Outside Australia its green across the board in Asia, despite Wall Street pulling back mildly on softer than expected US data overnight. The unexpected RBA rate rise has seen the Australian dollar soar while local stocks fell back sharply. Meanwhile other undollars remain steady given the recent resurgence of USD.

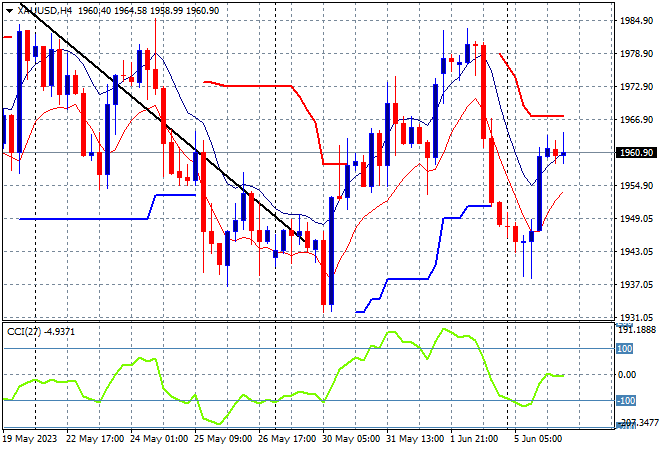

Oil prices are still strong in response to the latest Saudi output cuts with Brent crude holding well above the $76USD per barrel level while gold is trying to hold on to its overnight meagre gains, still hurting from its Friday night burst, now treading at just above the $1960USD per ounce level:

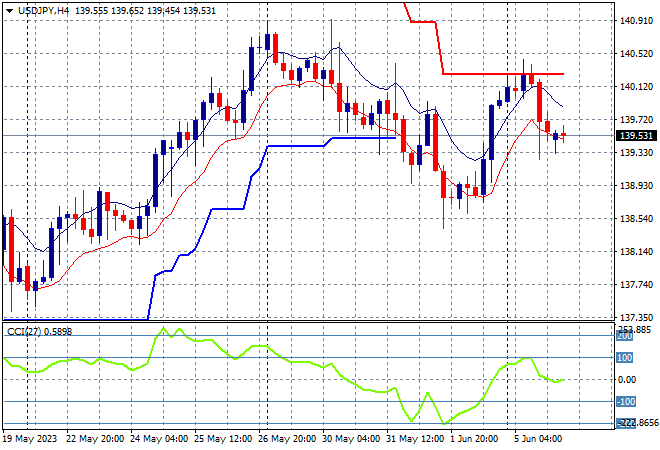

Mainland Chinese share markets are pulling back after the long lunch break with the Shanghai Composite down 0.4% to 3217 points while the Hang Seng Index is up 0.6% to remain above the 19000 point level. Japanese stock markets are putting in more upside with the Nikkei 225 closing more than 0.7% higher at 32453 points as the USDJPY pair sits below the 140 level, unable to get back to the previous weekly high:

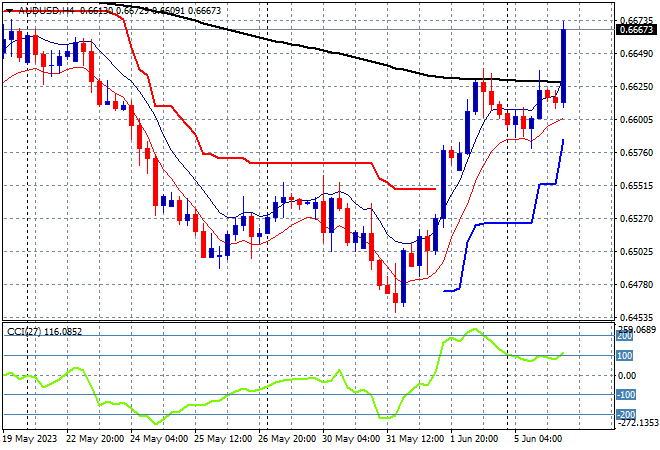

Australian stocks hated the RBA rate hike with the ASX200 closing exactly 1% lower at 7145 points. The Australian dollar has surged straight through the 66 handle, holding on to its post NFP print solid support level as traders seemed to have anticipated this new rate rise from the RBA:

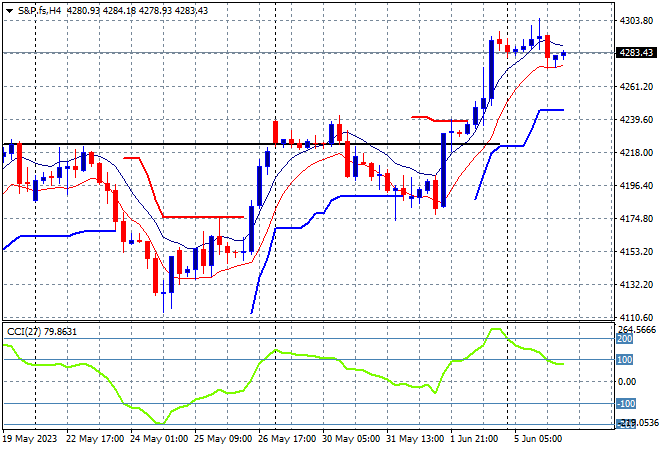

Eurostoxx and S&P futures are steady going into the London open with Wall Street wanting to hold on to its post NFP bounce and make it something more substantial. The S&P500 four hourly chart is showing a desire to get back to the 4300 point level after bursting through resistance at the 4200 area on Friday night:

The economic calendar is very quiet again with the latest Euro retail sales print.