Asian share markets are again mixed with only Japanese bourses advancing as local shares absorb the latest inflation figures while Chinese markets remain cautious in the wake of more property sector wobbles. A slightly stronger USD is not pushing the Australian dollar down however, which lifted on the November inflation print to remain above the 67 cent level in afternoon trade.

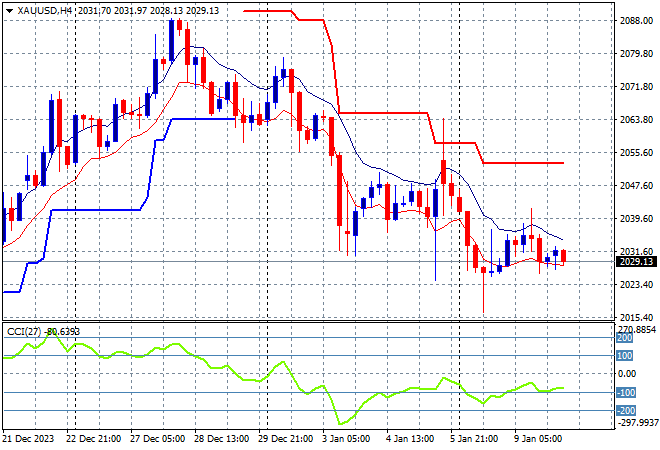

Oil prices are inching slightly higher with Brent crude heading above the $76USD per barrel level while gold is looking weak, currently hovering just below the $2030USD per ounce level:

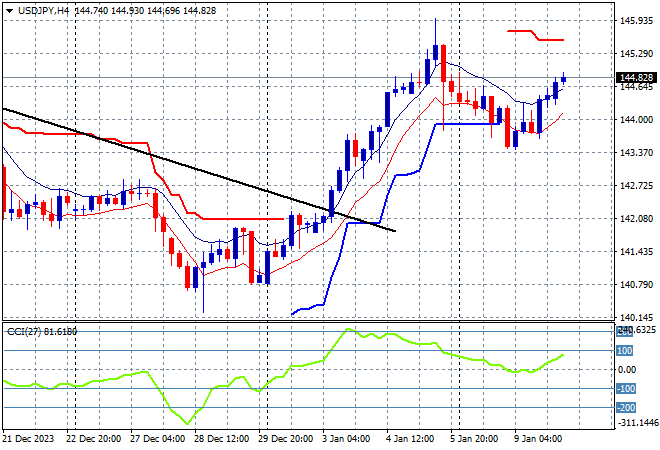

Mainland Chinese share markets were up initially but have fallen back in afternoon trade as the Shanghai Composite again remains below the 2900 point barrier, currently some 0.2% lower at 2887 points while in Hong Kong the Hang Seng Index is down 0.5% to 16102 points. Japanese stock markets are re-engaging to the upside with the Nikkei 225 up nearly 2% to 34357 points just before the close while the USDJPY pair lifts towards the 145 level:

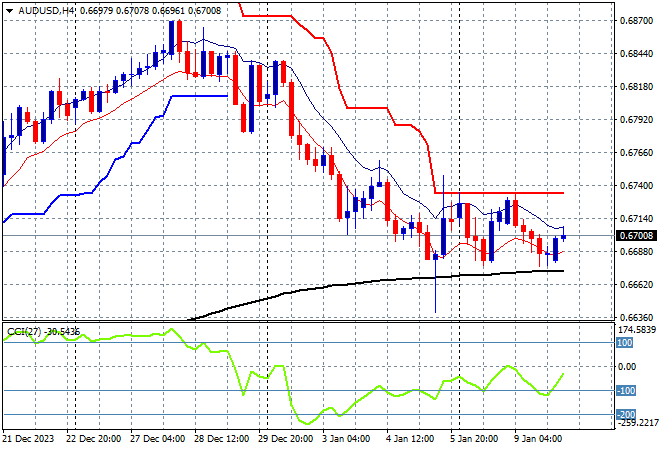

Australian stocks didn’t like the November CPI print, with the ASX200 down more than 0.6% at 7470 points while the Australian dollar has firmed slightly above the 67 handle in afternoon trade, but remains under resistance at the 67.40 level:

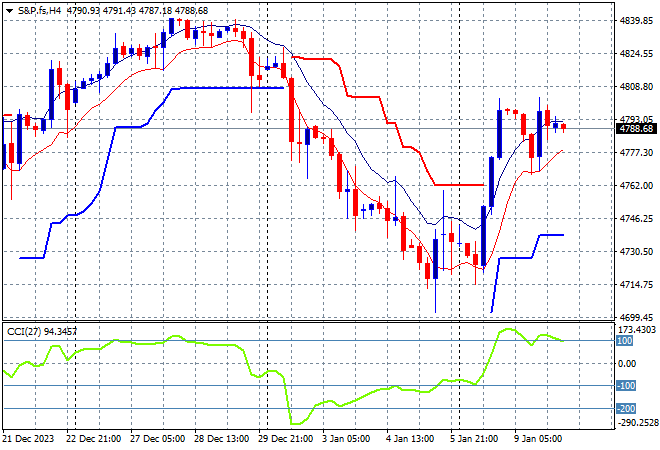

S&P and Eurostoxx futures are holding on to their recent gains with the S&P500 four hourly chart showing an attempt to get back to the start of year position above the 4800 point level with short term momentum very overbought:

The economic calendar is relatively light again with US wholesale inventories and a few BOE speeches to watch out for.