Asian share markets are trying to advance with Japanese markets leading the way while local stocks are jittery as traders await tonight’s US unemployment print. The Australian dollar is failing to make headway as it breaks below the 67 cent level in afternoon trade.

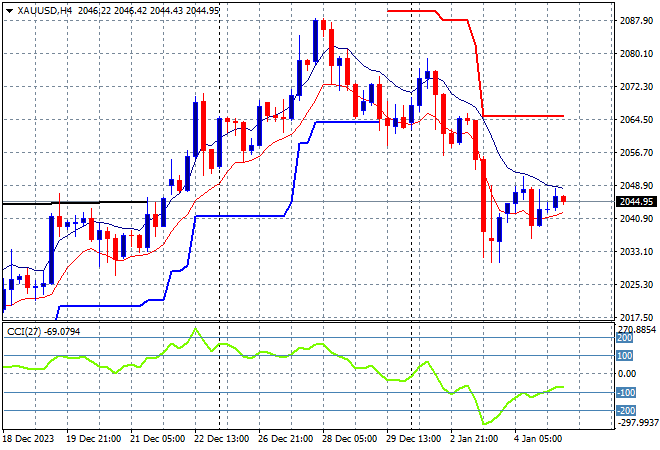

Oil prices are inching higher on Red Sea tensions as Brent crude stays anchored around the $78USD per barrel level while gold is continuing to consolidate following its recent plunge, holding just above the $2040USD per ounce level:

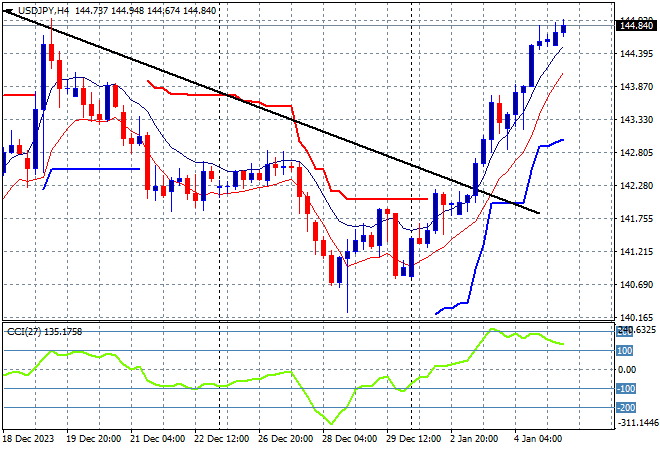

Mainland Chinese share markets are again unable to bounceback as the Shanghai Composite remains well below the 3000 point barrier, currently some 0.2% lower at 2950 points while in Hong Kong the Hang Seng Index is down a similar amount at 16622 points. Japanese stock markets are the exception with the Nikkei 225 gaining more than 0.7% to 33541 points helped by a declining Yen as the USDJPY pair pushes further above the 144 level:

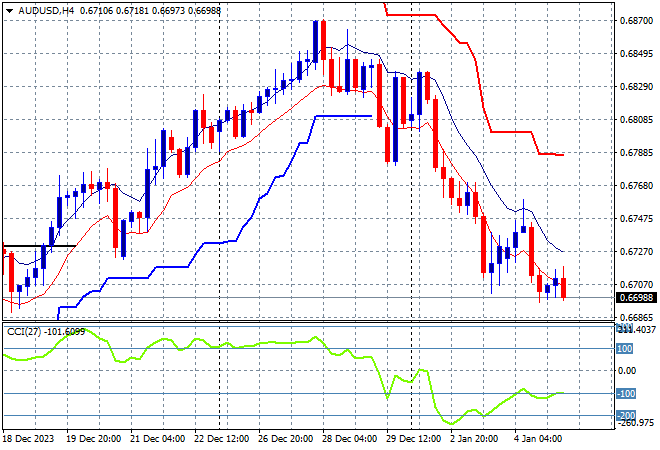

Australian stocks were able to finish with a scratch session with the ASX200 closing the week out just below the 7500 point level while the Australian dollar continues its decline after its New Year slump with a break below the 67 cent level:

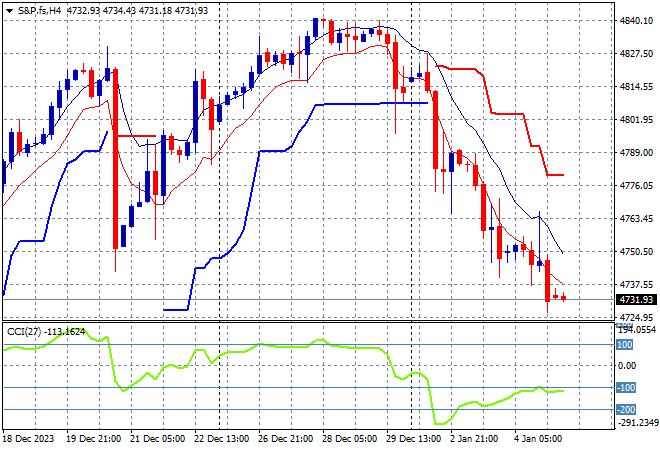

S&P and Eurostoxx futures are pulling back further from their start of year lows going into the London open with the S&P500 four hourly chart showing a continued breakdown below the 4800 point level with short term momentum quite oversold:

The economic calendar will focus squarely on the December US NFP unemployment print tonight.