Street Calls of the Week

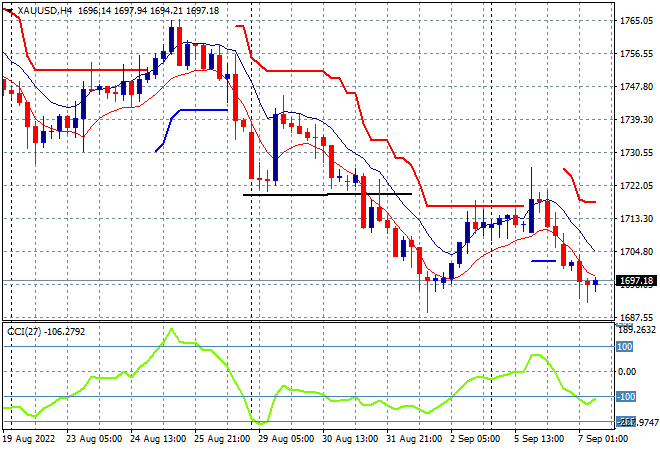

Asian stocks had another broad selloff in response to the unease on Wall Street and the surging USD as the bears continue to circle. The ongoing energy crisis in Europe continues to stoke recession fears, with the Euro below the 99 handle while the Australian dollar is depressed at just over 67 cents versus USD after yesterday’s rate hike. Meanwhile oil prices are pulling back further with Brent down over 2% to the $91USD per barrel level while gold has retraced below the $1700USD per ounce level back to its recent weekly lows:

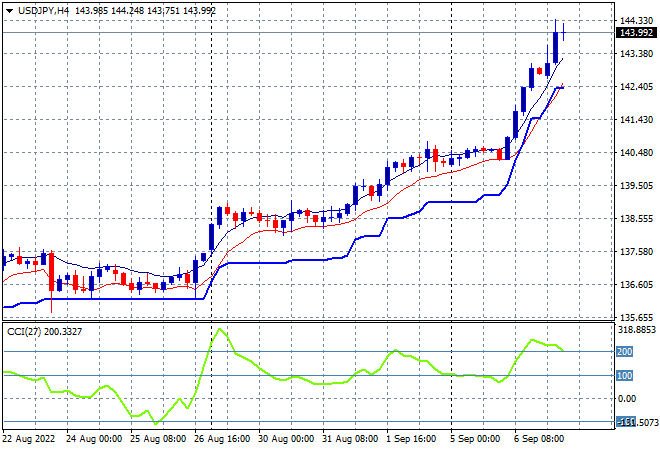

Mainland Chinese share markets are having a pause with the Shanghai Composite basically unchanged at 3243 points while the Hang Seng Index is still in sell mode, down nearly 2% to slump below the 19,000 point level, currently at 18833 points. Japanese stock markets are joining in with the Nikkei 225 closing 0.7% lower to 27430 points while the USDJPY pair pushing ever higher and now breaking through the 143 level in a big blowoff move:

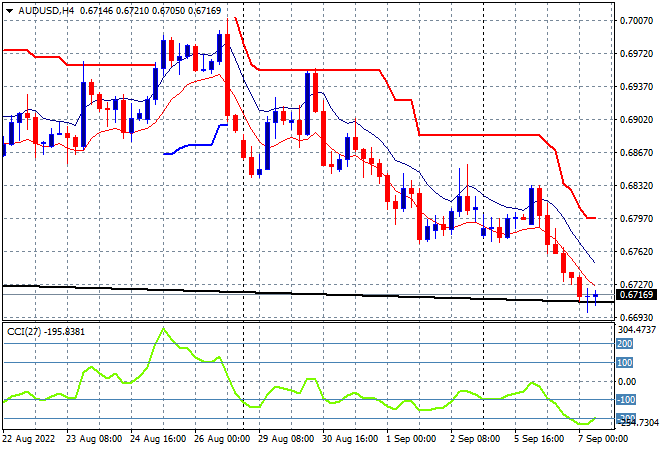

Australian stocks slumped in the wake of the reaction to the RBA decision but more so commodity prices and the local GDP print, with the ASX200 closing 1.4% lower to at 6729 points. The Australian dollar is well on the ropes and looks exhausted here after wide selling as it sits right on the monthly downtrend line at the 67 handle:

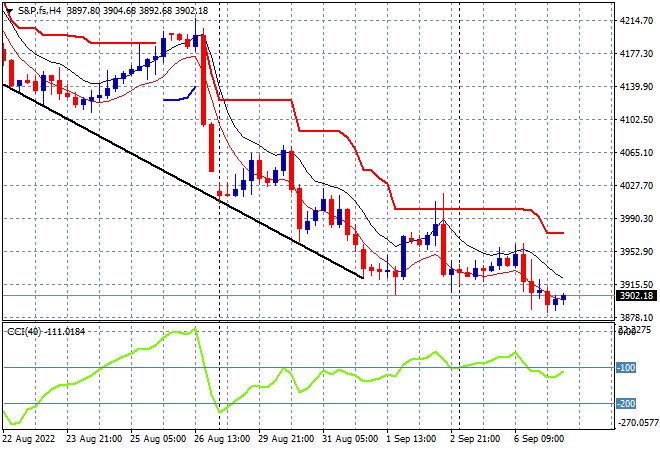

Eurostoxx and US futures are slowly going down as we head into the London session, with the S&P500 four hourly futures chart showing price action still stuck well below the 4000 point level and now even threatening 3900 as four hourly momentum remains quite negative here as overhead resistance firms:

The economic calendar includes the latest European wide GDP 3Q estimate, then US balance of trade figures.