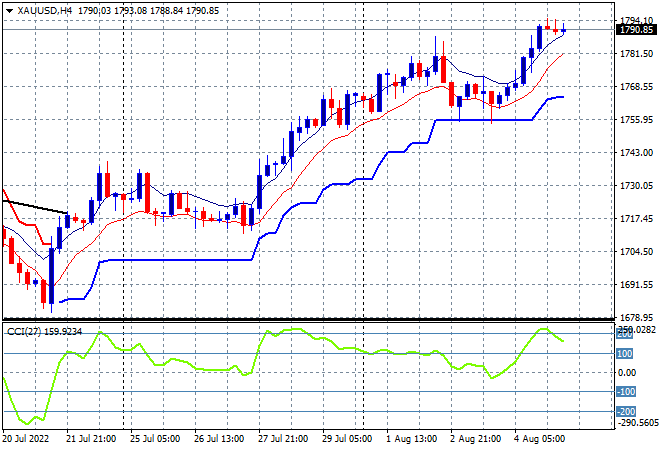

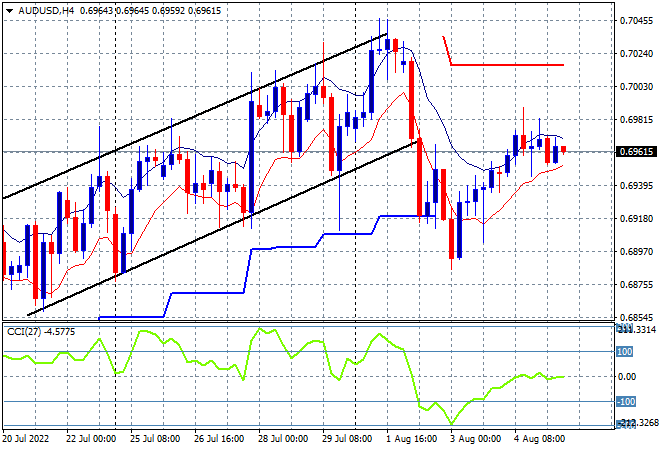

Asian stocks are having a solid session to finish the trading week as markets position themselves for what is likely to be a robust US unemployment print tonight. The USD is mixed versus most of the major currencies, although the Australian dollar is caught between the RBA playing catchup and the Fed as it hovers below the 70 cent level, while Pound Sterling remains weak despite the BOE raising rates overnight. Meanwhile oil prices are continuing to fall below recent key support levels, with Brent crude now pushed down to the $94USD per barrel level, while gold is relatively stable and holding above short term support at the $1790USD per ounce level:

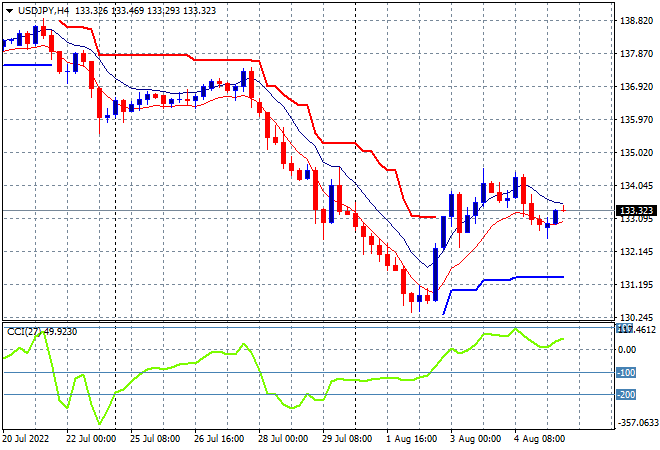

Mainland Chinese share markets are basically treading water with the Shanghai Composite up only 0.1% to 3189 points while the Hang Seng Index is slipping into the close, currently down 0.2% at 20127 points. Japanese stock markets however are the standout despite growing tensions over Taiwan, with the Nikkei 225 up 0.8% to 28168 points as the USDJPY pair deflates slightly down back to the 133 level:

Australian stocks are lifting going into the close the ASX200 finally pushing through the 7000 point level, currently at 7015 points. The Australian dollar however is unmoved as it remains unable to clawback its post RBA rate rise walloping as it holds well below the 70 level against USD:

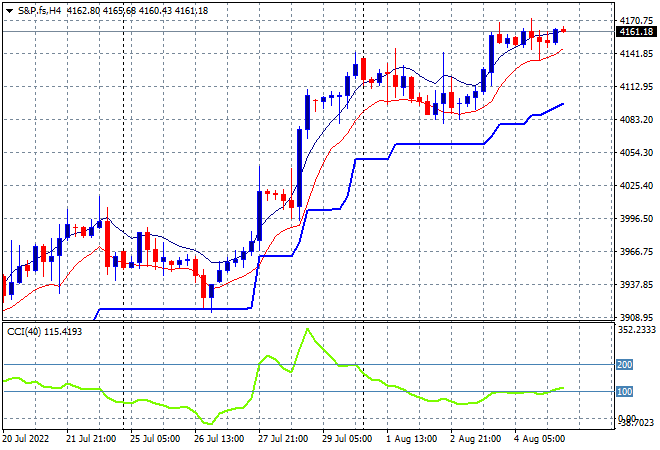

Eurostoxx and US futures are holding on to their overnight positions with the S&P500 four hourly futures chart showing price action pausing here at the 4150 point level as the relief rally takes another breather before the next legup:

The economic calendar will focus squarely on the latest US NFP – non farm payrolls – aka unemployment print tonight.