Chinese share markets were closed for the Chinese New Year break while other markets remained in a positive mood despite a mixed lead from Wall Street overnight as reduced volatility in bond and currency markets helps settle nerves. The USD is taking back some lost ground while the Australian dollar is still looking very weak just below the 65 cent level.

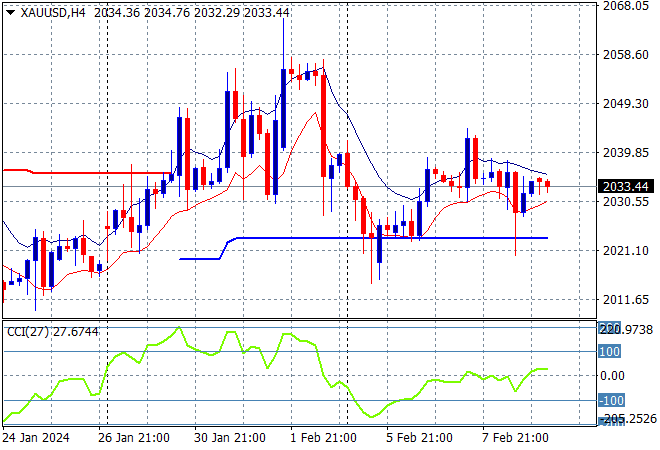

Oil prices are gaining slightly on their rally overnight with Brent crude moving beyond the $81USD per barrel level while gold is failing to push higher in Asian trade as it begins to stumble at the $2030USD per ounce level:

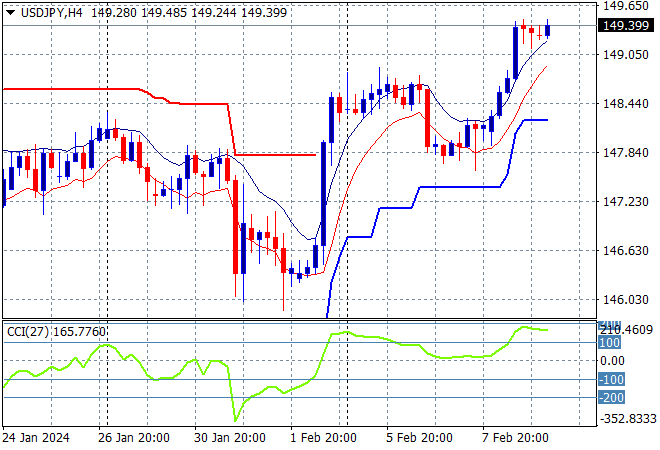

Mainland Chinese share markets were closed while in Hong Kong the Hang Seng Index is still falling, off by nearly 0.9% to 15741 points. Japanese stock markets are getting a wriggle on with the Nikkei 225 about to close nearly 0.6% higher at 37087 points while the USDJPY pair is pushing higher after its small retracement at the start of the week, currently just below the mid 149 level:

Australian stocks are trying hard to finish on a positive note with the ASX200 up just 0.1% at 7645 points while the Australian dollar is dead flat following the recent half hearted bounce above the 65 cent level from this week’s RBA meeting:

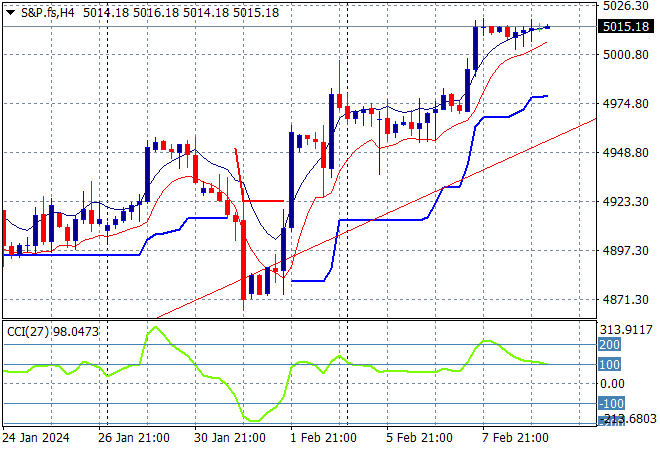

S&P and Eurostoxx futures are holding on to their overnight positions going into the London session as the S&P500 four hourly chart shows price action well on trend as it reaches for the 5000 point level:

The economic calendar finishes the trading week with German inflation and a private US oil rig count.