Stock markets are in a flux throughout Asia with Japanese bourses finally injecting some sanity while Chinese shares are split and local stocks are still wondering what the hell the RBA is up to…Wall Street futures are flat as the economic calendar remains quiet while the USD is strengthening against everything but the Australian dollar which looks set to hit the 67 cent level soon:

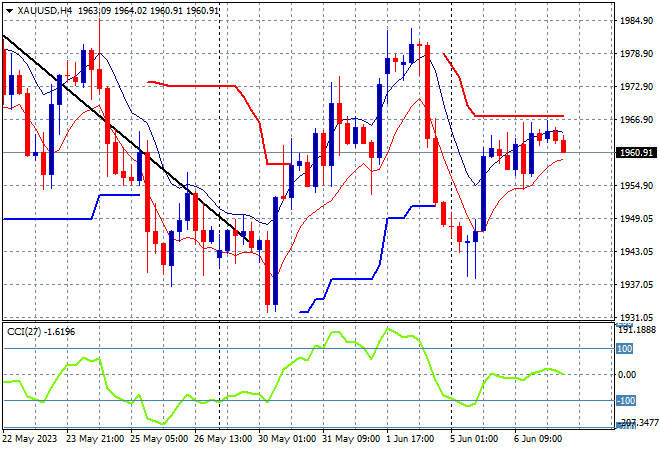

Oil prices are slowly retreating with Brent crude holding just above the $75USD per barrel level while gold is looking to rollover as it hits short term resistance at the $1970USD per ounce level:

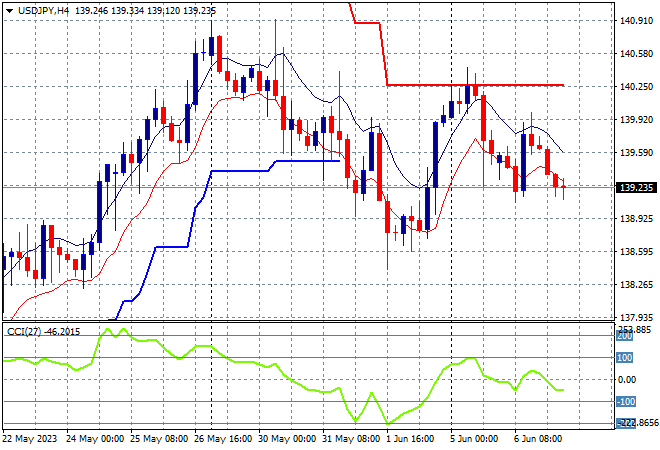

Mainland Chinese share markets are dead flat with the Shanghai Composite hovering just below the 3200 point level while the Hang Seng Index is up 1% to extend its gains above the 19000 point level. Japanese stock markets are finally putting on the brakes with the Nikkei 225 closing more than 1.7% lower at 31953 points as the USDJPY pair pulls back to 139 level, unable to get back to the previous weekly high:

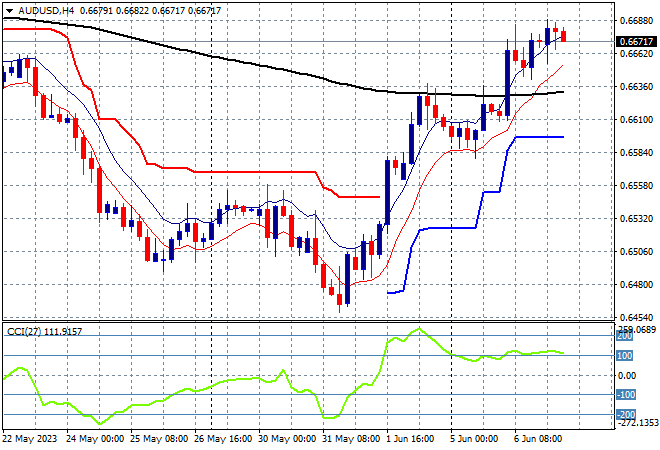

Australian stocks are licking their wounds with ASX200 closing just 0.1% lower at 7116 points. The Australian dollar has kept surging ahead, on its way to the 67 handle, holding on to its post NFP print support level and making a new weekly high following the new rate rise from the RBA:

Eurostoxx and S&P futures are flat going into the London open with Wall Street wanting to hold on to its post NFP bounce going into next week’s FOMC meeting. The S&P500 four hourly chart is showing a desire to get back to the 4300 point level after bursting through resistance at the 4200 area on Friday night:

The economic calendar is again fairly quiet tonight with the latest Canadian central bank decision plus some light European releases.