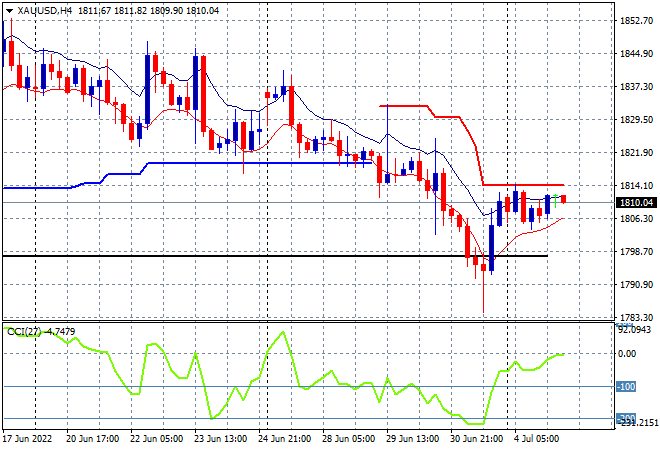

Asian share markets are doing well despite the lack of an overnight lead from Wall Street. The defensive USD is keeping Pound Sterling and Euro at bay, with Yen also weakening while the Australian dollar was essentially unchanged after the RBA raised rates 50bps as expected this afternoon, remaining depressed at the mid 68 cent level. Oil prices are trying to stabilise with Brent crude just above the $112USD per barrel level, while gold is holding on to its post Friday session bounce to be just above the $1810USD per ounce level:

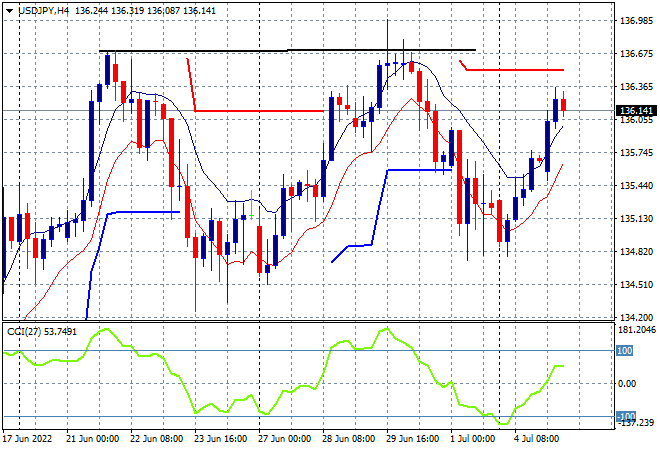

Mainland Chinese share markets are dropping sharply going into the close with the Shanghai Composite down nearly 0.7% to 3382 points while the Hang Seng Index is dead flat, currently at 21861 points. Japanese stock markets however are not minding the stronger Yen, with the Nikkei 225 index up 1% at 26423 points while the USDJPY pair has pushed higher, now breaking through the 136 handle as it continues its bounce off support from Friday night:

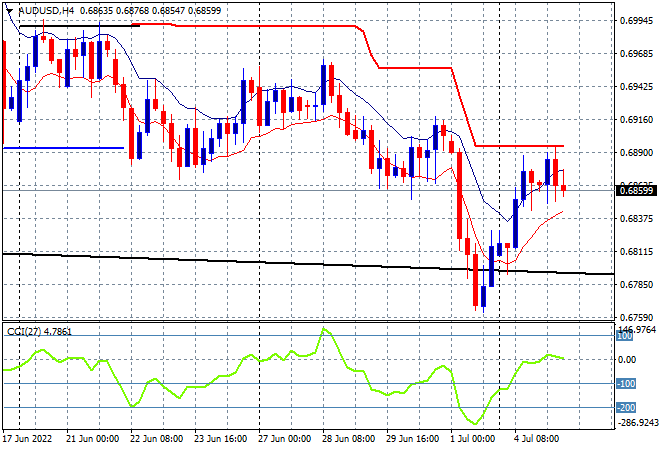

Australian stocks absorbed the RBA rate rise with aplomb with the S&P/ASX 200 finishing 0.2% higher, closing at 6629 points. The Australian dollar also had the rate rise priced in with an eventual pullback this afternoon to be on the mid 68 level with the overall trend still down:

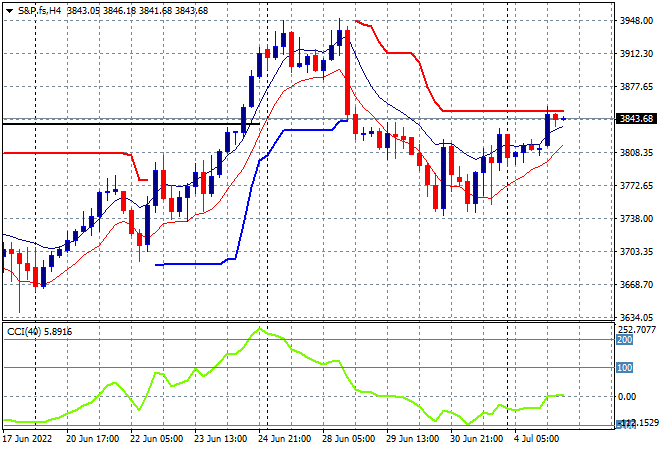

Eurostoxx and US futures are building slowly as we head into the European open and anticipate the return of traders to Wall Street, with the S&P500 four hourly futures chart showing price action building above the 3800 point level with momentum wanting to swap into the positive zone and get price back above Friday’s closing point:

The economic calendar is still relatively quiet with the latest UK services PMI and final factory orders data for the US.