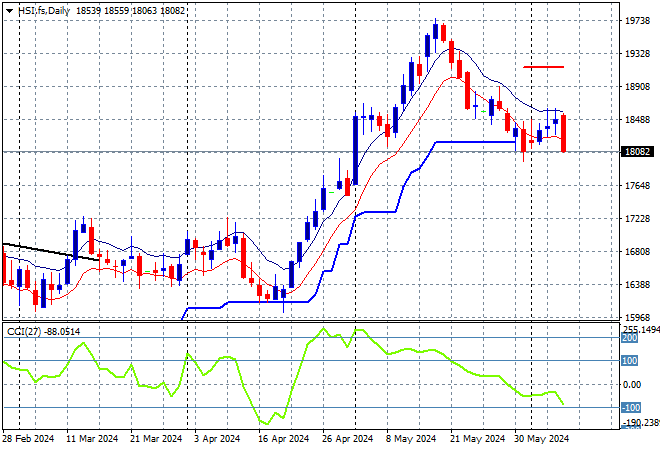

Looking at markets from Friday’s session in Asia, where mainland Chinese share markets were flat for their final session of the week with the Shanghai Composite slightly up going into the close while the Hang Seng Index is putting in a poor session, closing nearly 0.6% lower to 18360 points.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. Price action was looking way overextended but this retracement is now taking some heat out of the market but needs to stop soon before moving into corrective mode:

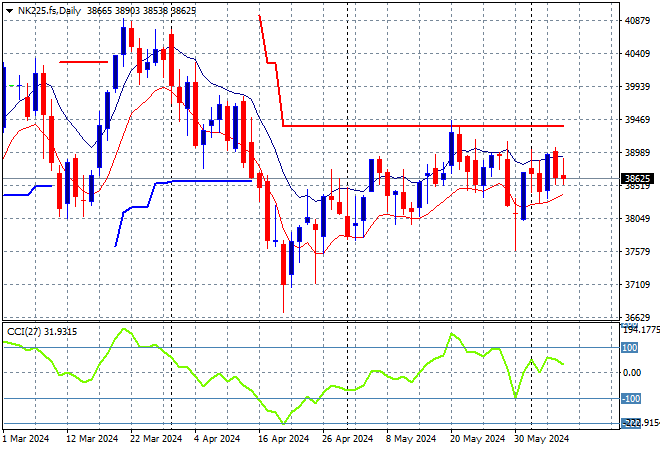

Meanwhile Japanese stock markets were almost unchanged with the Nikkei 225 off slightly at 38683 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance had been defended with short term price action now rebounding off former support at the 39000 point level with short term momentum still positive but futures indicating a slight pullback on the open:

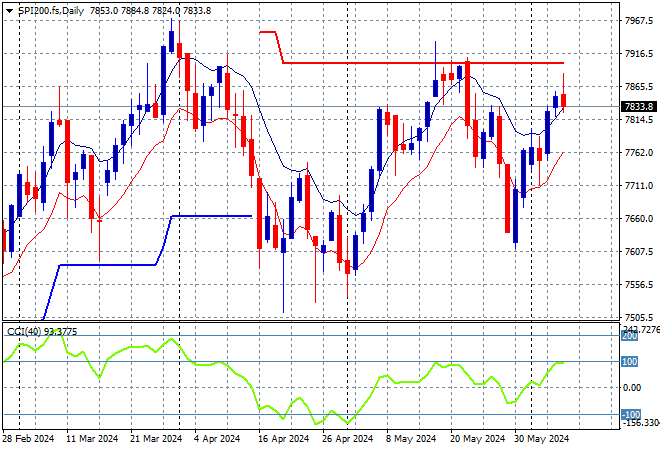

Australian stocks were the only ones to gain across the region with the ASX200 moving 0.5% higher to 7860 points.

SPI futures are down at least 0.5% due to the uneasy reaction to the NFP print on Wall Street from Friday night. The daily chart was showing a potential bearish head and shoulders pattern forming with ATR daily support tentatively broken, taking price action back to the February support levels in mid April. Momentum is finally getting out of its oversold condition and now rebounding back into the positive zone with a return to the 7900 point level possible, but resistance overhead beckons:

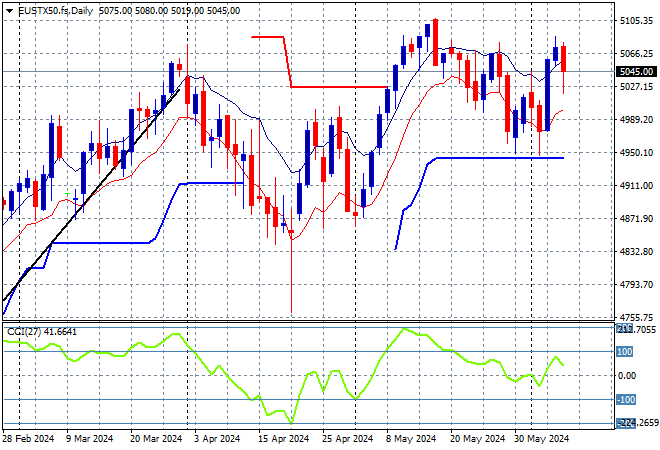

European markets couldn’t follow through on the post-ECB meeting gains and fell back across the continent with the Eurostoxx 50 Index closing 0.3% lower to 5051 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance finally brushed aside as it breaks the 5000 point barrier:

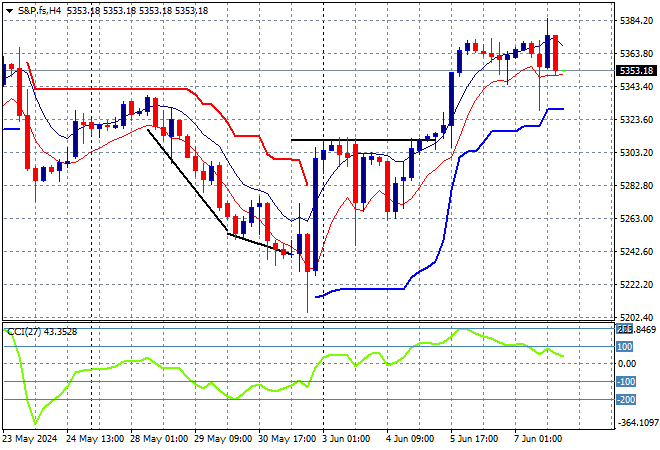

Wall Street was not impressed by the NFP jobs report with both the NASDAQ and the S&P500 losing around 0.2% with the latter holding on above the 5300 point level, closing at 5346 points.

The four hourly chart showed the Friday night rebound coming up against a lot of hesitation here at the 5300 point level with short term momentum ready to launch higher as it turned into a solid breakout, but not price action is pausing. This was a good setup before the NFP print but market expectations about what the Fed will do are causing a lot of hesitation here:

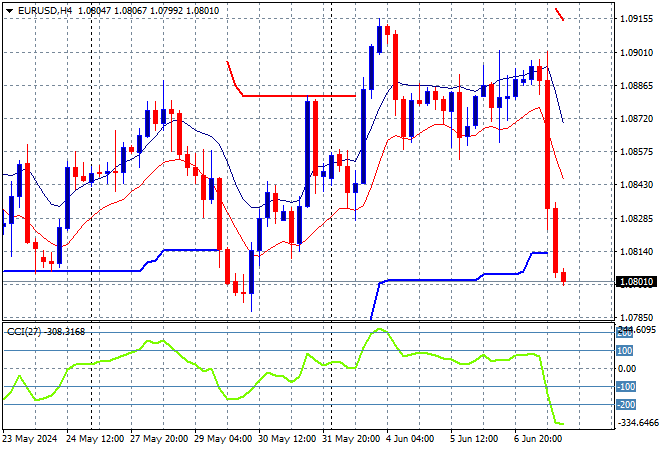

Currency markets are now back in the thrall of USD following Friday night’s US job numbers with solid breakdowns across all the major currency pairs with Euro leading the way, smacking all the way back to the 1.08 handle.

The union currency had previously bottomed out at the 1.07 level at the start of April as medium term price action with a reprieving reversal in price action back towards the 1.09 level before its own inflation print. Medium term support was briefly tested at the 1.08 level with momentum rebounding back into the positive zone, but not able to sustain overbought conditions before this flummoxing back to the 1.08 handle again:

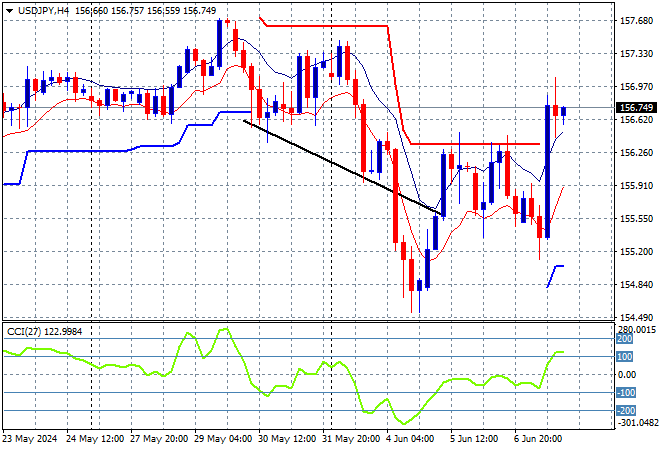

The USDJPY pair was unable to bounceback in the previous session before the NFP print but took that all back and more, finishing the week above the mid 156 level, finally getting back above resistance at the 156 handle proper.

Short term momentum had gotten out of oversold condition but was not yet positive with price action suggesting a further pause or rollover here before the print with this move taking the pair back to last week’s finishing point, overall not yet exciting enough:

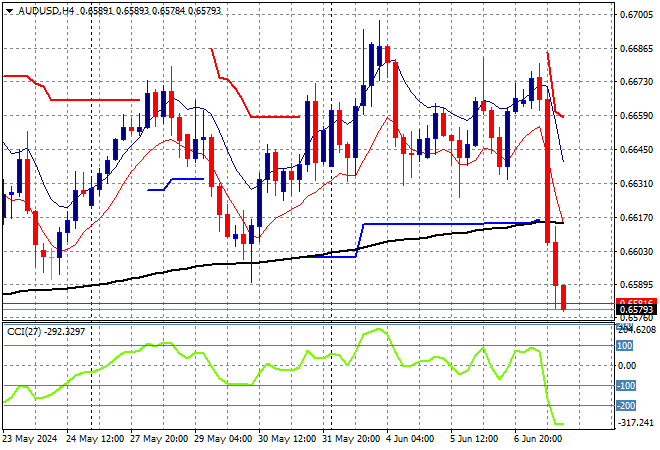

The Australian dollar was almost able to break the 67 cent level at the start of the week but was pushed into a new two month low, heading below the 66 cent level as a result of the US jobs print on Friday night.

So far the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone in recent weeks with price action whipsawing around the mid 66 cent level as a point of control. This breakdown does not bode well for the rest of the month:

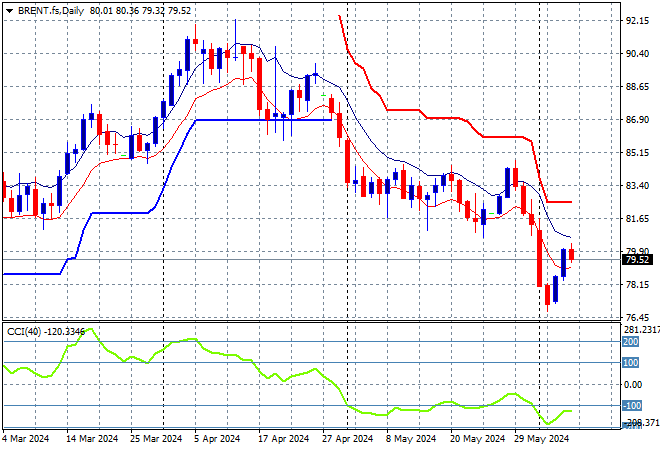

Oil markets remain in correction mode although Brent crude was stabilise somewhat on Friday night after breaking below the $81USD per barrel level previously, settling just below the $80 level as it tries to find a bottom amid the market volatility.

After breaking out above the $83 level last month, price action has stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Watch daily ATR support here at the $86 level which is still broken and will likely be resistance for sometime with short term momentum still quite oversold:

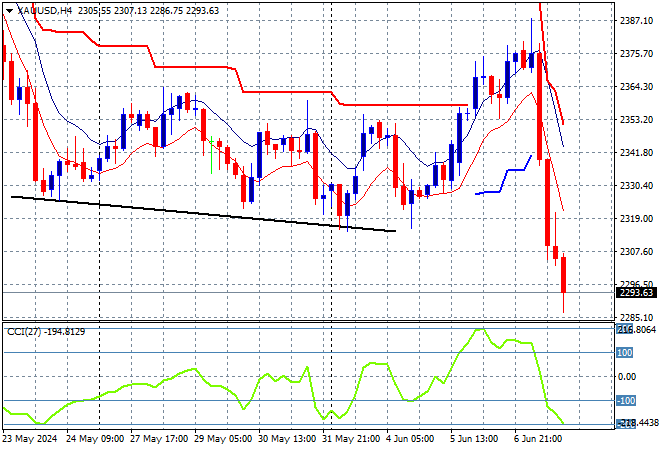

Gold was trying a lot harder to get back on trend as it bottomed out at the $2300USD per ounce level, furthering its recent breakout above the $2350 level mid week but this was all taken away and then some, making a new two monthly low below the $2300 level in one swift move lower.