Street Calls of the Week

Asian stock markets are treading water as they absorb the closure of Wall Street overnight due to the 4th of July holiday, and while currency markets are still feeling the weight of a stronger USD they too are largely unchanged. The only movement is in local stocks as the RBA surprised with a pause, holding rates at 4.1% with the Aussie dollar roundtripping while the ASX200 put on a small surge.

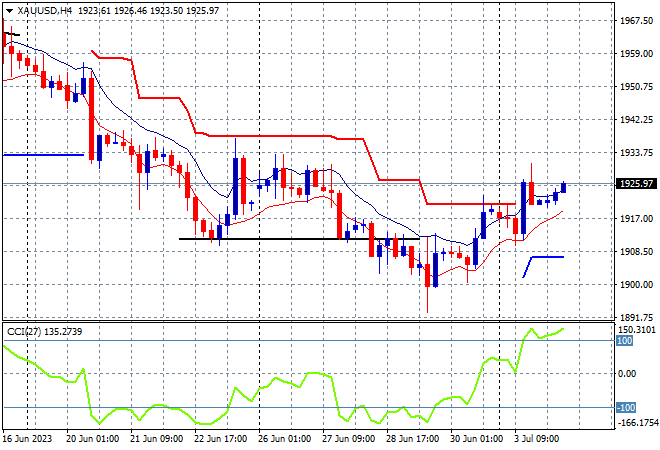

Oil prices have not reacted positively to the OPEC/Ruzzia production cuts, with Brent crude hovering just above the $75USD per barrel level while gold is looking a lot better, getting out of its depressed mood to almost make a new weekly high above the $1920USD per ounce level:

Mainland Chinese share markets are failing to translate their solid start to the trading week with the Shanghai Composite currently in a scratch mood, stuck at 3242 points while the Hang Seng Index is doing the same, barely up a handful of points at 19324 points.

Japanese stock markets are selling off however, with the Nikkei 225 closing 1% lower at 33423 points with the USDJPY pair basically unchanged like most of the major currency pairs but still wanting to push above the 144 level:

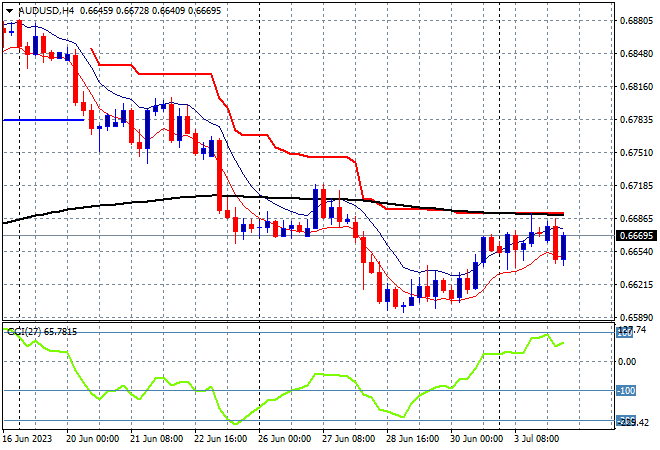

Australian stocks were the best performers today as trader’s loved the RBA pause with the ASX200 closing nearly 0.5% higher at 7279 points. The Australian dollar pulled back immediately on the pause but has taken back that small loss in the main, holding just below the 67 handle, with short term momentum providing a divergent reading to short term price action:

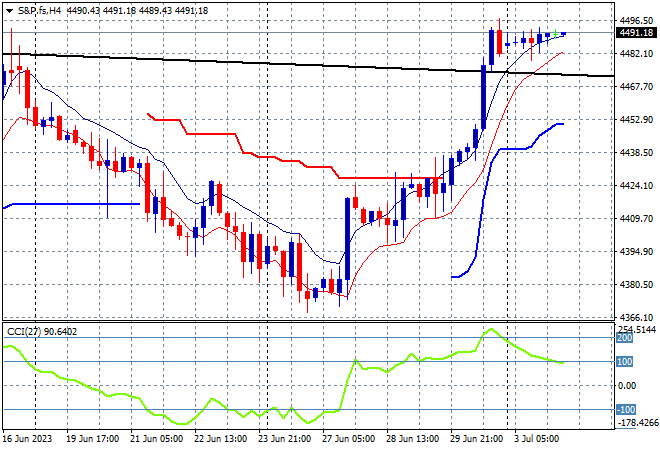

Eurostoxx futures are about 0.1% higher while S&P futures are stuck given tonight’s holiday on Wall Street. The S&P500 four hourly chart is still holding well above previous ATR resistance at the 4400 point level:

The economic calendar remains quiet due to the 4th of July US holiday with nothing of note overnight.