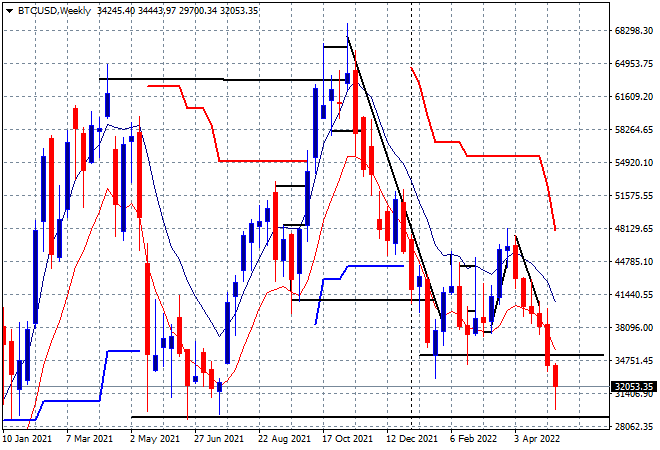

Still not a good day for risk takers out in the Asian stock markets although a late bounce this afternoon has seen equity futures for Europe and Wall Street lift, dragging up some local bourses as well. Currency markets remain in line with a strong USD, with the Australian dollar almost crossing below the 69 handle while oil markets have pulled back again as Brent crude goes below the $104 level. In undollar land, gold is trying to comeback but remains under stress, currently at $1862USD per ounce while Bitcoin is crushing hit, heading below the $30K level and on track for a new yearly low with the weekly chart showing the next stage of an epic head and shoulders pattern almost complete:

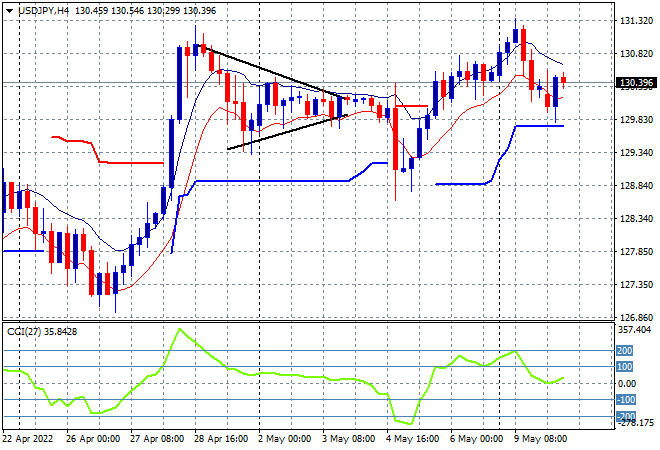

Mainland Chinese share markets were able to recover their early losses with the Shanghai Composite currently up 0.7% at 3025 points while the Hang Seng Index returned from its holiday to a large selloff, down more than 2% to 19549 points. Japanese stock markets are still under threat with the Nikkei closing 0.4% lower at 26213 points while the USDJPY pair has pulled back half of its overnight losses to still anchor above the 130 level:

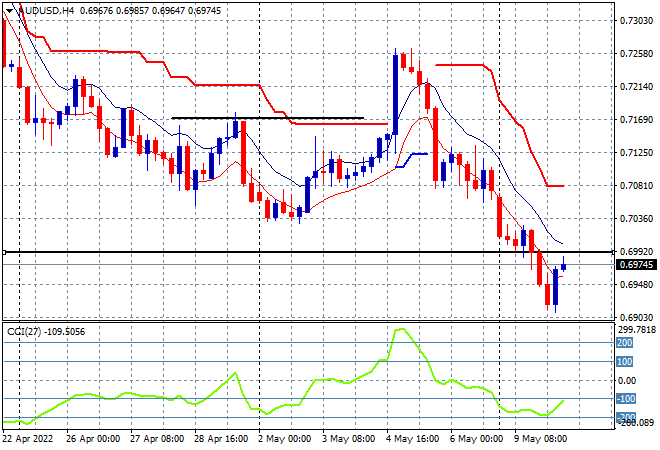

Australian stocks started off in a shocking state but were able to clawback throughout the afternoon with the ASX200 finishing down nearly 1% proper at 7051 points. Meanwhile the Australian dollar is continuing to make new weekly and monthly lows, almost cracking through the 69 handle before a late arvo bounce – but it looks extremely weak from here:

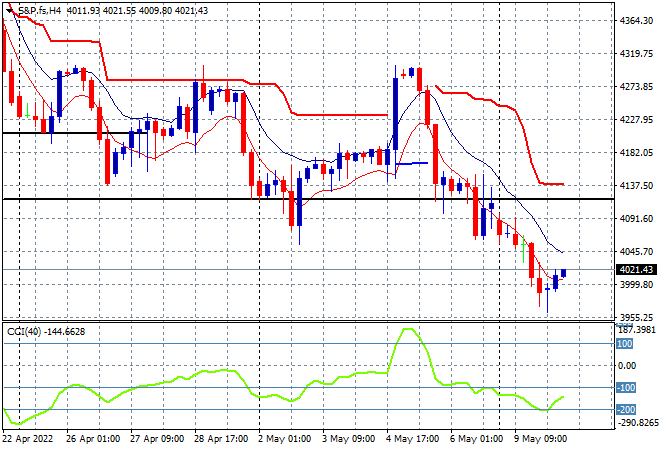

Eurostoxx and Wall Street futures are seeing a small bounce ahead of the European open with the S&P500 four hourly chart showing price wanting to return to above the 4000 point level and stave off what looks like a formal bear market definition:

The economic calendar will include the closely watched German ZEW survey tonight, followed by a slew of Fed member speeches.