The ASX appears to have shaken off the bears for the moment, maintaining its upward trajectory through the week to gain 3.40% over the last five days, now down just 3.45% for the year.

The other indices have made similar gains: S&P500 (+6.36%), Nasdaq (+7.48%), FTSE100 (+3.60%), and Nikkei225 (+3.63%) all rose over the week and even the Hang Seng has begun to recover, up +4.65% although still down 33.01% for the year.

The ASX200 sectors were mostly in the green this week, with only Energy (-3.21%) and Information Technology (-0.73%) missing out as Utilities (+14.41%) and Materials (+8.10%) enjoyed the biggest upward swings.

Commodities were a similar story; base and precious metals rose, none more strongly than silver (+14.74%), platinum (+13.69%), and tin (+10.11%) although copper (+9.76%) and palladium (+9.50%) weren’t far behind.

West Texas Intermediate crude was the only commodity to fall, shedding 1.98% although still up 6.04% for the year.

US capital market predicts strong growth

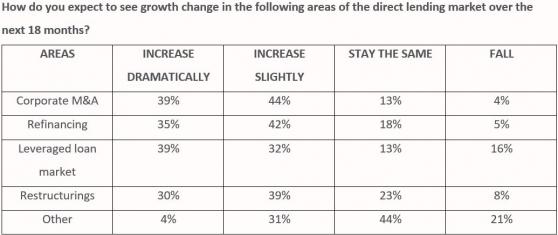

Research from the loan agency provider Ocorian has revealed positive sentiment is growing among capital market executives, who expect strong growth in the direct lending market to be led by corporate mergers and acquisitions (M&A) and refinancing.

Some 99% of market executives working in direct lending in the UK and US – that specialise in first lien loans to companies with under $1 billion in annual revenue – are predicting growth in the volume of loans, with just 1% expecting a standstill.

Ocorian’s study found that 59% predict growth of 10% or more over the next 18 months with one in seven (14%) forecasting 15% growth.

The full results are shown in the table below:

“Our research shows that improvements in regulation are seen as the biggest driver for growth in the direct lending market with senior executives working in the sector expecting a surge in the volume of loans over the next 18 months,” Ocorian head of capital markets – Americas Martin Reed said.

“Of course, regulation is not the only factor, and our research identified the need for diversification and the performance of these asset classes during volatile markets are also driving expansion.”

71% of Australians are losing trust in banks

New research from Money Transfer Comparison, a money transfer rate comparison site, has suggested Australians may be reaching their limit on the level of interest rates, fees and charges banks are levying.

Nearly three quarters (71%) of Australians say they have lost some trust in banks based on high interest rates and fees, and 74% would consider switching their accounts, loans, or transactions to more affordable online services.

While the RBA certainly holds some responsibility for high rates, banks were increasing fixed-rate loans well before the RBA mandates began to roll out, with some loan interest rates sitting 4-5% higher than the current cash rate of 2.85%.

The survey also cited high international wire fees, high exchange rates, and fees on missed payments or overdrafts as points of contention.

Younger age groups are more likely to have lost at least some level of trust in traditional banking; 74% of 18-54-year-olds, compared with 58% of over-65s respondents.

“Our research shows that the majority of customers are not blindly loyal to their banks – and will move elsewhere if rates and fees increase disproportionately,” Money Transfer Comparison founder and managing director Alon Rajic said.

“With so much information available online, and so much competition in the market, it is very easy for consumers to compare interest rates and fees across dozens of financial service providers.

“It is also fairly simple to switch to a new provider with the help of online comparison services – and I am encouraged to learn that three in four Australians are willing to make the switch to low-cost and innovative financial platforms if they can get a better deal.

“A significant consumer shift from traditional banks to innovative fintechs may also drive banks to increase their competitiveness.”

The willingness to move bank for cheaper services remained across age groups; 35-54-year age bracket were the most willing at 80%, but 73% of 18-34-year-olds and 67% of over-55 respondents said they were likely to make the jump.

Small cap wins for the week

Skyfii surges 100%

Skyfii Ltd (ASX:SKF, OTC:SFIIF) has made an impressive showing this week, doubling the SKF share price over the last five days on news the company has delivered an “industry first” whole-of-restaurant monitoring solution to McDonald’s USA.

Read more

Venture Minerals soars 40%

Venture Minerals Ltd (ASX:VMS, OTC:VTMLF) has lifted its share price 40% this week, after discovering high-grade REE mineralisation up to 12.5% TREO at Golden Grove North.

Read more

Sarytogan Graphite climbs 30.43%

Sarytogan Graphite Ltd (ASX:SGA) shares lifted more than 30% following high-grade results from the Central Graphite Zone at the company’s namesake project in Kazakhstan.

Read more

QMines shares lift 17.94%

QMines Ltd (ASX:QML)’s share price was also up this week, after the company announced it was on track to deliver Mt Chalmers and Woods Shaft JORC-compliant maiden mineral resource estimates.

Read more

Core Lithium jumps 16.37%

Core Lithium Ltd (ASX:CXO) hit a major milestone at Finniss this week, beginning transportation of spodumene DSO to Darwin Port.

Read more

Read more on Proactive Investors AU