Street Calls of the Week

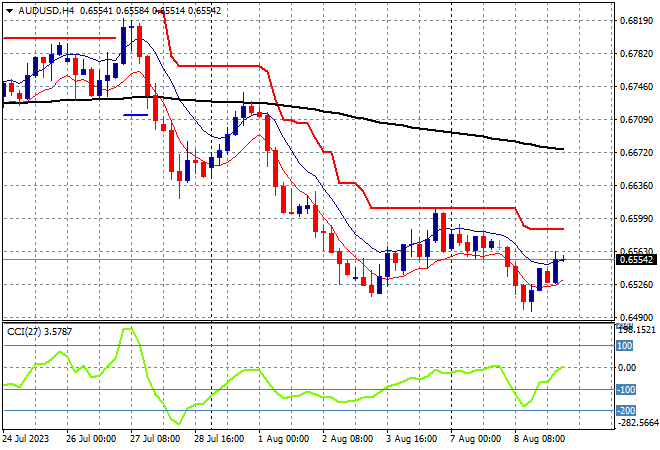

Asian stocks are in retreat mode as Chines inflation numbers were much lower than expected while local stocks are bouncing back after CBA announced a record profit. The USD is pulling back slightly against the majors with the Australian dollar putting in a modest rally to return to the mid 65 cent level, while Euro is stalled below the 1.10 handle.

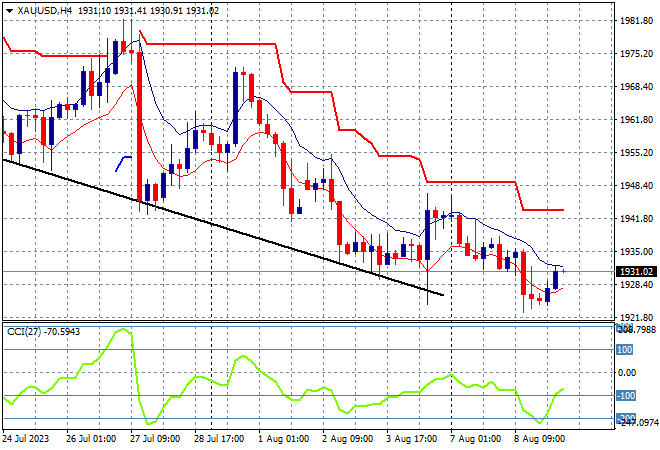

Oil prices remain elevated but taking a pause with Brent crude just above the $86USD per barrel level while gold has been unable to claw the overnight losses completely back, falling to the $1930USD per ounce level with its downtrend still entrenched:

Mainland Chinese share markets fell on the poorer than expected inflation print with the Shanghai Composite eventually closing 0.5% lower at 3242 points while in Hong Kong the Hang Seng Index has only slipped a little, down 0.2% to 19149 points.

Japanese stock markets have reversed course again with the Nikkei 225 closing nearly 0.5% lower at 32204 points while the USDJPY pair has paused its weekend gap uptrend, steadying just abover the 143 level:

Australian stocks were the only positive market in Asia with the ASX200 lifting just over 0.3% to close at 7338 points. The Australian dollar also lifted after bottoming out at the 65 handle overnight, now moving back to its start of week position at the mid 65 level but still quite weak going into tomorrow’s US CPI print:

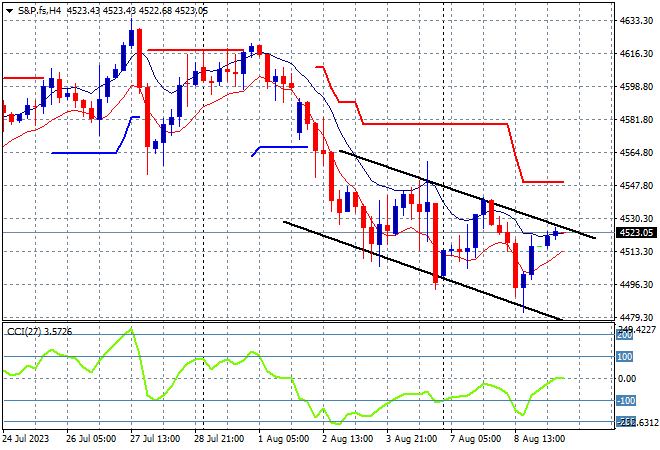

Eurostoxx and S&P futures are pushing up slightly higher as the S&P500 four hourly chart shows another potential bottom after threatening the key 4500 point level on Friday night. The inability to get back above the 4600 point level before Friday’s NFP print however could result in this trend channel winding down further:

The economic calendar is relatively quiet tonight with some EIA oil data and not much else.