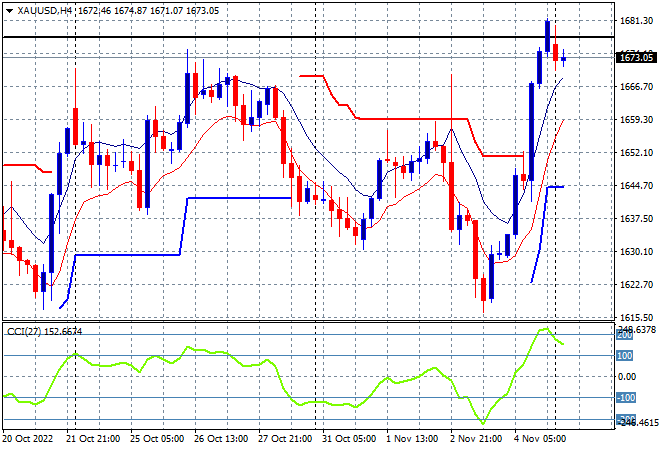

Asian stock markets are continuing their Friday session rebounds in the post NFP environment with the mixed US jobs print keeping USD under the thumb and risk taking back on track, although Wall Street does seem to lag the rest of the risk complex. The USD is down against most of the currency majors although there were some big gaps first thing in the morning due to the lack of weekend trade, with Euro remaining above the 99 level while the Australian dollar is trying to get above the 65 handle. Oil prices are pushing higher on Iranian/Saudi ructions with Brent crude just below the $98USD per barrel level while gold is off its Friday night surge highs, currently at the $1673 USD per ounce level:

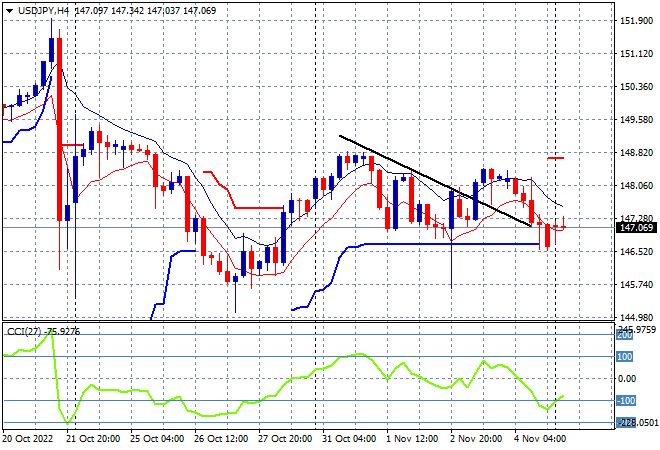

Mainland Chinese share markets are pulling back ever so slightly after their recent sharp rebound with the Shanghai Composite putting in a scratch session so far, currently at 3068 points while the Hang Seng Index has surged again, up more than 2.8% to extend its gains above the 16000 point level. Japanese stock markets are playing catchup after a shaky finish on Friday with the Nikkei 225 closing 1% higher at 27539 points, while the USDJPY pair has gapped slightly higher to steady here somewhat just above the 147 handle:

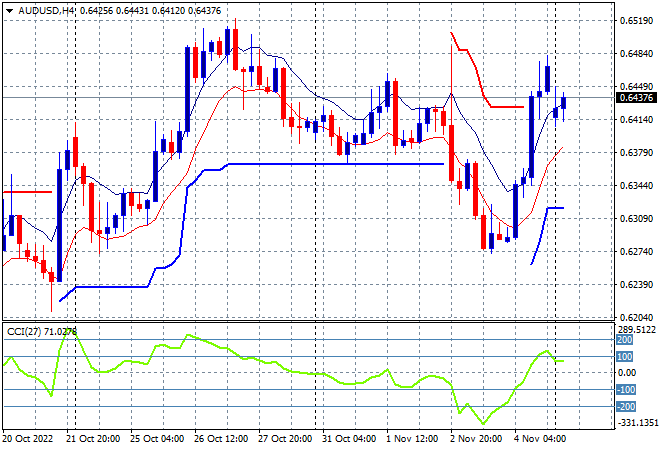

Australian stocks finished in the green as expected, with the ASX200 closing 0.6% higher, getting back above the 6900 point level to finish at 6933 points. The Australian dollar gapped lower but then held on to most of its Friday night zoom gains, pipping back above the 64 handle after a big bounce back but still off the October high position above the 65 cent level in the wake of the hawkish Fed:

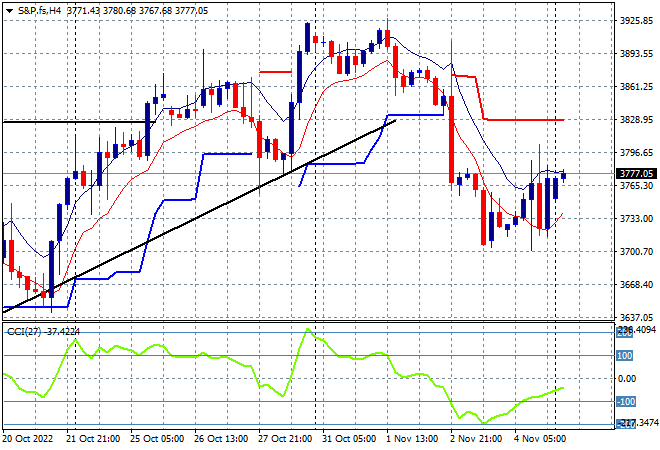

Eurostoxx and US futures are trying to lift higher as we head into the London session with the S&P500 four hourly chart showing price action bunched up here below the 3800 point level. This market is still somewhat contained and below the recent uptrend line, unlike other bourses so watch for a breakout above 3800 points and trailing ATR resistance before getting too excited here:

The economic calendar starts the week slowly post the NFP print with some US Treasury auctions.