-

Economic resilience has held up, but emerging signs of weakness suggest investors should stay vigilant.

-

Market volatility is creeping higher, hinting at a potential shift from the steady gains of recent years.

-

Geopolitical uncertainty remains the biggest wild card, making adaptability crucial for long-term investors.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 for half price as part of our FLASH SALE.

Long-term investing requires patience, a solid plan, and the humility to accept that predicting geopolitical events is nearly impossible. While I always focus on the bigger picture, the current pace of change demands attention. Rapid shifts can bring both risks and opportunities, and navigating them requires more than a black-and-white perspective—nuance is essential.

Several risk factors are gaining prominence, including economic uncertainty, market instability, systemic weaknesses, currency fluctuations, and geopolitical tensions. The U.S.’s role as a global power also faces new challenges. One risk in particular stands out: the increasing likelihood of a policy misstep. This development deserves close monitoring.

Let’s examine three key concerns that, while still contained, are likely to intensify over the next 12 months:

1. Recession Risks Are Rising—But Don’t Expect an Immediate Downturn

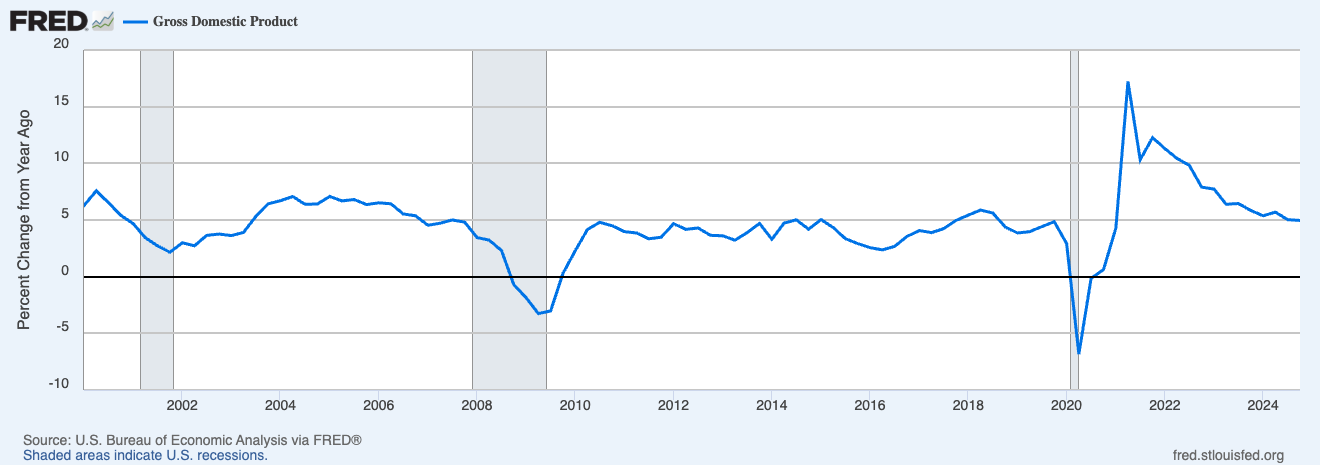

For years, recession calls have been premature, and the market has acknowledged the economy’s resilience. However, signs of moderation are emerging.

Retail sales have softened, and durable goods orders aren’t showing strong momentum. While a contraction isn’t imminent, the economy’s vulnerability is becoming more evident as per the GDP—a risk that investors can’t ignore.

2. Volatility Is Creeping Higher

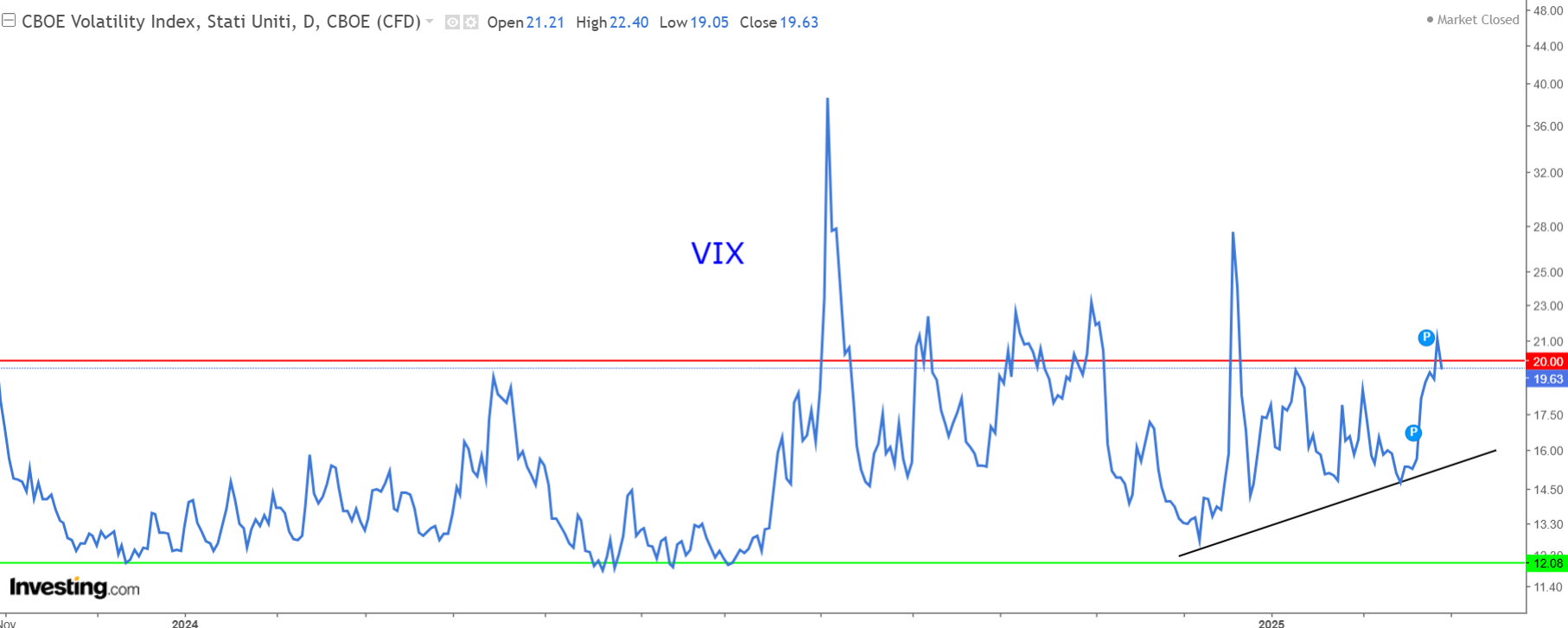

Despite equities repeatedly hitting all-time highs, market volatility has started to climb. If record highs define a bullish market, then failing to break previous peaks could signal a shift toward higher volatility.

The CBOE Volatility Index, which hovered at historically low levels post-pandemic, is now trending upward, edging past 20. While this isn’t alarming yet, it hints at potential turbulence ahead.

3. The Geopolitical Wild Card

Unlike economic and market risks, geopolitical uncertainty is harder to quantify. Historical trends can guide expectations for recessions and volatility, but geopolitical shifts are unpredictable. The ongoing tensions involving Ukraine, Russia, China, Europe, and even trade routes like the Panama Canal introduce an additional layer of uncertainty.

To navigate this, investors must resist the trap of emotional bias and prepare for a range of scenarios. That said, if I had to choose between fear and optimism, I’d still bet on the latter.

Growing risks don’t just bring challenges—they create opportunities for investors who can stay ahead of market shifts.

Subscribing to InvestingPro to capitalize on potential corrections. A subscription will also allow you to access the latest ProPicks monthly rebalancing update for March, using this link.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.