Street Calls of the Week

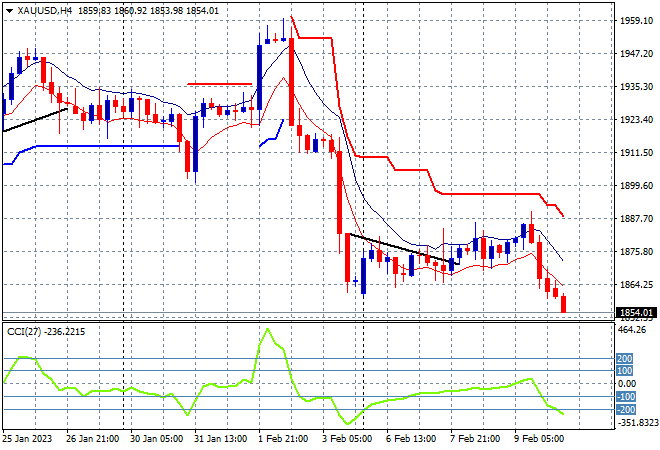

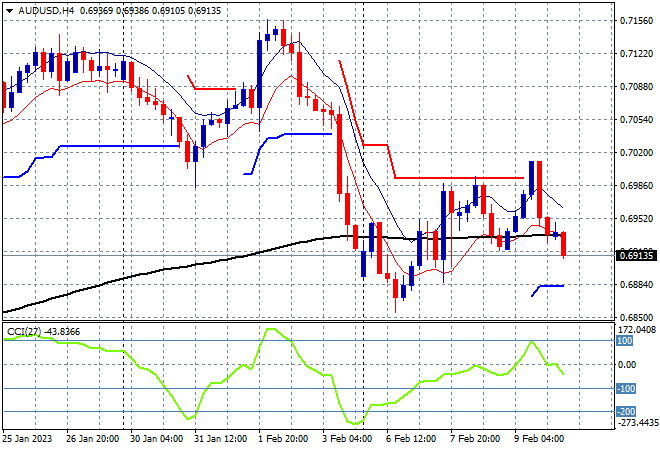

Asian stock markets are again having a mixed reaction to overnight price action, not helped by a lower than expected Chines inflation print or the local verbiage from the RBA on continued interest rate hikes. The USD is still strong with the Australian dollar heading down to the 69 cent level while other undollars remain under pressure. Meanwhile oil prices are steady with Brent crude hovering above the $84USD per barrel level as gold continues to sell off from its mid week crunch, now down to the $1850USD per ounce level:

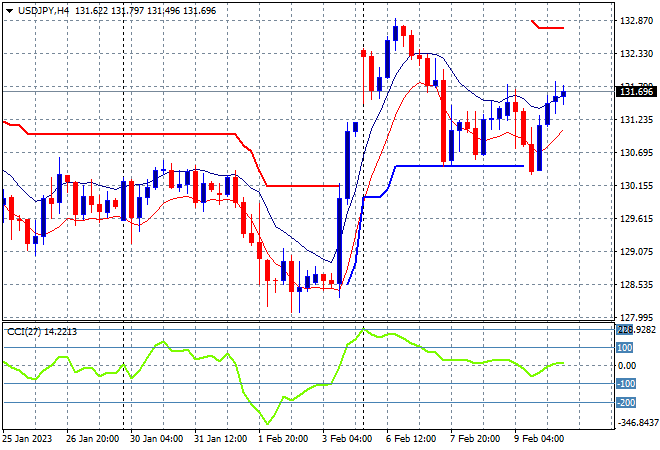

Mainland Chinese share markets are taking a diver post the inflation print with the Shanghai Composite down 0.5% to 3250 points while the Hang Seng is following with an even bigger retracement, down 1.8% to 21237 points. Japanese stock markets are currently up slightly however with the Nikkei 225 moving 0.2% higher to 27653 points with the USDJPY pair also pushing just that little bit higher, still bouncing off of trailing ATR support and just above the mid 131 level:

Australian stocks are still falling with the ASX200 down some 0.7% to continue its falls well below the 7500 point level, currently at 7431 points. The Australian dollar failed to gain traction on the SOMP release by the RBA, stalling again below the mid 69 level, basically back where it started the week:

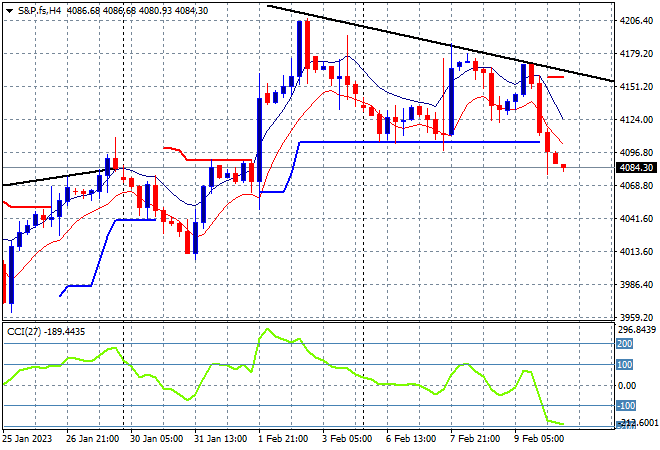

Eurostoxx and US futures are moving lower with the S&P500 four hourly chart showing price action crossing below the strongly supported 4100 point zone, with short term momentum retracing into oversold territory as the lack of new session highs all week weighed on the market:

The economic calendar finishes the week with UK GDP, Canadian unemployment and US Michigan consumer sentiment with a slew of Fed speeches as well.