Street Calls of the Week

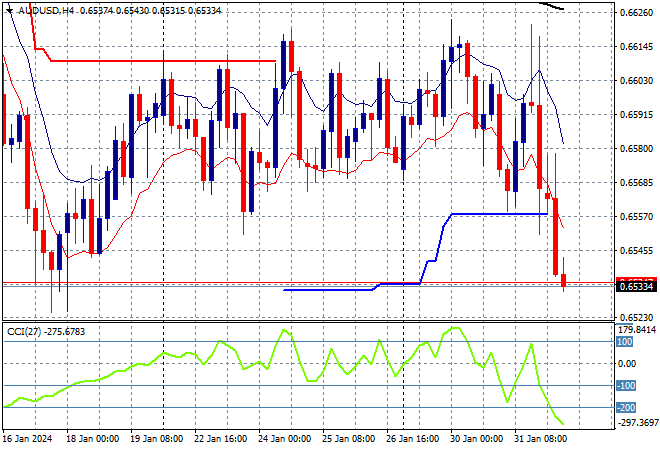

Asian share markets are reacting to the overnight moves on Wall Street and the latest FOMC meeting with rate cut expectations dampening the mood. The USD is quite mixed as a result although the Australian dollar is falling as domestic rate cut expectations hold true going into the RBA February meeting.

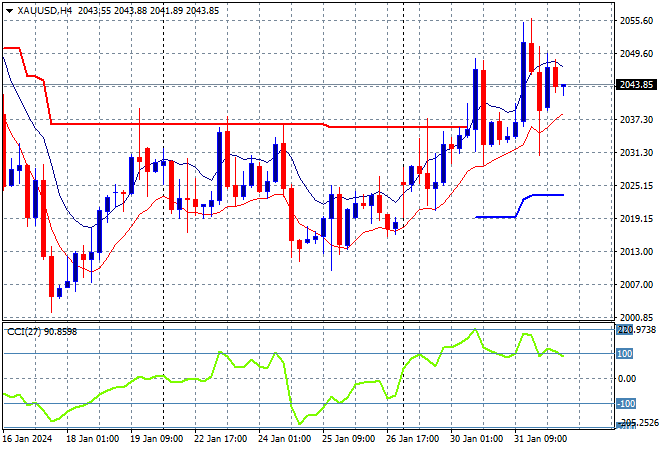

Oil prices remain volatile in the wake of Middle East tensions with Brent crude barely holding above the $80USD per barrel level while gold is still wanting to climb higher as it extends above the $2040USD per ounce level:

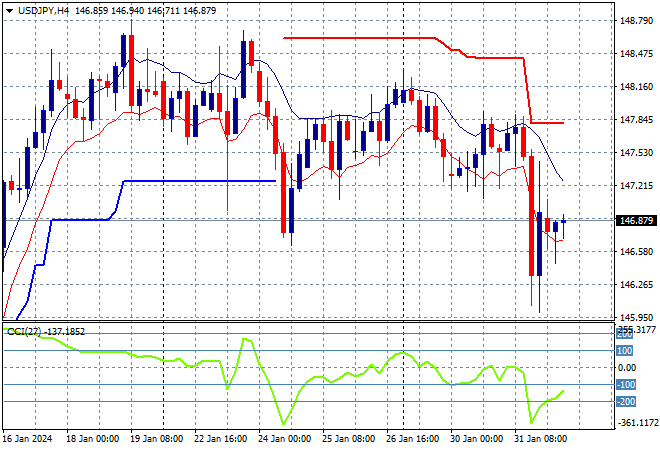

Mainland Chinese share markets are falling again in afternoon trade as the Shanghai Composite moves nearly 0.6% lower to 2774 points while in Hong Kong the Hang Seng Index managed a dip higher, currently up 0.5% to 15556 points. Japanese stock markets however pulled back in line with Wall Street with the Nikkei 225 closing 0.7% lower at 36011 points while the USDJPY pair has managed to fight back after the big losses overnight, holding just below the 147 level:

Australian stocks sold off very sharply, pulled down by the CBA mainly as the ASX200 closed more than 1.2% lower at 7588 points while the Australian dollar managed to fall down to the 66 cent level as it fails to hold on to short term support:

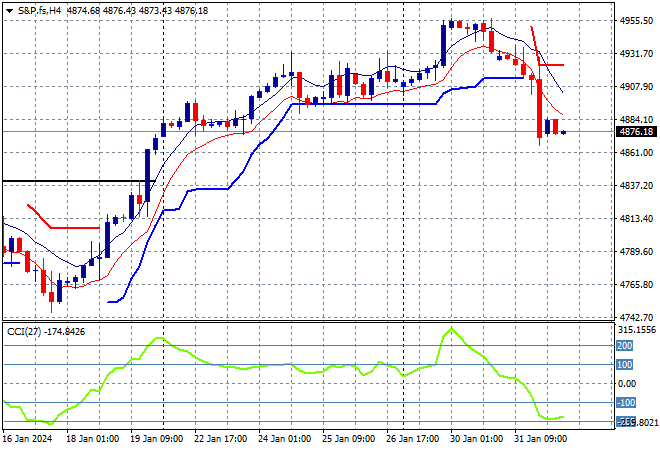

S&P and Eurostoxx futures are falling back again going into the London session with the S&P500 four hourly chart showing price action remaining below the recent daily highs as the 4900 point level:

The economic calendar includes the latest Euro core inflation print, then the BOE interest meeting, followed by US ISM manufacturing print.