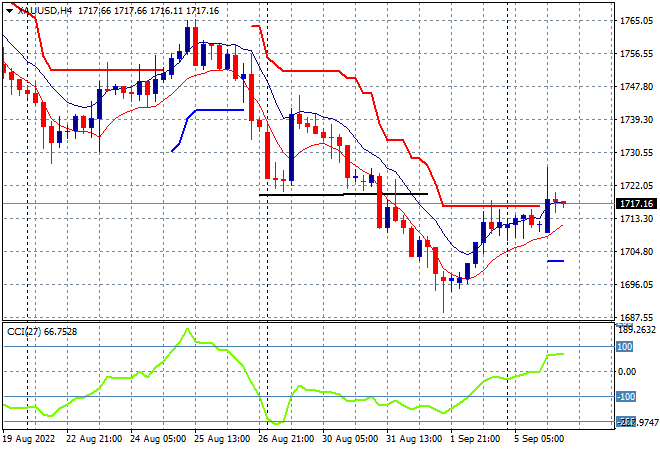

Asian stocks remain mixed with the absence of US markets overnight hopefully stabilising the risk complex as they return from the long weekend, although the growing energy crisis in Europe and in Brexitland as Thatcher 2.0 comes to power is still putting the squeeze on Euro. The Australian dollar absorbed the latest recession causing rate hike by the RBA, feeling depressed again below the 68 cent level. Meanwhile oil prices are somewhat flat with Brent just above the $95USD per barrel level while gold is possibly finding a short term bottom here at just above the $1710USD per ounce level but it may only be temporary:

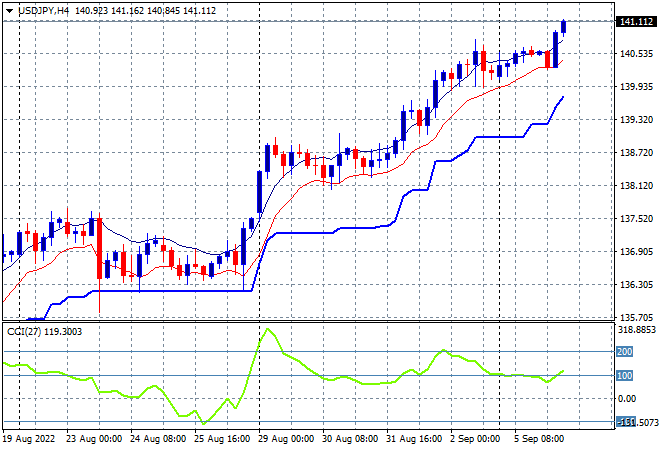

Mainland Chinese share markets are having a very positive session with the Shanghai Composite up 1.2% to 3238 points while the Hang Seng Index is still in sell mode, down another 0.5% to 19142 points the 20,000 point level turns into resistance. Japanese stock markets are trying to stabilise with the Nikkei 225 closing with another scratch session at 27626 points while the USDJPY pair pushing ever higher and now breaking through the 141 level:

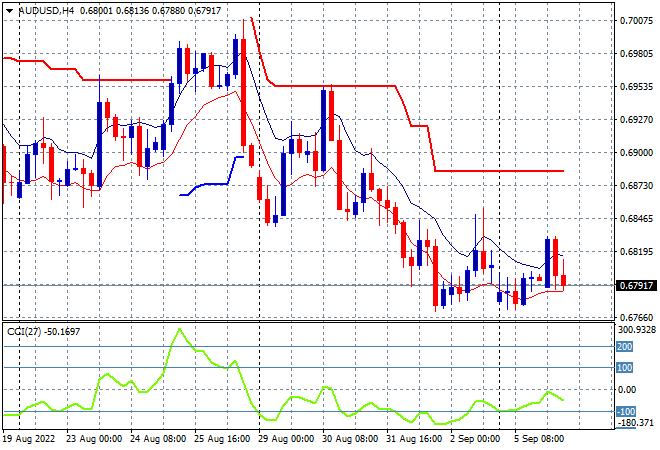

Australian stocks didn’t like the RBA decision with the ASX200 closing nearly 0.4% lower at 6826 points, taking back the recent gains. The Australian dollar also absorbed the rate hike by dashing up above the 68 handle briefly before bottoming out again to return to its start of week position, under a lot of pressure from the bears:

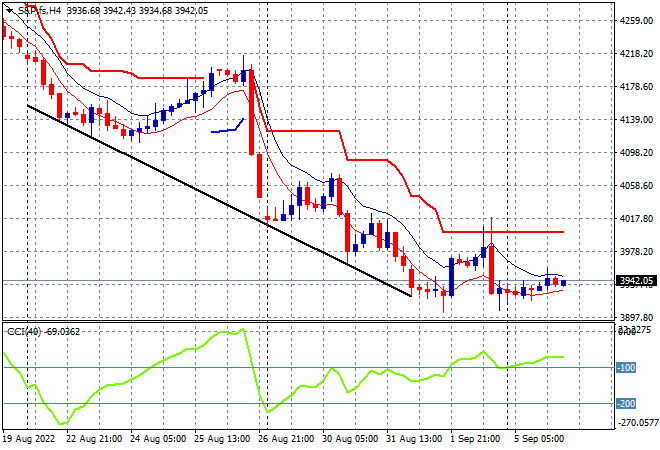

Eurostoxx and US futures are still going nowhere as we head into the London session, with the return of US traders possibly helping risk sentiment energise higher, but the S&P500 four hourly futures chart showing price action still stuck well below the 4000 point level. Four hourly momentum remains quite negative here as overhead resistance firms:

The economic calendar includes a slew of construction and other global PMI surveys, plus the all important ISM non-manufacturing print that could be risk sensitive.