The modest rally on Wall Street overnight is giving Asian stocks a small boost after starting the new trading week with trepidation in the previous session, with local stocks still directionless. The USD has clawed most of its lost ground from its Friday night falls with the Australian dollar rolling over back down to the 65 cent level, while Euro is stalled at the 1.10 handle.

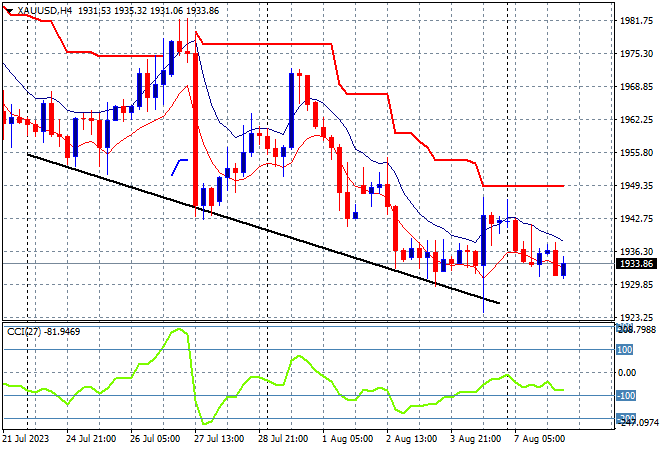

Oil prices are pulling back slightly due to last night’s weak close with Brent crude below the $86USD per barrel level while gold remain unable to push past the $1940USD per ounce level with its downtrend still entrenched:

Mainland Chinese share markets initial fell sharply on the open but have recovered mid session with the Shanghai Composite up a handful of points to just below the 3300 point level while in Hong Kong the Hang Seng Index has gone the other way, down nearly 1.5%, currently at 19255 points.

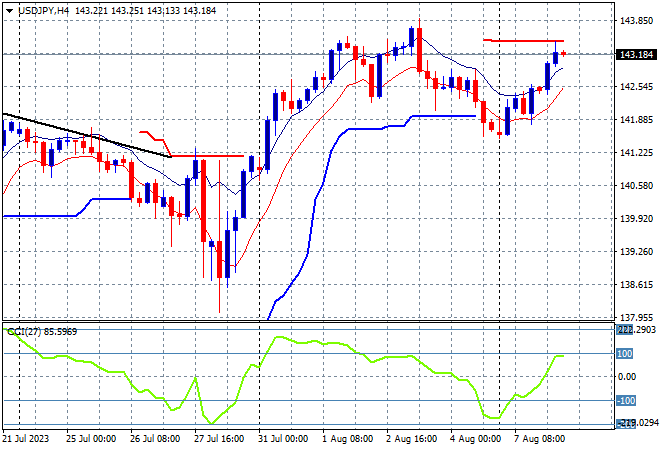

Japanese stock markets are finding more buyers as Yen weakens with the Nikkei 225 up 0.3% to 32350 points while the USDJPY pair has continued its weekend gap higher, now pushing through the 143 level:

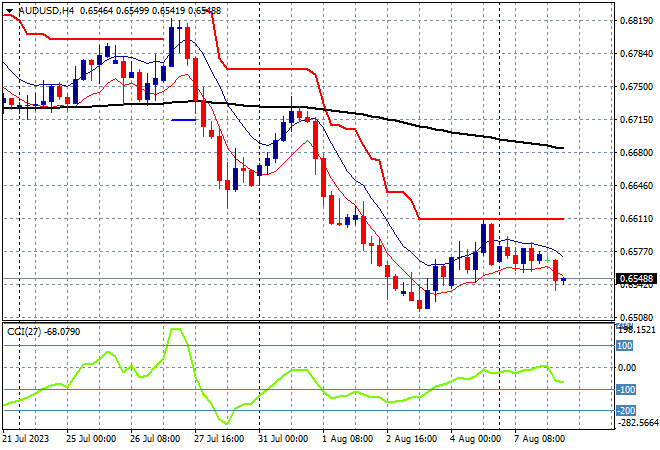

Australian stocks are still unable to find direction with the ASX200 barely off the ground, up only 0.1% or so to hover around the 7300 point level. The Australian dollar failed in its Friday night bounce to deflate back to the 65 cent level as I warned it remained set in a downtrend:

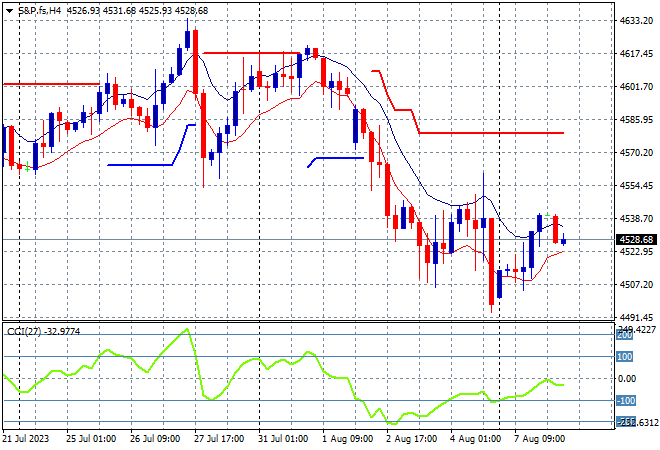

Eurostoxx and S&P futures are pulling backo slightly as the S&P500 four hourly chart does show a potential bottom after threatening the key 4500 point level on Friday night. The inability to get back above the 4600 point level before Friday’s NFP print however could result in a sharp rollover:

The economic calendar ramps up with the latest German inflation figures, then US wholesale inventory reports.