Street Calls of the Week

Asian share markets have not liked the wobbly tone on overnight markets with the rising USD not helping either. The Australian dollar fell back to a weekly low following the expected RBA rate rise while local stocks continue to resist the key 7000 point level on the ASX200.

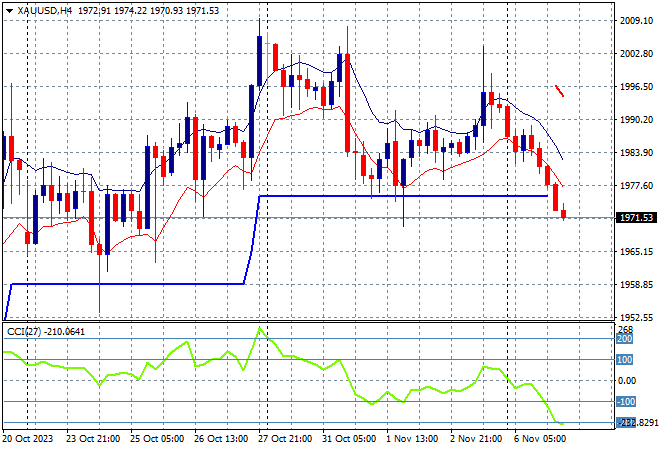

Oil prices are failing to stabilise, with Brent crude now back down to the $84USD per barrel level while gold is also dropping back, currently just above the $1970USD per ounce level to take out short term support:

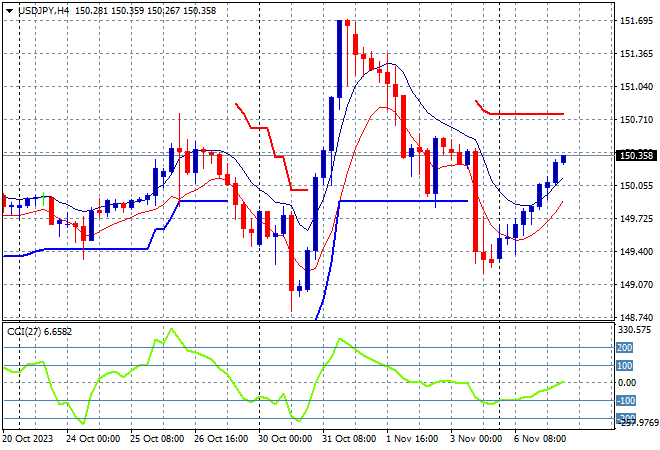

Mainland Chinese share markets have just held on to initial gains with the Shanghai Composite up only 0.1% at 3059 points while in Hong Kong the Hang Seng Index took back its previous gains to lose 1.2% and close at 17747 points. Japanese stock markets were in a similar downfall with the Nikkei 225 losing more than 1.2% to 32271 points while the USDJPY pair recovered once more to get back above the 150 level:

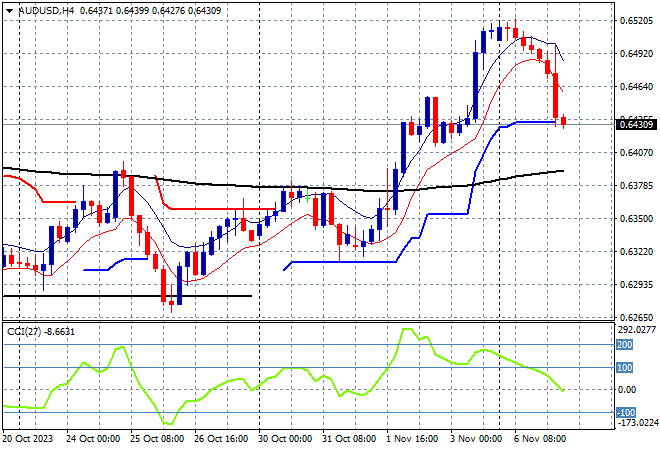

Australian stocks were able to absorb the RBA rate rise and only managed a small retraction with the ASX200, closing 0.3% lower at 6977 points, again just shy of former support at 7000 points while the Australian dollar fell sharply on the rate rise after topping out on Friday night, heading back to the 64 cent level:

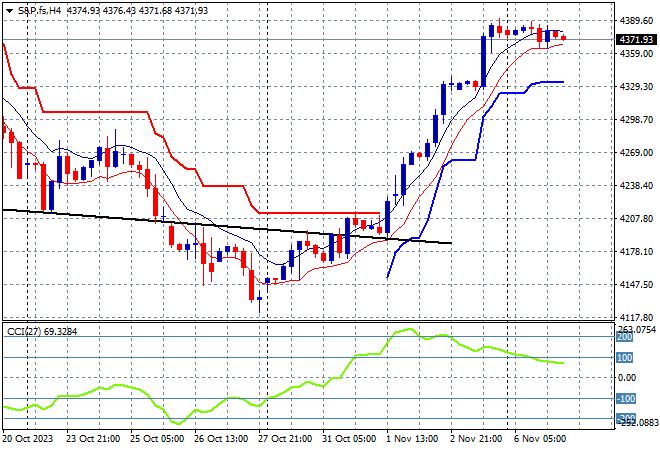

S&P and Eurostoxx futures are steady going into the London open as the S&P500 four hourly chart shows support getting upgraded from the 4200 to 4300 point level as short term momentum retraces slightly from being somewhat overbought:

The economic calendar includes the latest US balance of trade figures plus some Fed speeches to watchout for.