Risk sentiment has flipped to one of unease given the combination of further hawkish comments from the Fed and heightened tensions over US Speaker Pelosi’s visit to Taiwan, confirming the glass jaw of Chinese diplomacy is still as fragile as ever. This sent Chinese stock markets down sharply yesterday with currency volatility not far behind as the USD regained its recently lost strength against almost everything with a sharp reversal in Euro. The Australian dollar was whallopped despite the RBA raising rates half a percent, with steeper falls overnight to almost get through the 69 handle. Bond markets saw a reversal in yields with 10 Year Treasuries jumping up to the 2.7% level with more than 100bps in rate rises predicted by the end of 2022. Commodities remain volatile as oil prices pushed lower, as Brent crude remains anchored below the $100USD per barrel level while copper and gold both dropped on the stronger USD.

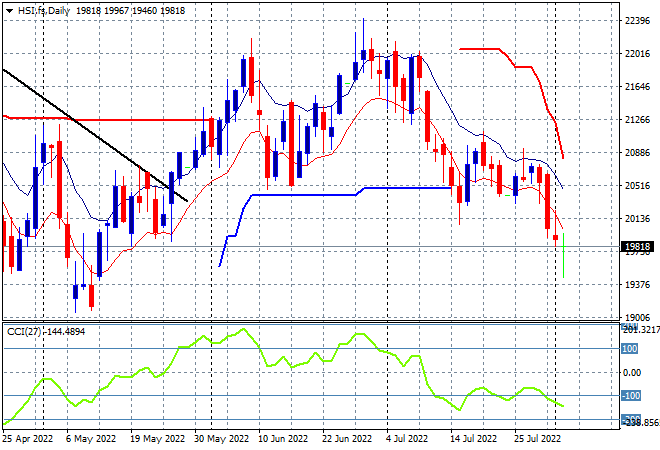

Looking at share markets in Asia from yesterday’s session, where mainland Chinese share markets sold off fast on renewed Taiwan tensions with the Shanghai Composite finishing more than 2% lower to 3186 points, while the Hang Seng Index also fell sharply through the 20000 point barrier, closing 2.4% lower at 19689 points. Sentiment continues to wane fast on the daily chart with considerable overhead resistance and daily momentum readings remaining solidly oversold. It looks like the May lows will come under pressure soon – all over a plane flight from Pelosi!:

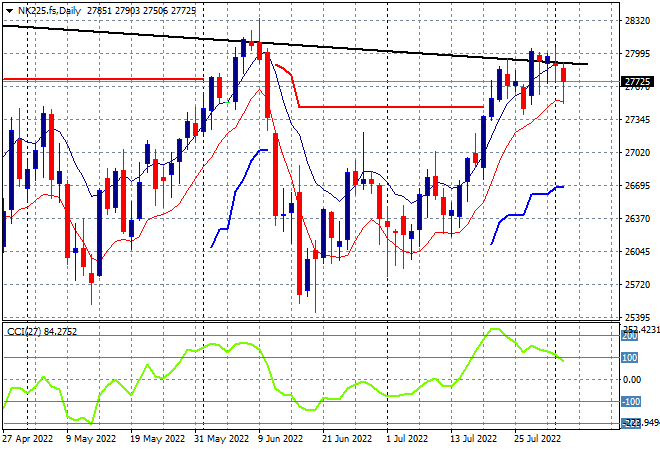

Japanese stock markets also lost significant ground, with the Nikkei 225 closing down 1.4% to 27594 points. Futures on the daily chart are now suggesting another pause in this breakout phase that has been unable to clear resistance at the previous highs at 28000 points. Daily momentum has retraced from its overbought status and while price recently made a new weekly high, the overall monthly/weekly downtrend (sloping black line above) is still in play:

Australian stocks slid in with a scratch session despite the RBA rate rise with the ASX200 closing 0.1% higher to almost push through the 7000 point level, closing at 6998 points. SPI futures are down a handful of points on the unease on Wall Street overnight. The daily chart still looks quite firm with a short term breakout situation as it tries to convert the recent bottom into a new uptrend. Daily momentum remains nicely overbought with the potential for more upside action but can it get through the 7000 point level:

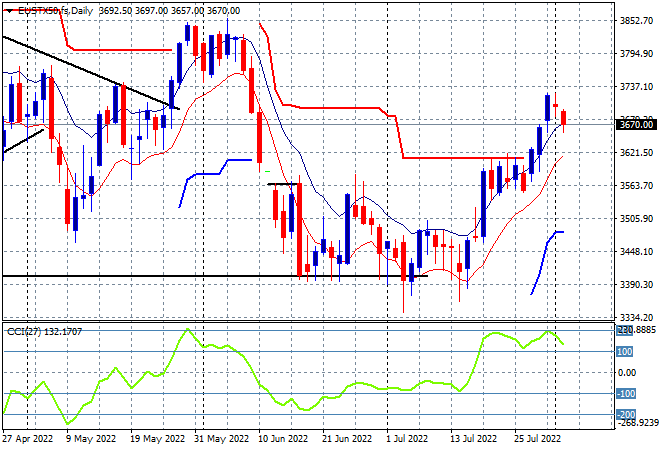

European stocks were hesitant to re-engage the bullish trend of last week with most bourses pulling back slightly, with the Eurostoxx 50 index retracing some 0.6% to finish at 3684 points. The daily chart shows price action having moved sharply higher through overhead resistance but pausing as momentum gets ahead of itself into extreme overbought mode. The May highs at the 3850 point level remain the next target but watch for this retracement to head back to the former ATR support level around 3600 points:

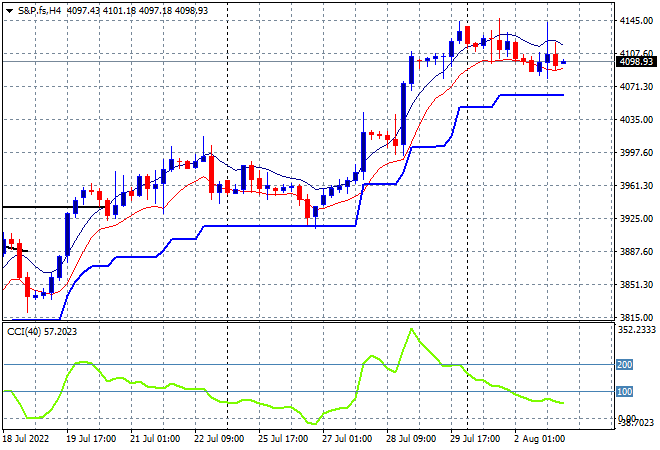

Wall Street continued its start of week pause as well with earnings and Fed comments confusing the picture across the three main markets. The Dow lost over 1% while the NASDAQ had a scratch session, the S&P500 was middle of the road with a 0.6% loss to finish at 4091 points. Price action remains above previous key resistance at the once elusive 4000 point level but the question is can it hold here as it too attempts to get back to the May highs with short term momentum retracing from its overbought mode as the delayed reaction to the recent Fed rate hike and earnings becomes a re-assessment of risk. Watch short term ATR support at the 4050 point level to come under threat here:

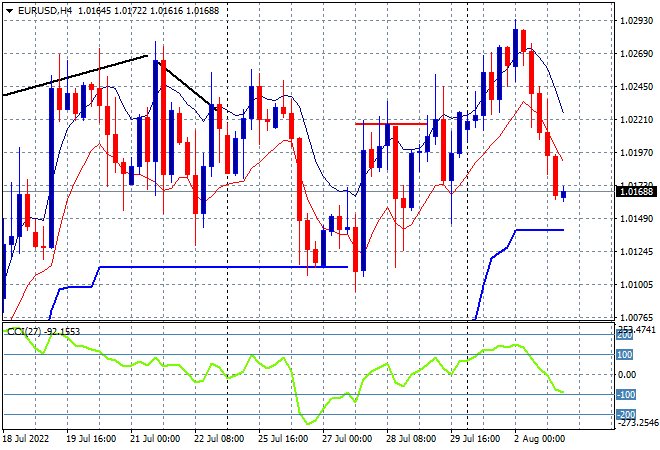

Currency markets spiked in volatility after a relatively calm period post the FOMC decision with USD becoming the defensive play of the day overnight against all the majors. Euro got out of its holding pattern briefly before selling off sharply to finish below the 1.02 handle overnight to take it back to the middle of road trend. I still contend there’s a potential short term top brewing as resistance builds past the mid 1.02 level:

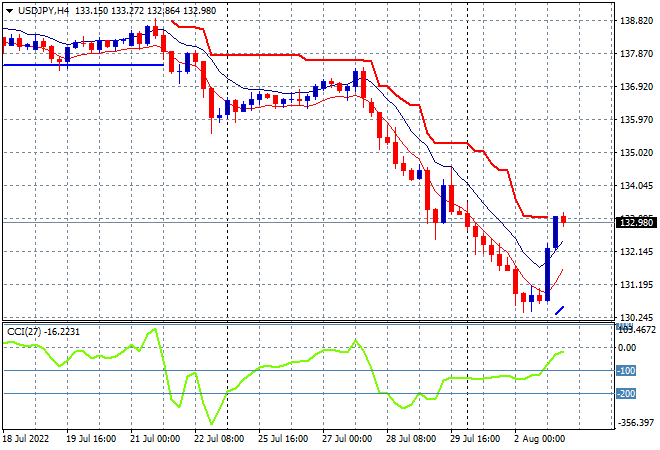

The USDJPY pair was pushed sharply higher after bottoming out briefly at the 130 level to head almost above the 133 handle early this morning. This has been a volatile period for Yen and normally this move would provide a tailwind for Japanese stocks but correlations are all over the place, with more Yen buying making sense as part of rising Asian tensions as well. Watch for any short term move above trailing ATR resistance at the 133 level proper next:

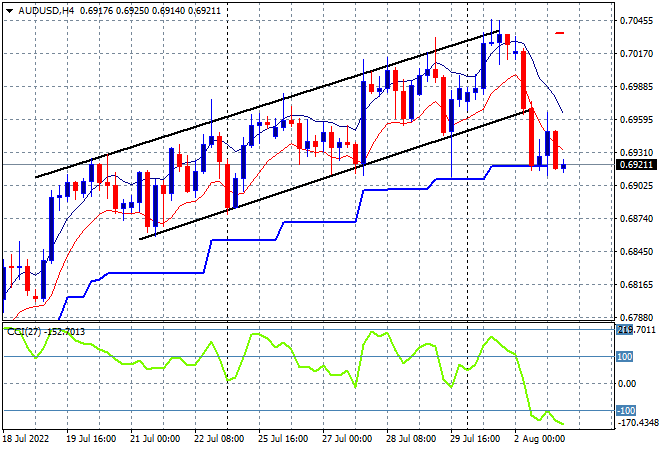

The Australian dollar had been in strong position post the Fed rate hike and indeed leading up to yesterday’s RBA interest rate meeting but this all disappeared following the big hike by the boffins at Martin Place, reinforced by the stronger USD overnight. The Pacific Peso was sent straight down to the 69 level with my call for a possible breakdown on the four hourly chart below ATR support at the 69 handle still in play here:

Oil markets are failing to recover after dicing with the $100USD per barrel level for sometime now, with Brent crude pulling back below that level overnight to remain below the June downtrend. Price action failed to continue the previous week’s bounce off the $90’s lows, with the downtrend line yet to be beaten from the June highs and nor has daily momentum got out of its negative funk, so watch for the $100 level to continue to turn into resistance here:

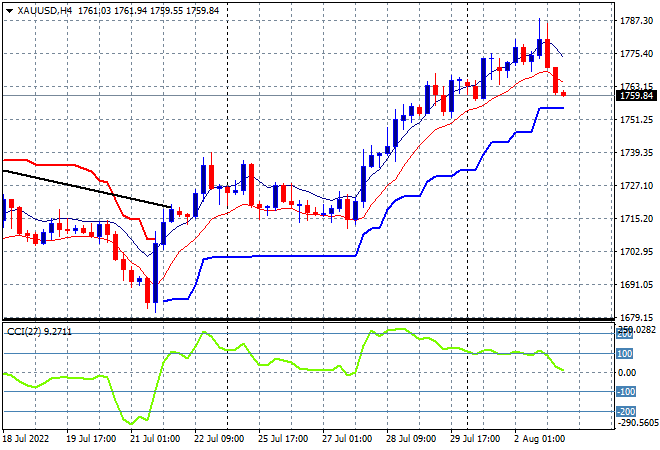

Gold pulled back overnight after almost reaching the $1800USD per ounce level on hawkish comments from the Fed, retracing back to a still respectable $1759 level. The solid move that has pushed aside short term resistance to turn this bottoming action into a proper relief rally, was yet to clear daily ATR trailing resistance, or the actual uncle point at the $1800USD per ounce level that must be beat to call this a proper medium/long term bottom. On the four hourly chart, watch trailing ATR support thats coming under stress: