The ASX looks set to open lower today, with ASX Futures down 0.5% or 38 points before trading begins.

All eyes will be on the RBA meeting at 2:30 pm AEST today when the central bank will hand down its interest rate decision for the month. More on that in a moment.

Global markets generally fell last night, investor sentiment dampened by continuing economic uncertainty and profit-taking after last week’s gains.

European travel and leisure shares fell by 1.3%, including Lufthansa shares which slipped 2.1%. The real loser of the day's declines was Sweden's Viaplay Group.

The streaming company's shares crumbled by a staggering 62.7% to a record low after slashing forecasts and replacing its top executive.

The UK FTSE 100 slipped 0.1%, dragged down by a 3% drop in precious metal miners’ stocks.

On the other side of the Atlantic, US share markets stumbled as investors considered potential pauses in the Federal Reserve's interest rate hikes at its next policy meeting.

Further complicating matters, the Institute for Supply Management's overall gauge of services has unexpectedly fallen to the lowest levels of the year, indicating the economy isn’t as healthy as most would like.

Tech giants weren't immune to the shifting tides. Apple shares (NASDAQ:AAPL) (-0.8%) saw a brief apex before succumbing to gravity, despite the grand reveal of a new virtual reality headset at their annual Worldwide Developers Conference.

Intel (NASDAQ:INTC) (-4.6%) suffered losses as Apple announced its new chip, with Nvidia (-0.4%) also correcting after surging 36.5% in the last 30 days.

Other prominent losers included software engineering firm Epam Systems (NYSE:EPAM), whose shares plunged by 21.7% amid further deterioration in near-term demand.

Banks and oil stocks also fell, with JP Morgan Chase (NYSE:JPM) losing -1%, Goldman Sachs (NYSE:NYSE:GS) -0.6%, Exxon Mobil (NYSE:XOM) -0.4% and Chevron (NYSE:CVX) -0.5%.

In the news

Economists mixed on June RBA cash hike

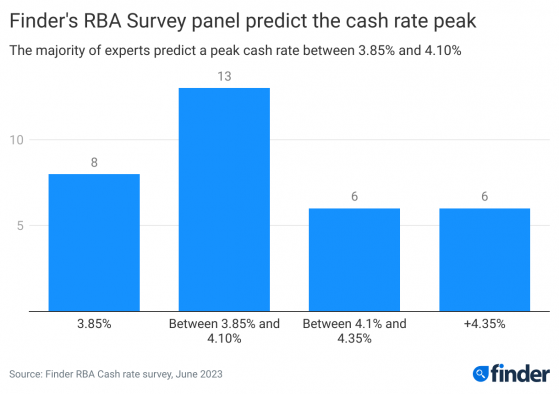

Recent research by Finder.com surveying 39 experts and economists on cash rate movements has offered mixed sentiment on the RBA’s next cash rate decision.

A slim majority of 56% believed the RBA will hold the cash rate this month, with 44% expecting an increase.

To dig a little deeper, more than a third (38%) of experts believe the RBA will hike the cash rate by a further 25 basis points, bringing the cash rate to 4.10%.

Looking beyond this month, two in three surveyed analysts believed July would see the cash rate hold steady.

“Our panel continues to be heavily divided – demonstrating the uncertainty in the market around the RBA’s strategy,” Finder head of consumer research Graham Cooke said.

“Despite the RBA board being heavily criticised due to its unprecedented series of rate hikes, the recent uptick in inflation may be enough to trigger another rate increase.

“Our experts forecast a maximum of two more rate rises this year. After that, the flood waters should start to subside.”

“Although inflation has moderated, it still remains at levels well above that seen prior to the COVID-19 pandemic,” UNSW Economics PhD DR Nalini Prasad said, “of particular concern is services inflation which continues to be strong.”

“Since labour is the main component of services, this points to higher labour costs. This would be concerning to the RBA.”

Emerson (NYSE:EMR) Economics managing director Craig Emerson is a little more optimistic.

“The economy is slowing already with much more contraction yet to come through from previous cash rate increases,” he said.

Either way, inflation does appear to be dropping, although 85% of Finder’s panellists don’t expect inflation to hit the RBA’s target of 2% until at least the June quarter next year.

“The long-term forecast from our panel is for inflation to continue to decline, which should mean the cash rate does too,” Finder’s Graham Cooke said.

“This will be welcome news to those still in a variable mortgage but may be bad news for savers.”

Yields, currency and commodities

US government bond yields for short-term bonds declined after new orders slowed in May, which could assist the US central bank in managing high inflation. The US 10-year Treasury yield remained near 3.69%, while the US 2-year Treasury yield fell to 4.47%.

In foreign exchange markets, currencies were stronger against the US dollar.

The Euro (US$1.0710) and the Aussie dollar (US$0.6615) appreciated, as did the Japanese yen (JPY139.60).

Oil rose on Monday night as Saudi Arabia cut production by another million barrels a day, intending to bump up crude values in the face of global headwinds.

Brent responded with a 0.8% or US$0.58 increase, while US Nymex gained 0.6% or US$0.41.

Base metal prices were mixed, with copper futures rising 1.1% but aluminium futures shedding 1.3%.

Gold rose once again, continuing its strong showing this year and rising by 0.2% or US$4.70 to US$1,974 an ounce.

Iron ore also gained despite dire warnings of a crash in recent days, lifting 1% of US$1.05 to hit US$107.38 a tonne on the back of renewed support for China’s beleaguered property market.

Read more on Proactive Investors AU