A better trading session across stock markets in Asia today despite the flat result on Wall Street overnight as risk continues to absorb the outcome of Friday’s US jobs report, which came in hotter than expected. The USD is now slipping and becoming weaker against all the majors as the Australian dollar pushes above the 66 cent level.

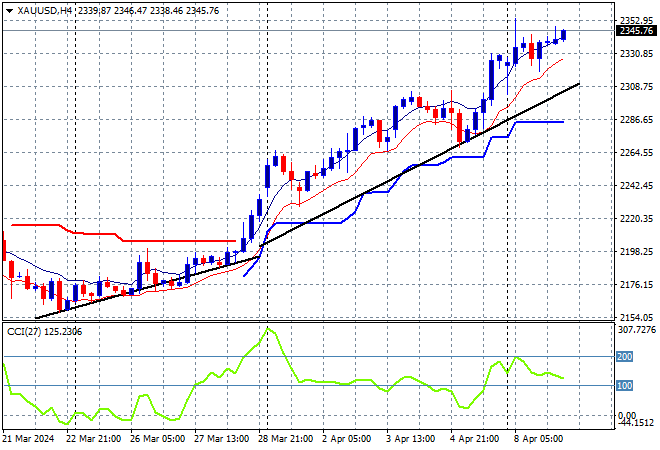

Oil prices gapped down over the weekend on macro concerns in the Middle East but Brent crude has recovered to hold on above previous weekly resistance, currently just above the $90USD per barrel level while gold is still going straight up, currently at the $2345USD per ounce level:

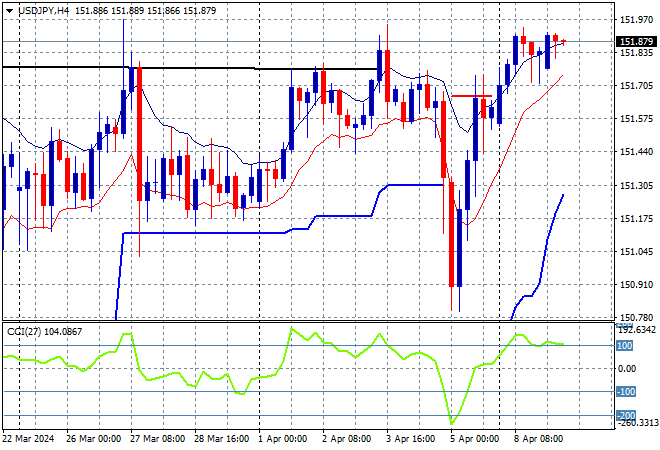

Mainland and offshore Chinese share markets are again diverging with the Shanghai Composite down more than 0.2% while the Hang Seng Index is rebounding, currently up 0.6% to 16843 points. Japanese stock markets are now in line with their regional partners as the Nikkei 225 closed 0.7% higher at 39652 points with the USDJPY pair getting back on track to exceed the recent weekly highs:

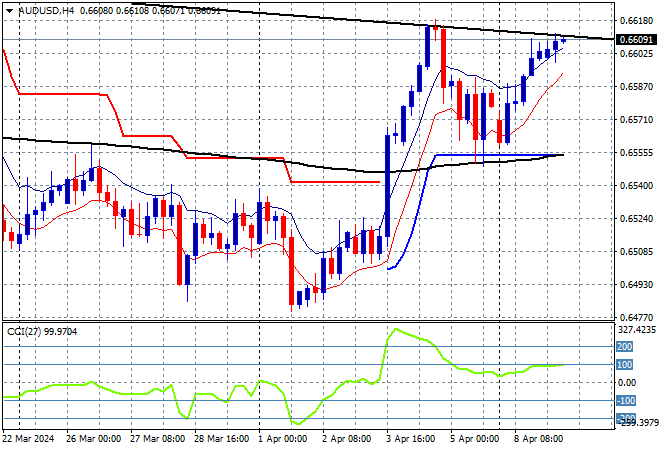

Australian stocks had a solid session with the ASX200 closing 0.5% higher to 7828 points while the Australian dollar is trying to match its recent weekly high as it again tries to break above the 66 cent level:

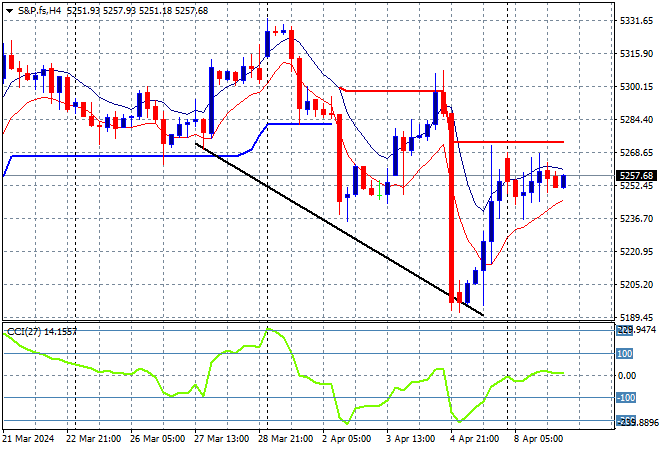

S&P and Eurostoxx futures are fairly flat as we head into the London session with European shares likely to rise slightly on the open while the S&P500 four hourly chart shows price action still in a technical downtrend:

The economic calendar tonight is again fairly quiet post the US jobs report with no major prints.