Street Calls of the Week

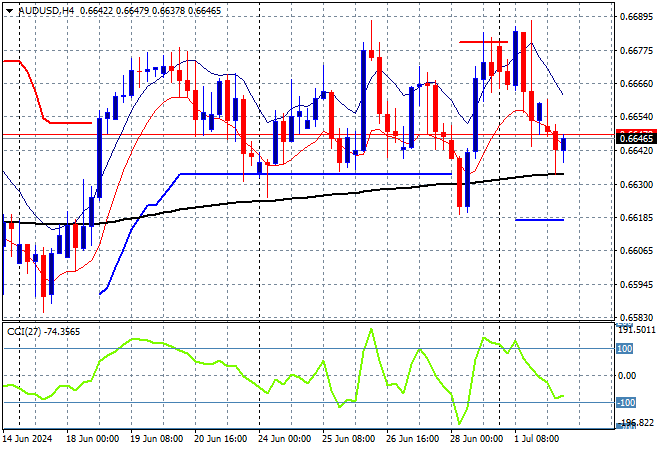

A few regional and local economic releases had little change in Asian share markets which remain quite positive and taking the lead from Wall Street, except the ASX200 which continues to lose ground. The release of the latest RBA minutes which point to a possible rate hike if July’s inflation numbers remain high, but this had nearly no impact on the Australian dollar which remains at the mid 66 cent level.

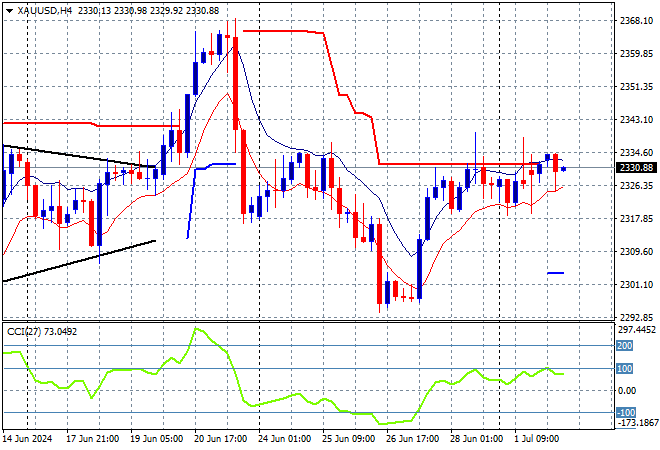

Oil prices are pushing higher with Brent crude pushing above the $86USD per barrel level while gold continues to struggle to be just above the $2330USD per ounce level:

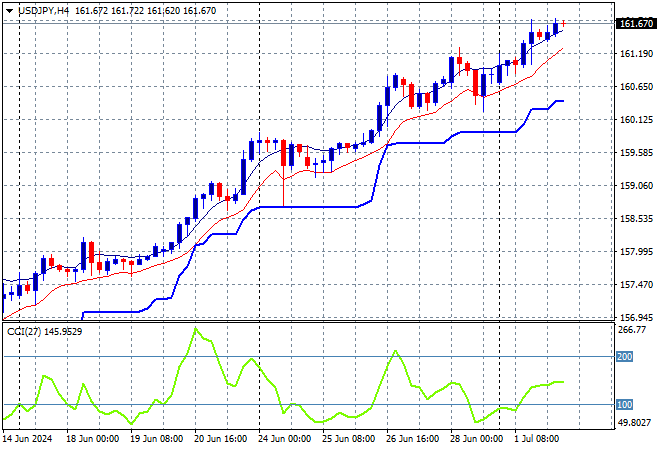

Mainland Chinese share markets are making a strong comeback with the Shanghai Composite about to break above the 3000 point barrier while the Hang Seng Index has returned from holiday to be up 0.5% at 17808 points. Meanwhile Japanese stock markets are also moving up with the Nikkei 225 closing 1% higher to 40075 points as the USDJPY pair moves above the 161 level in what seems like a straight line:

Australian stocks were again the worst performers with the ASX200 losing more than 0.3% to 7723 points while the Australian dollar is struggling to hold at the mid 66 cent level despite the somewhat hawkish mood at the RBA:

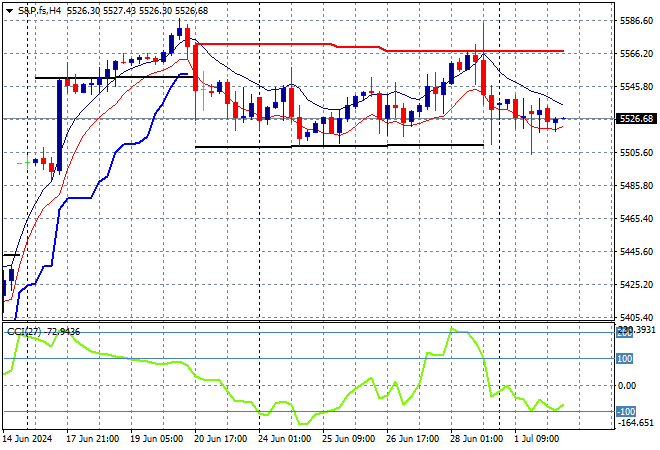

S&P and Eurostoxx futures are somewhat flat as we head into the London session with the S&P500 four hourly chart showing price action wanting to advance above the 5500 point level which continues to act as support:

The economic calendar includes Euro core inflation plus Fed Chair Powell’s speech.