The ASX was floundering this week, shedding 0.45% in the face of the biggest daily percentage slump in three months for US markets.

The Nasdaq and S&P 500 dropped 2.45% and 1.71% respectively, with the rest of the markets following suit: FTSE100 was down 0.62%, the Nikkei 225 1.03% and the Hang Seng reversed recent gains to fall 2.98%.

Commodities were in similarly bad shape, down almost across the board except for a 6.38% surge for West Texas Intermediate crude over the week.

The sectors were a little more mixed, with Energy leading the way up (+4.03%) alongside Information Tech (+1.84%) while Utilities took the biggest hit, shedding 2.95%, with Materials (-2.64%) close behind.

Consumer Discretionary (-1.48%) and Health Care (-1.87%) weren’t fairing much better, but the other sectors gained or lost less than 1%, only moving marginally up or down.

In the news this week

AGM attendance near doubles in twelve month

Attendance at Annual General Meetings (AGMs) in Australia has near doubled between 2021 and 2022 according to new data from Lumi, a structured finance company with an emphasis on delivering AGMs.

An analysis of 1,000 meetings across Australia has revealed the average number of shareholders per meeting almost doubled Year on Year, with a 91% increase in 2022 compared to 2021.

Engagement in meetings is up too, with the average number of messages growing 16% from 2021 to 2022.

Unsurprisingly post-COVID19, virtual and hybrid meetings were the most popular and engaging format for AGMs this year, with the number of hybrid meetings surging exponentially from just 7% in 2021 to more than one in three (38%) in 2022, and half (50%) of all meetings being conducted virtually.

“The shareholder voice is louder than ever in Australia, and it’s being driven by inclusivity and accessibility,” said Lumi Australian and New Zealand managing director Oliver Bampfield.

“Hybrid AGMs make it easier than ever for shareholders to access companies and to engage with them on the issues that matter to them.

“As a result of that accessibility, we’re seeing attendance boom, and engagement continuing to increase in 2022; on top of the unprecedented engagement we saw in 2021.

Lumi also noted a surge in younger investors, who tend to be more inclined to engage and interact with AGMs.

“Younger demographics are socially conscious and are becoming more considered in the companies they interact with and engaged in the practices of these businesses at a deeper, more meaningful level,” Bampfield said.

“They want their voices heard on issues such as ESG, executive pay, diversity, cyber security and more; and they’re using the platform of AGMs to share their views.

“Engaging with this new wave of engaged Australian shareholders will be crucial to the success of not only the AGM itself, but the year-round governance of the companies in question.

“It’s encouraging to see many organisations take this group seriously.”

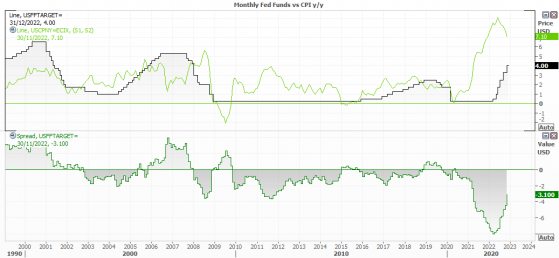

Have markets over-reacted to the US CPI data?

City Index senior market analyst Matt Simpson offers some insight on recent US CPI data and asks whether the market is a little too sensitive to inflation data at the moment.

For the second month running US CPI data was softer than expected, effectively handing the Fed an early Christmas present and providing less reasons to doubt a 50-basis-point hike this week.

At 7.1%, it remains historically high, but it’s good to see that inflation is trying to at least meet the Fed’s interest rate halfway.

The combination of softer US inflation, negative producer prices in China and, of course, China’s reopening, boded well for sentiment overnight, based on hope that a lower terminal rate may not deteriorate growth quite as much as we feared.

Whilst we can expect a nice sentiment boost today, I doubt we’ll see outlandish moves given the FOMC meeting is so soon.

Investors may be forced to reconsider their positions and perhaps look to add to their long equity exposure – but I would urge caution, as the Fed may not be as dovish regarding the terminal rate that markets are pricing in, so it’s best to remain nimble.

In a nutshell, markets now expect a lower terminal Fed rate, which has given sentiment a nice bump ahead of this week’s FOMC meeting.

Large speculators remained near record levels of net-short exposure to the 2-year treasury futures ahead of CPI, so there’s clearly been some aggressive short covering to suppress the short-end of the curve since Fed fund futures now imply a lower terminal rate of 5% (down from 5.25% the day prior).

Markets responded predictably with yields dragging the dollar broadly lower, and risk assets such as AUD, equities and oil prices are rising.

The yen benefited from a converging US-JP yield differential but was also given a boost from rising oil prices, which rallied on hopes that demand won’t be as suppressed.

I think there’s a danger that markets have over-reacted to the CPI data and that the Fed will deliver a more hawkish message than is currently being priced in.

We know they need to upwardly revise their dot plot, so the median rate for 2023 will be a core focus for many. There’s still a reasonable chance the Fed may need to raise rates above 5% - as much as I’d prefer if they didn’t.

Musk delivers Christmas pain for Tesla (NASDAQ:TSLA)

Josh Gilbert, market analyst for eToro, breaks down why Elon Musk’s recent sell down of 22 million Telsa shares (US$3.6 billion) may hurt Tesla shareholders over the Christmas break.

Overnight, Elon Musk sold another 22 million shares of Tesla worth around US$3.6 billion. With the Tesla share price in free fall, this isn’t the Christmas present investors wanted.

Musk’s sales in the past year have reached in excess of US$40 billion as the Twitter debacle continues.

The worry now of Tesla shareholders is when this selling ends, given that Twitter seems to be a never-ending money pit.

In April, Musk said he was no longer selling Tesla stock, but the selling has continued, putting Tesla shares under immense pressure.

Investors are slowly losing patience with Musk, especially as his focus is away from Tesla and directly on Twitter as he tries to justify the whopping US$44 billion price tag.

The next few months will be a huge test for Tesla to navigate weak investor confidence, the ongoing issues in China, demand question marks and the deteriorating brand reputation.

However, Tesla's Q3 earnings were up by more than 69% despite the stock falling by more than 50% this year.

So business is still booming, with EV adoption continuing to accelerate whilst Tesla’s valuation has fallen dramatically from more than 130x forward P/E (price-to-earnings) in March this year to now under 30x forward P/E.

The sale also comes in the same week as Elon Musk was knocked off the top spot of the world's richest man, leapfrogged by LVMH CEO Bernard Arnault.

Small cap wins for the week

Pursuit Minerals surges 33.3%

Pursuit Minerals Ltd (ASX:PUR) shares experienced a 33.3% increase over the week on news the company had acquired an advanced lithium brine project in Argentina.

Read more

Green Critical Minerals soars 25%

Green Critical Minerals Ltd (ASX:GCM) shares rose 25% in the last five days; the company has had a busy week, appointing a new graphite processing expert and a sales and marketing advisor for the company’s mine-to-market graphite ambitions.

Read more here, here and here.

Galena Mining jumps 24.32%

Galena Mining Ltd (ASX:G1A) shares lifted 24.32% this week, buoyed on news the company had reached 97% completion for the Abra Base Metals Mine in Western Australia.

Read more

Boadicea Resources up 20%

Boadicea Resources Ltd (ASX:BOA) shares were up 20% over the week, on news of rapid progress on the Kookaburra Well REE Project and the grant of a new lithium licence for Hanns Gully in North Queensland.

Read more here and here

Read more on Proactive Investors AU