Stock markets are looking wobbly throughout Asia without a sound lead from Wall Street as Chinese banks cut rates to stimulate while the Yuan loses significant ground against USD. Japanese bourses are pulling back again after a too far, too fast rally while local stocks are actually performing the best, relatively speaking. Maybe traders are finding more work to do like the RBA Governor advised?

Wall Street futures are falling back as the economic calendar remains relativley quiet while the USD is moderating its recent gains against everything including the Australian dollar.

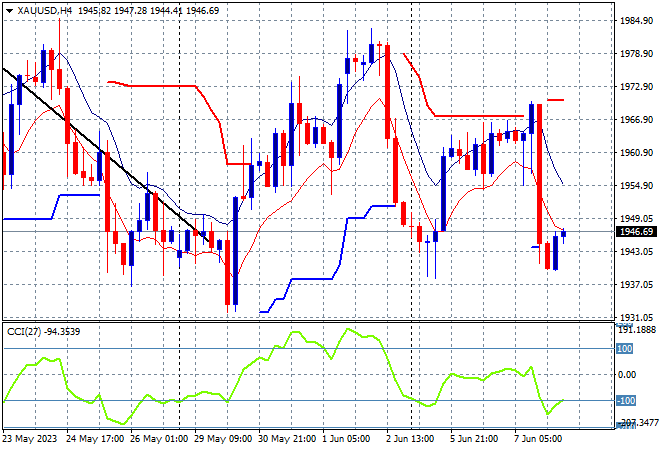

Oil prices are slowly lifting with Brent crude holding just below the $77USD per barrel level while gold is clawing back a very tiny amount of its selloff from overnight, barely hitting the $1950USD per ounce level:

Mainland Chinese share markets are dead flat with the Shanghai Composite hovering just below the 3200 point level while the Hang Seng Index is down 0.5% to remain well above the 19000 point level.

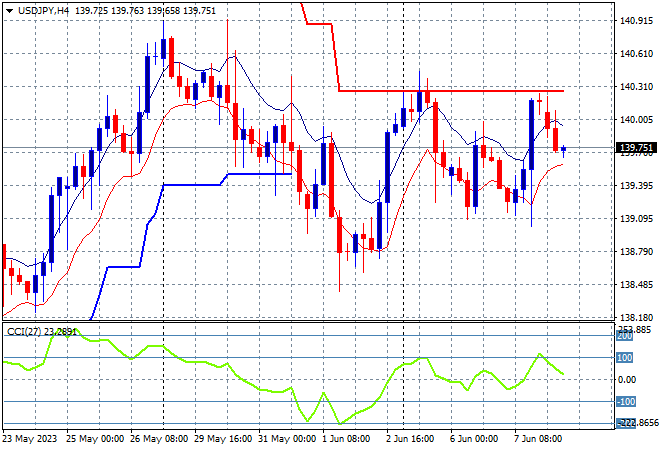

Japanese stock markets however are having the second selloff in a row with the Nikkei 225 closing more than 1.4% lower at 31455 points as the USDJPY pair pulls back to the mid 139 level, unable to get back to the previous weekly high:

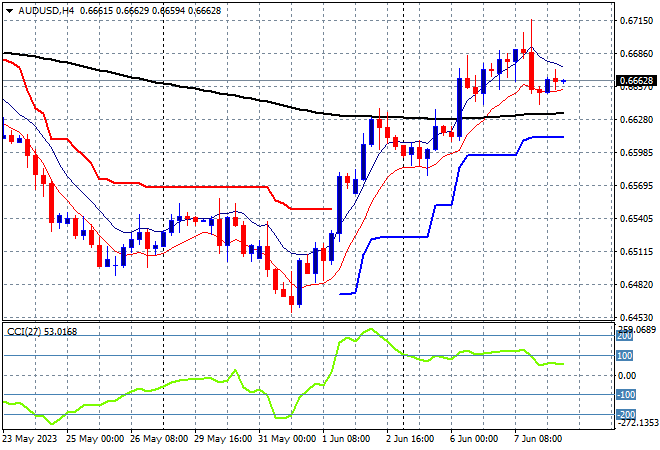

Australian stocks are still licking their wounds with ASX200 about to close 0.4% lower at 7094 points. The Australian dollar is holding on above the 66 handle after a minor pullback overnight, keeping its post RBA rate rise gains:

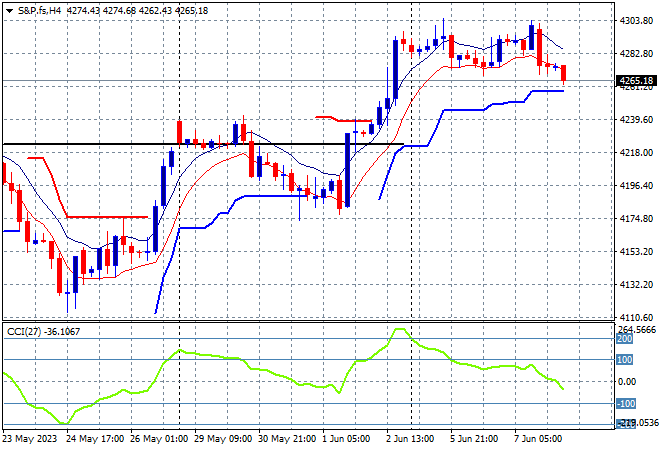

Eurostoxx and S&P futures are falling going into the London open with Wall Street trying hard to hold on to its post NFP bounce going into next week’s FOMC meeting.

The S&P500 four hourly chart is showing a desire to get back to the 4300 point level after bursting through resistance at the 4200 area on Friday night, but is slowly rolling over to short term support:

The economic calendar is again fairly quiet tonight although the latest Eurozone GDP estimates may shake things up.