Asian share markets are trying to reduce in volatility again today but all eyes remain on bond markets which continue to have the jitters. Yen is weakening again to alleviate some pressure on Japanese equities but this looks shortlived as the Australian dollar also fails to make any headway following the recent unemployment print as it stalls above the 65 cent level.

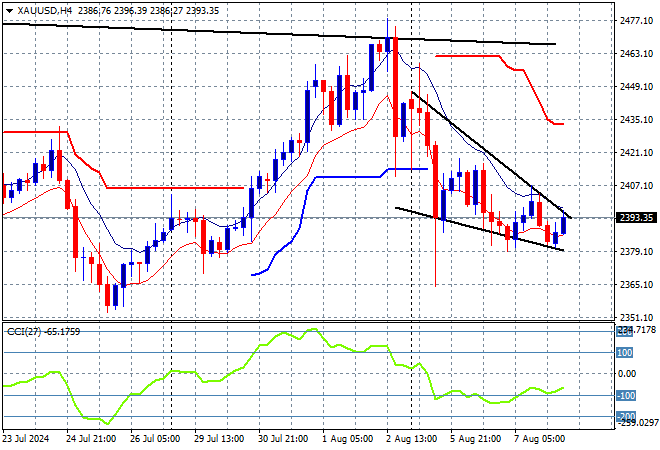

Oil prices are holding on to their modest overnight breakout with Brent crude remaining just above the $77USD per barrel level while gold is trying in vain to get back above the $2400USD per ounce level as momentum remains oversold – but is that a bullish falling wedge pattern forming on the four hourly chart:

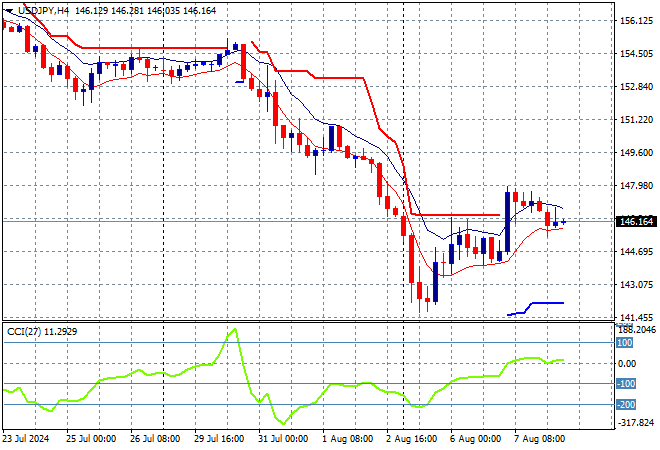

Mainland Chinese share markets are putting in a little lift higher as the Shanghai Composite moves up 0.2% while the Hang Seng Index is up nearly 0.7% to 16995 points. Meanwhile Japanese stock markets are reducing in volatility but are slipping into the close with the Nikkei 225 down some 0.3% to 34997 points while the USDJPY pair has pulled back from its overnight breakout to be just above the 146 handle:

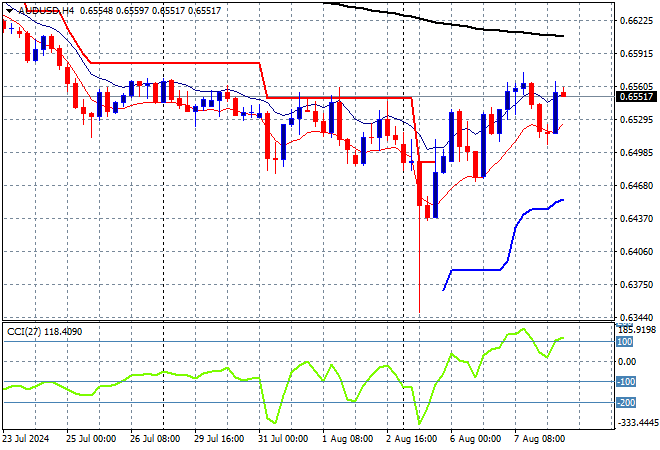

Australian stocks are pulling back once again going into the close with the ASX200 down 0.3% to 7677 points while the Australian dollar is trying to double down on its recent small breakout this afternoon but just can’t clear the mid 65 cent level:

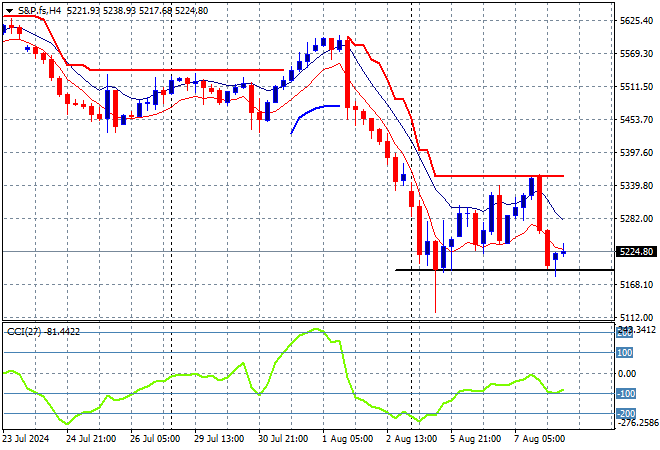

S&P and Eurostoxx futures are up only a smidgeon going into the London session with the S&P500 four hourly chart showing some stability returning to the major index as a dead cat bounce pattern is not yet completed:

The economic calendar tonight includes the latest weekly initial jobless claims print from the US.