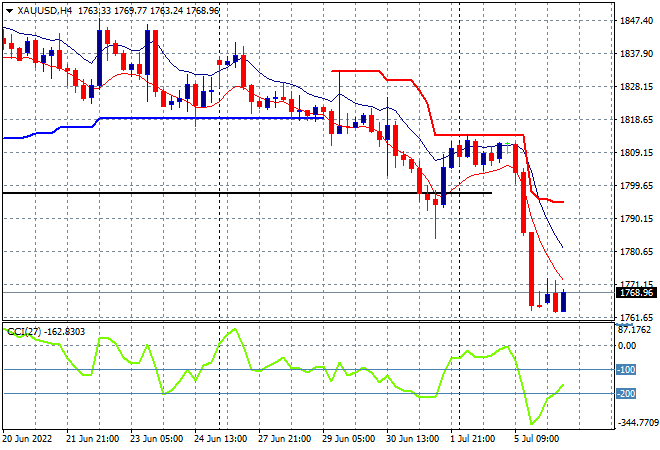

A sea of red across Asian share markets despite the somewhat positive overnight lead from Wall Street as traders react to the steep falls in commodity prices and growth fears. The defensive USD is keeping Pound Sterling and Euro at its heels, while the Australian dollar was essentially unchanged after being floored overnight post the RBA rate rise that had been priced in already, remaining depressed right on the 68 cent level. Oil prices are trying to stabilise from their big falls overnight, with Brent crude just above the $104USD per barrel level, while gold is treading water as gold bugs chew their fingers following last night’s flog through what was support at the $1800USD per ounce level:

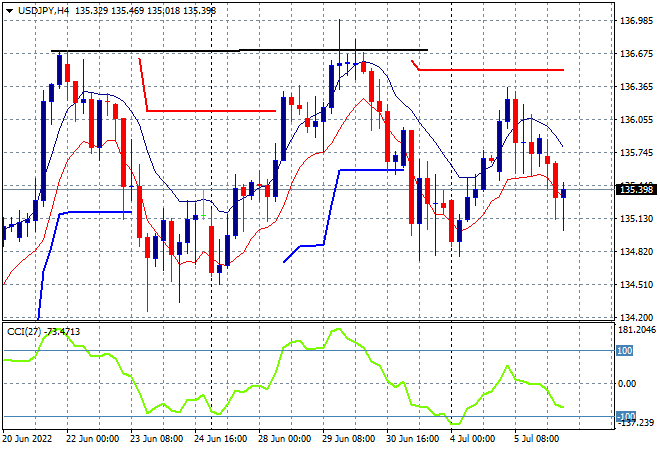

Mainland Chinese share markets are dropping sharply going into the close with the Shanghai Composite down nearly 1.5% to 3353 points while the Hang Seng Index is off by more than 2%, currently at 21343 points. Japanese stock markets are also selling off, with the Nikkei 225 index closing some 1.2% lower at 26107 points while the USDJPY pair has found a modicum of support at the 135 handle after rolling over slightly overnight as the previous bounce off support from Friday night failed to sustain momentum:

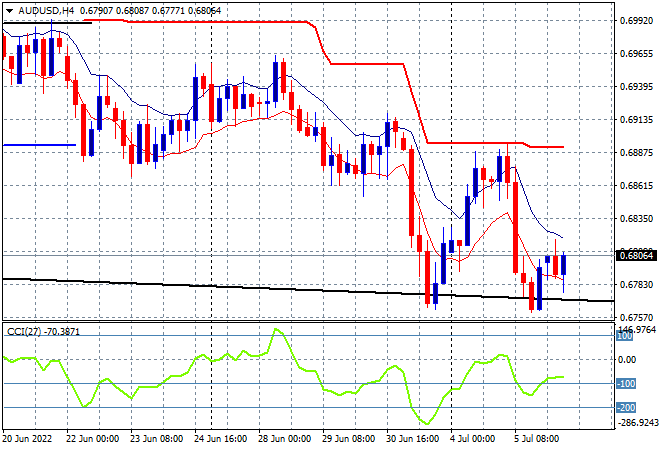

Australian stocks were the best relative performers, with the ASX200 finishing 0.5% lower at 6594 points. The Australian dollar remains on the ropes although its had a tiny surge throughout the day, just a reaction to the overnight whalloping to the mid 67 cent level with the overall trend still down:

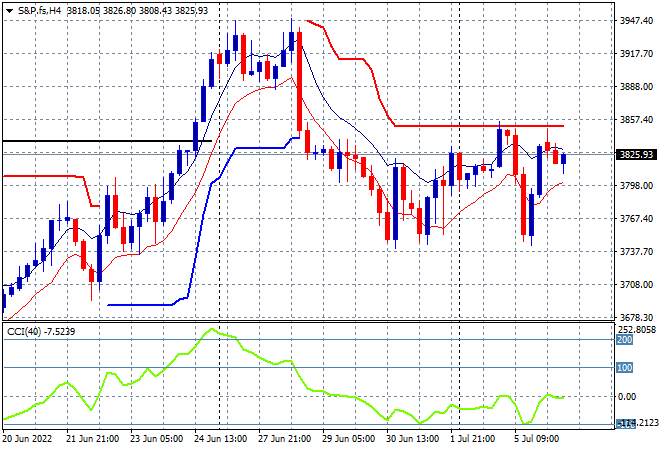

Eurostoxx and US futures are faltering as we head into the European open, with the S&P500 four hourly futures chart showing price action contained just above the 3800 point level with momentum wanting to swap into the positive zone and get price back above Friday’s closing point, but finding resistance to hard to climb over:

The economic calendar has some basic construction PMI data first in the European session but then heats up with the latest US non-manufacturing ISM print and the release of the latest FOMC meeting minutes.