The ASX had a rocky Australia Day, gaining just 0.53% over the last five days after recovering from a dip at end of trading on Wednesday.

The index is now sitting 1.74% off its 52-week-highs, although analysts warn a correction may be on the cards given recent high inflation data.

It was a good week almost across the board for markets, with only the FTSE 100 missing out on significant gains to languish with just a 0.18% increase.

The Nasdaq gained 6.08%, the Hang Seng 4.23%, the S&P500 4.14% and the Nikkei 225 3.02%.

As for ASX sectors, they were mostly in the green, Information Technology gaining 2.93% as the biggest winner for the week while Health Care (-1.75%) and Energy (-1.15%) languished in the red.

Commodities were mostly flat or down, with tin (+5.73%), aluminium (+2.63%), nickel (+2.54%) and zinc (+1.82%) bucking the trend to rise.

RBA likely to hike rates again in February

With inflation and rate hikes at the forefront of the market’s musings, City Index senior market analyst Matt Simpson breaks down the latest inflation data.

There’s no escaping the fact that Australian inflation continues to point the wrong way for the RBA and consumers alike, and today’s report should quickly eradicate hopes of an RBA pause in February.

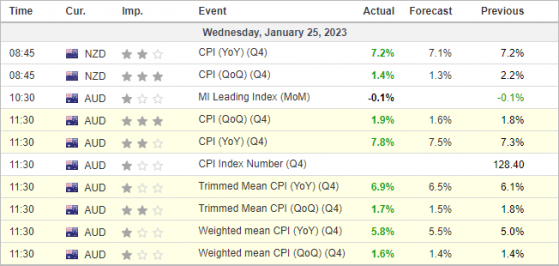

Australian/New Zealand inflation data.

Today’s inflation report is one that matches Australia’s weather. Hot.

Choose your flavour – core CPI, trimmed mean or weighted – they’re all above expectations with no obvious signs of a ‘peak’ in sight.

That has seen any hopes of an RBA pause at its February meeting evaporate, topple the ASX 200 from its arguably overbought highs and send the Aussie higher.

With higher interest likely coming for Australia, China’s reopening and higher base commodity prices, the Australian dollar could be a tough currency to bet against.

Quarterly data on Australian CPI SA year-on-year.

Prior to the meeting there were some hopes that inflation could cool following NAB’s business sentiment report, which cited easing pricing pressures.

But with CPI at 7.8% year-on-year (y/y) (and the new monthly annual read at 8.2% y/y) it is hard to get excited over peak inflation just yet.

For comparison, US inflation peaked in July 2022 and the Fed is still hiking interest rates, and with inflation continuing to rise in Australia it is hard to see how we’ll see a peak rate at 3.6% as markets had been expecting.

The OIS curve is higher across the board following the inflation report to underscore the potential of a higher terminal rate.

Market response in a nutshell:

- AUD broadly higher;

- ASX 200 erased most of yesterday’s gains; and

- GBP/AUD touched a 15-week low.

New Zealand’s Q4 inflation rose 7.2% y/y, which is slightly above 7.1% forecast yet beneath the RBNZ’s own forecast of 7.5% as of its November MPR (monetary policy report). CPI rose 1.4% quarter-on-quarter (q/q) which is below RBNZ’s forecast of 1.7% yet above market consensus of 1.3%.

As these numbers remain high it keeps the pressure on RBNZ to tame the inflationary beast, so in all likelihood NZ is still on track for a 50 basis point (bp) hike in February to take rates from 4.25% to 4.475%.

As per its own projections, the RBNZ see rates peaking at 5.5% in September, although the 9-month OIS suggest a peak rate of 5.1%.

AUD/USD 1-hour chart:

The Aussie sprang higher out of its consolidation and came close to testing 0.7100 – a scenario discussed today’s client report.

Yet 0.7100 is acting as resistance due to its ‘round number’ status, so perhaps we’ll see a slight pullback before its next leg higher.

From here bulls could seek bullish setups above the 0.7063 high in anticipation of potential break above 0.7100.

AUD/NZD daily chart:

It has been a tale of two inflation reports, and its conclusion is perfectly captured on AUD/NZD.

With AU inflation rising and NZ inflation below RBNZ’s own forecasts, AUD/NZD has turned higher.

At the time of writing the cross is testing last week’s highs and trying to close above the 100 and 200-day EMAs.

RSI (14) is holding above 50 to show positive momentum and confirming the rise higher on the price action. Next up could be the 1.1000 - 1.1045, a break above which brings 1.1200 into focus for bulls.

ASX 200 daily chart:

The ASX 200 has erased all of yesterday’s gains, and today’s inflation report could be the trigger which prompts an arguably needed correction.

It’s had a great start to the year and has seen little in the way of a pullback. Rising trading volumes have complemented its latest rally so we do not see an overall threat to the trend, but we may see a three-wave countertrend move.

A break below 7,435 would be a good first step to confirming such a pullback, with a break below 7,354 suggesting a deeper correction.

Interest rates likely to hit 4.35% before year end

As outlined by City Index senior market analyst Matt Simpson above, inflation is showing no signs of slowing to desired levels just yet.

“Today’s figures will not come as welcome news for investors, who have enjoyed a New Year rally based on cooling sentiment around inflation and China’s reopening,” Stake ASX equities analyst Dylan Zhang said.

“Today’s higher than expected headline inflation figure at 7.8%, the highest in 35 years, confirms that inflationary pressures have not peaked as expected, so we can expect rate hikes to continue or even increase.”

Zhang agrees that a 50 bp rate hike is not “unthinkable”, as with inflation running so high, the real cash rate is sitting at about -4.7%.

“If we look back to May 2022 at the start of the rate hike cycle, the real interest rate was -5.15%, not much lower than now,” Zhang explained.

“This inflation adjusted figure reflects the true cost of borrowing and saving, showing that most people are still losing purchasing power over time.”

The latest quarterly wage price numbers have shown the fastest increase in nearly a decade, according to Zhang, which – despite positive sentiment around a small slowdown in the jobs market last week – points to a terminal cash rate of 4.35% by the end of 2023.

“Turning to the markets, most sectors are likely to stay negative, but it’s likely that recent gains for tech stocks will backtrack the most,” he said.

“With a bear market looking more sustained, volatility is almost guaranteed. However, commodity and energy sectors may benefit from China’s economy restarting.

“Companies like BHP (ASX:BHP) (BHP Group Ltd (LSE:BHP, ASX:BHP)) and Rio Tinto (ASX:ASX:RIO) could also benefit from the recent appreciation in the Aussie dollar as their exports become more valuable.”

Top 100 popular Aussie stocks on Stake

Investment platform Stake has revealed the top 100 ASX stocks of 2022 on its platform, with top mining companies including Core Lithium Ltd (ASX:CXO), Pilbara Minerals Ltd (ASX:PLS) and Lake Resources NL (ASX:LKE, OTCQB:LLKKF).

"2022 was a tough year for investors as increased interest rates impacted overall returns, and given the historically low rates we've seen following the GFC, many experienced the dramatic effect that higher rates can have on the markets for the first time,” Stake market analyst Megan Stals said.

“Despite this, investors didn’t panic and continued to add to their positions, with 68% of trading activity consisting of buy orders.

“Interestingly, the busiest trading day on Stake was January 25, 2022, which coincided with ABS quarterly CPI data release — one of the first signs that inflation was accelerating.

“This could suggest that some investors were ahead of the curve when it came to rebalancing their portfolios for higher rates.”

Lithium was by far the most popular market sector in 2022, boosted by increasing demand and record-high prices.

Core Lithium was the most popular lithium stock on Stake, enjoying 78% returns for the year.

“Index funds were also popular as many investors switched to a dollar cost averaging strategy in a volatile market,” Stals said.

“The Vanguard Australian Shares Index ETF (ASX:VAS) was the most popular by far, showing how Australians are optimistic about the long term prospects of the local economy.

“The index was down slightly at -1.77%, but the overwhelming buy to sell ratio of VAS (10:1) shows that investors are committed to long term returns.

“For some, it appears they have been rewarded already, with the index having already risen by over 7% since the beginning of this year.

“Given the substantial volatility in 2022, we witnessed firsthand just how rapidly sentiment can change.

“Investors were reminded that it’s impossible to predict where the markets will go in the short term. Aussie shares have rallied so far this year, but concerns about a possible downturn remain.”

Small cap wins for the week

Anson Resources surges 38.8%

Anson Resources Ltd (ASX:ASN) enjoyed a 38.8% jump to its share price this week, having secured key land and water approvals for its lithium projects in the US, and been included in the Global X Uranium (NYSE:URA) ETF just today.

Read more here, here and here.

New Century Resources leaps 32.7%

New Century Resources Ltd (ASX:NCZ) shares surged 32.7% over the last five days on news the company is considering restarting operations at the Mt Lyell copper mine, where it believes it can generate 555,000 tonnes of copper and 320,000 ounces of gold-in-concentrate over a 25-year mine life.

Read more

Altech Chemicals jumps 22%

Altech Chemicals Ltd (ASX:ATC) gained 22% to its share price this week, after the company made broad progress in advancing its CERENERGY® battery joint venture (JV) project toward a definitive feasibility study.

Read more

Critical Resources gains 20.9%

Critical Resources Ltd (ASX:CRR) was up 20.9% this week, on news the company had generated its first batch of spodumene concentrate from the Mavis Lake Lithium Project in Canada for metallurgical test work.

Read more

Kingfisher (LON:KGF) Mining lifts 18.8%

Kingfisher Mining Ltd (ASX:KFM) shares were up 18.8% over the week, buoyed by news surface rare earth element samples from the Mick Wells Project had returned grades up to 32% total rare earth oxide (TREO).

Read more