Street Calls of the Week

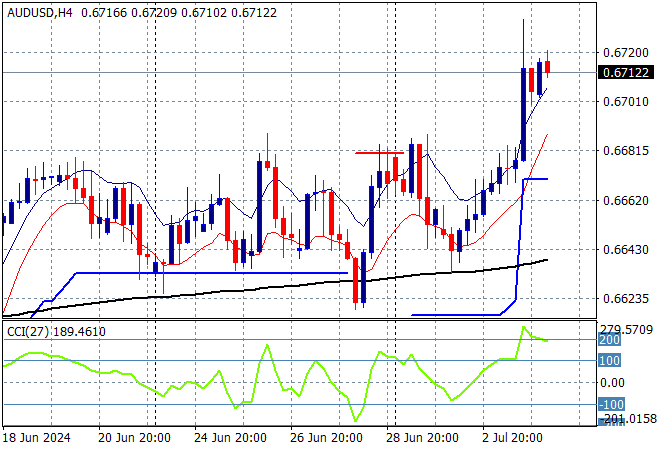

Asian share markets are generally higher across the region as the bet tonight’s closed Wall Street’s will have little impact overall on risk. The UK election will feature squarely in European eyes while continued speculation about President Biden’s reelection may push bond and currency markets around more than expected. The Australian dollar holding firm above the 67 cent level as a result.

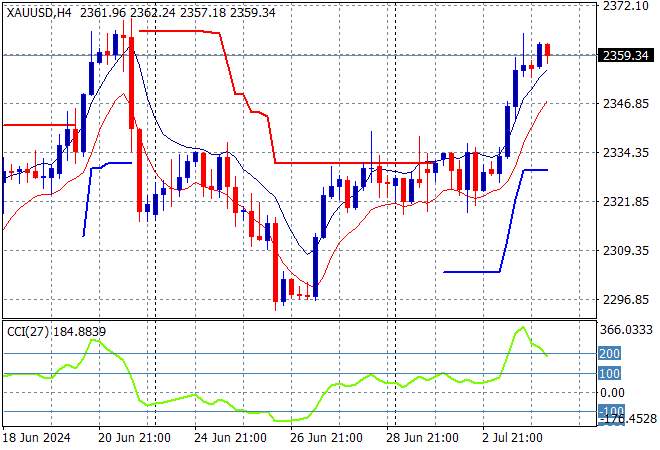

Oil prices are holding at their recent highs with Brent crude nearly above the $87USD per barrel level while gold wants to push higher above the $2350USD per ounce level:

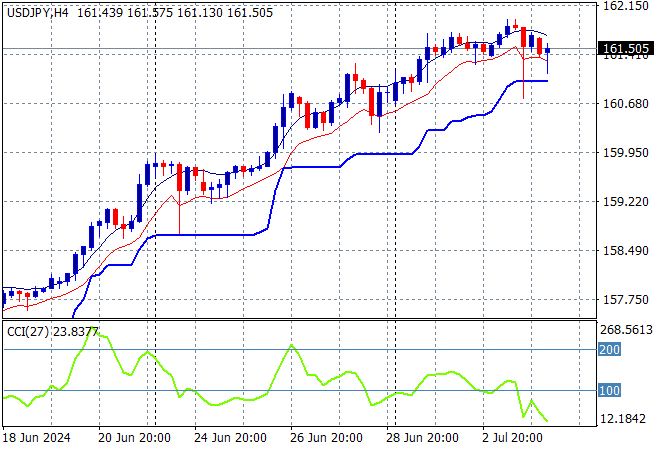

Mainland Chinese share markets are failing to make a comeback with the Shanghai Composite again rejecting the 3000 point barrier, currently down 0.5% while the Hang Seng Index is barely 0.1% higher at 17998 points. Meanwhile Japanese stock markets are still lifting with the Nikkei 225 up more than 0.8% to 40933 points as the USDJPY pair nearly breaks above the 162 level in what seems like a straight line:

Australian stocks finally were not the worst performers with the ASX200 gaining over 1% to 7829 points while the Australian dollar is holding steady above the 67 cent level, wanting to keep steady above its breakout:

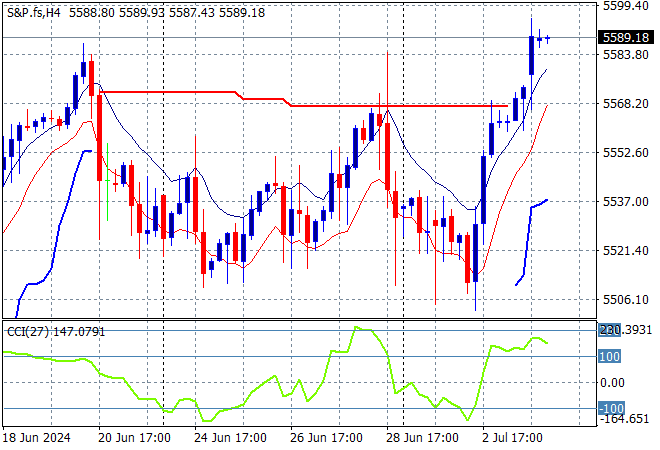

S&P and Eurostoxx futures are somewhat flat as we head into the London session with the S&P500 four hourly chart showing price action wanting to advance above the 5500 point level which continues to act as support:

The economic calendar includes the UK General Election and the latest ECB Minutes, while US markets will be closed to mourn the death the of US Republic and bring in the New Kingdom of North America.