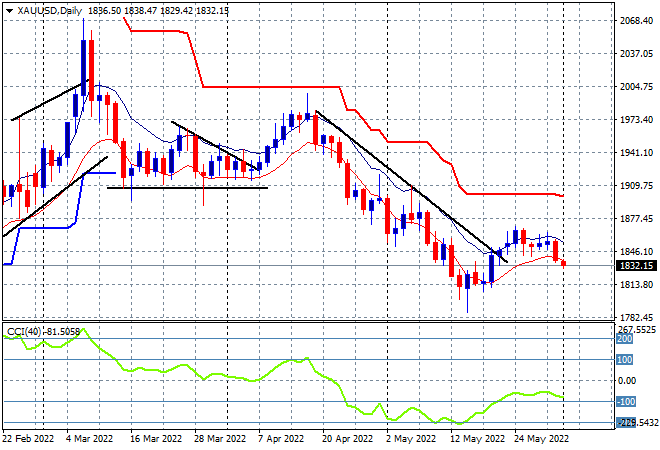

Another mixed session for Asian share markets reacting to the poor lead from Wall Street and European shares overnight which continue to be rattled by inflation concerns. In currency land, the Australian dollar took the latest GDP in its stride as Euro and Pound Sterling moved lower against USD. Oil prices are sliding with Brent crude continuing its pullback from overnight after briefly touching the $120USD per barrel level while gold has continued its rollover below the $1850USD per ounce level:

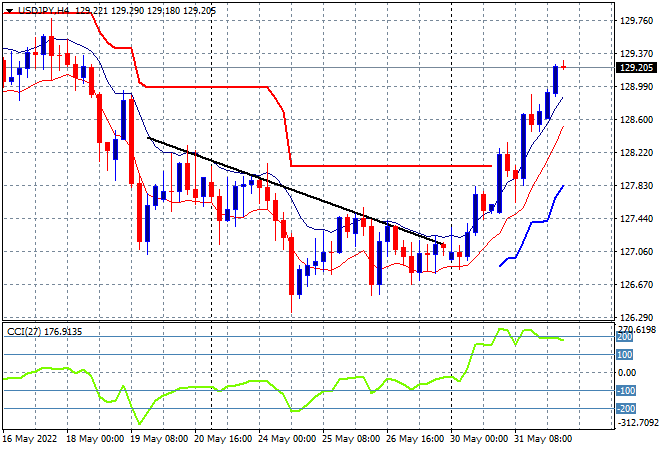

Mainland Chinese share markets are basically stuck with the Shanghai Composite currently down 0.2% to 3181 points while the Hang Seng Index has been unable to build on its recent gains, down 0.9% to 21206 points. Japanese stock markets however are doing well, with the Nikkei 225 index up more than 0.6% at 27455 points while the USDJPY pair has zoomed higher, now pushing through the 129 handle on more inflation comments from Governor Kuroda:

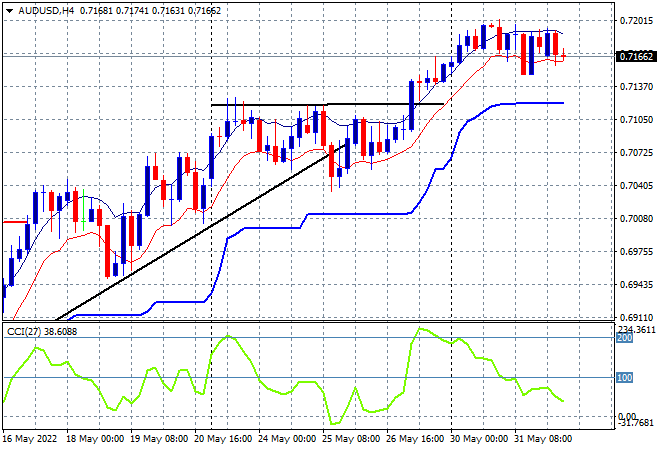

Australian stocks have oscillated all day after absorbing the latest GDP print with the ASX200 looking to close about 0.2% higher at 7219 points while the Australian dollar has paused in its move above the 71 handle against USD, still stuck just below the 72 level as momentum abates:

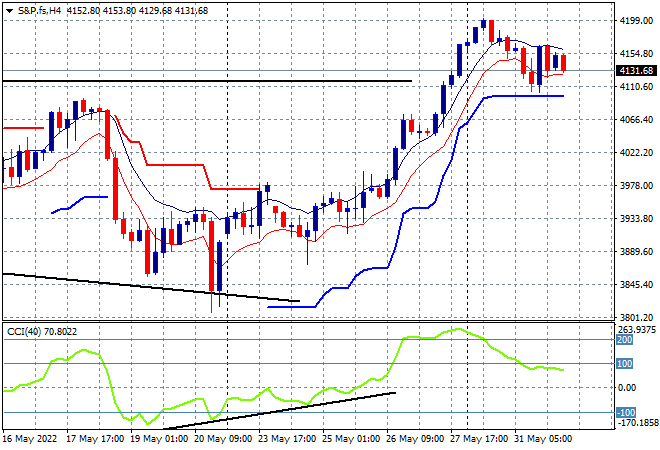

Eurostoxx and Wall Street futures are down slightly as we head into the European with the S&P 500 Futures four hourly futures chart showing price consolidating after being heavily overextended after the Friday night surge through the 4100 point level. Short term momentum has retraced from a very overextended position, but is not yet negative, so a flat start is likely on the open tonight:

The economic calendar includes German retail sales and final manufacturing PMI surveys for UK and Euro area, followed by the US ISM print.