This week is expected to be relatively quiet. The most notable data release will be the ISM Manufacturing Report on Friday, January 3. Early in the week, we’ll get some housing data, while continuing jobless claims on January 2 will likely draw attention. Last week’s claims spiked to 1.91 million, though these figures are often revised downward. If claims unexpectedly increase, it could signal a potential slowdown in the labor market, but the broader data suggests continued strength.

The December jobs report from the BLS won’t arrive until January 10, making this week’s ISM data—expected at 48.2, slightly down from 48.4—one of the few key indicators for now.

Equities and Market Performance

Last Friday, equity markets opened sharply lower but managed a modest rebound by the close. The S&P 500 saw a notable late-day rally, gaining about 30-40 basis points in the final 15 minutes, driven by a $2 billion buy imbalance. Despite this, market breadth was weak: only 48 stocks advanced, while 452 declined, and three were unchanged.

Major contributors to losses included tech giants like Nvidia (NASDAQ:NVDA), Tesla (NASDAQ:TSLA), Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Amazon (NASDAQ:AMZN). The Bloomberg 500 index mirrored this weakness, emphasizing the challenging day for equities.

S&P 500 Futures and Financing Trends

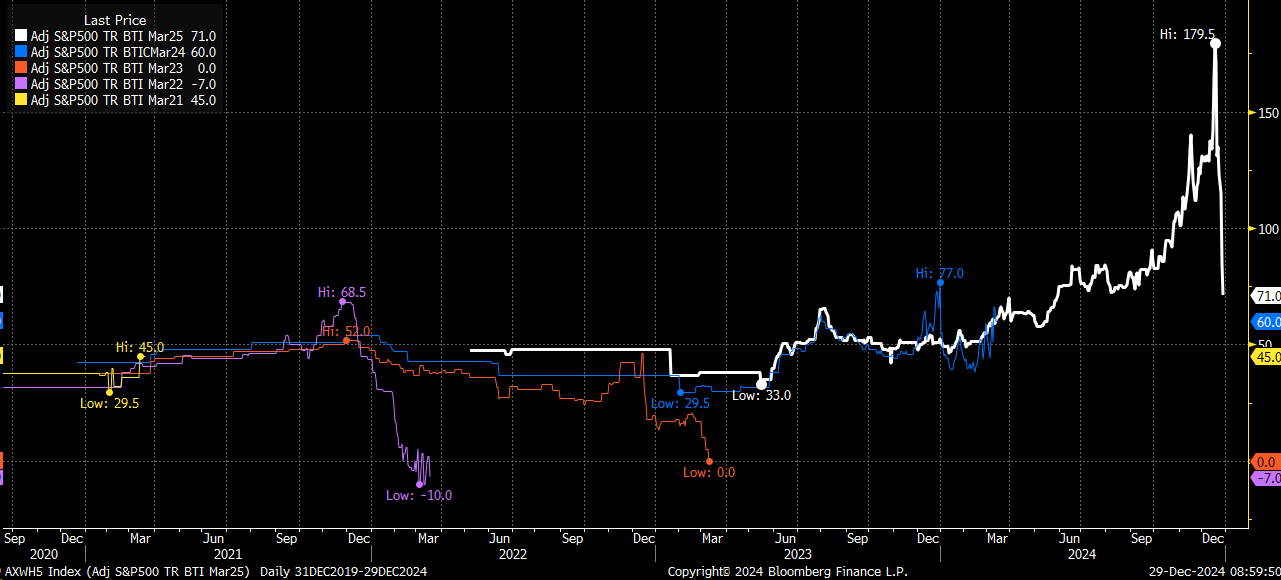

One noteworthy trend has been the sharp decline in BTIC S&P 500 total return futures contracts for March 2025. These contracts, which are used to measure equity financing costs, have fallen from a high of 179.5 to just 71 as of Friday’s close. Historically, such contracts trade within tighter ranges, suggesting that this year’s movement is more extreme.

This could indicate end-of-year deleveraging or reduced demand for margin and leverage. If this trend persists, it may reflect broader market dynamics, such as tightening liquidity or adjustments in dealer balance sheets. We’ll have more clarity when FINRA margin balance data is released in mid-January.

Interest Rates and the Yield Curve

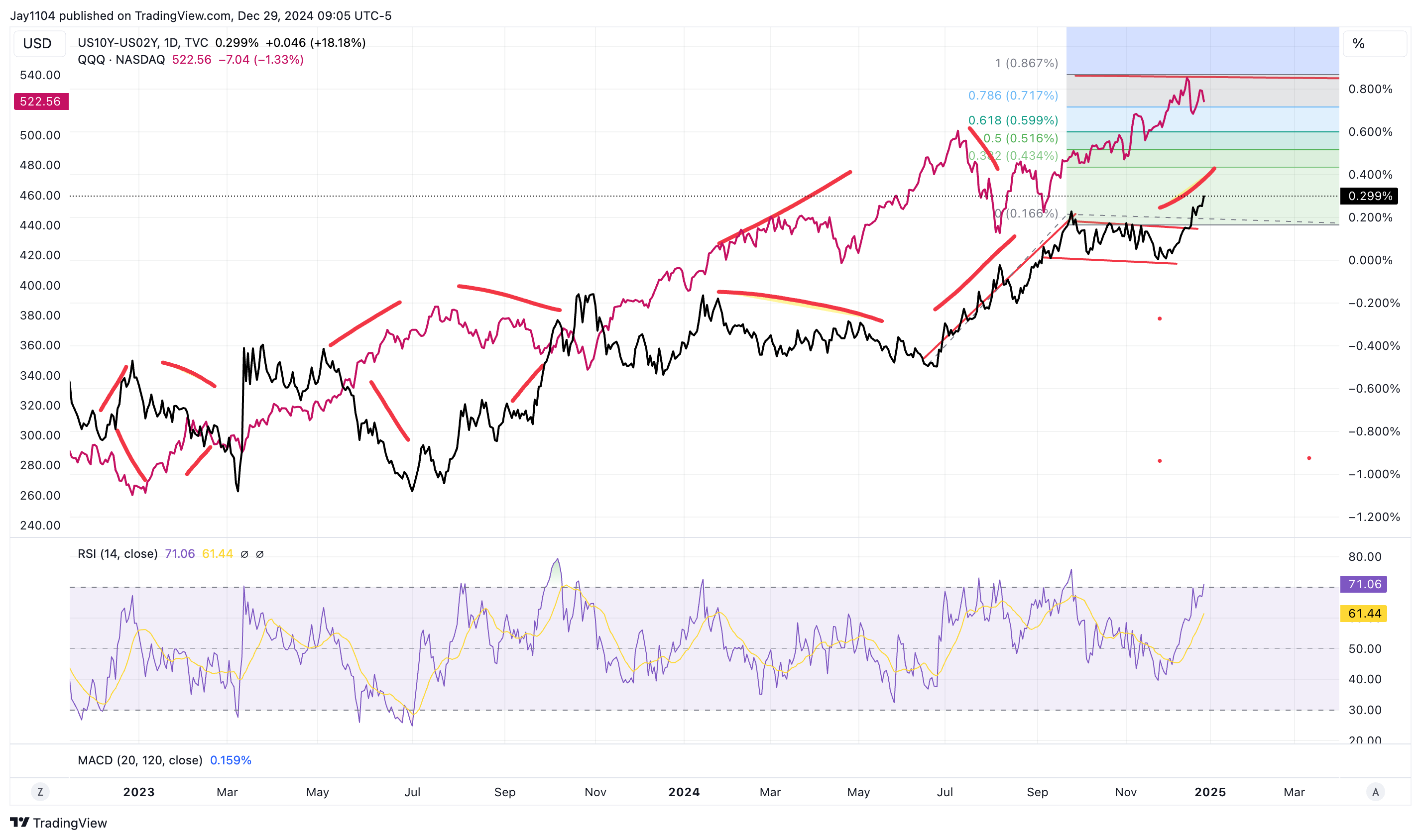

The 30-year Treasury yield hit its highest level since November 2023, closing at 4.82%. Unlike late 2023, when yields were falling, they are now rising, potentially heading back above 5%. A steepening yield curve, especially in the 30-year minus 3-month and 10-year minus 3-month spreads, is unfolding rapidly.

This bear steepener—where longer-term yields rise faster than short-term ones—can weigh on equities. Historically, equities struggle during periods of steepening, especially when rates at the back end of the curve lead the way higher.

Key Market Signals and Historical Parallels

Forward-looking contracts, such as the 3-month Treasury bill vs. 18-month forward contracts, suggest rates could rise by about 20 basis points over the next 18 months. Similarly, 12-month forward contracts imply a 50% chance of a rate hike within the next year. This may explain the reduced demand for leverage, as equity financing costs are unlikely to decrease.

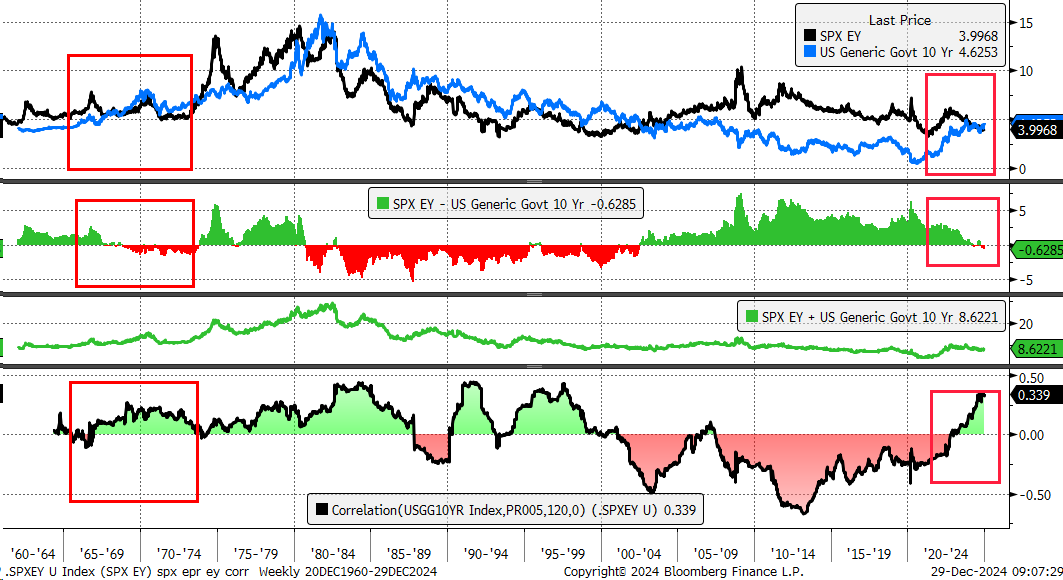

Drawing parallels to the 1960s, rising rates and a deepening yield curve contributed to negative equity risk premiums and significant market challenges during that era.

We could see similar dynamics unfold in the coming months if these trends persist.

Final Thoughts

Have a great Sunday, and we’ll see you on Monday!

Key Terms:

1. ISM Manufacturing PMI Diffusion Index: Tracks monthly changes in manufacturing sector output, with specific sensitivity to input costs, new orders, and employment indices. A reading below 50 implies contraction, impacting GDP projections.

2. Continuing Claims vs. Revisions: Continuing unemployment claims provide a lagging labor market indicator, with upward revisions offering insights into structural shifts in employment conditions.

3. TICS (S&P 500 Total (EPA:TTEF) Return Futures): A proxy for equity financing costs priced in basis points above or below the Federal Funds Rate. Their sharp declines often reflect year-end deleveraging or tightening of liquidity conditions in equity markets.

4.FINRA Reg T Margin Balances: Represents investor leverage trends; declining balances typically signal a reduction in speculative positioning or forced deleveraging by brokers.

5. Long-End Treasury Yields: The 30-year yield-breaking resistance levels (e.g., 4.82%) suggests structural changes in inflation expectations, growth forecasts, and term premium dynamics.

6. Bear Steepener Dynamics: Rapid increases in long-term yields relative to short-term rates, often caused by rising term premiums or shifts in real yield expectations, exerting pressure on duration-heavy assets like tech equities.

7. Forward Curve Dynamics (18-Month Forward 3-Month Rates): Market-implied rate hikes priced into forward curves suggest higher expectations for monetary policy tightening relative to the spot curve.

8. Equity Gamma Exposure (GEX): The late-session rally attributed to buy-side gamma effects near critical strike levels ($59.50) highlights the role of dealer hedging dynamics in short-term price action.

9. Dealer Repo Activity and Balance Sheet Constraints: Declines in dealer-reported equity repo activity signal reduced risk appetite and liquidity constraints, often tied to year-end regulatory pressures or capital reserve adjustments.

10. Yield Curve Bear Flattening vs. Historical ERP Dynamics: Comparing the negative equity risk premium during the 1960s stagflationary environment to current dynamics underscores the risks of tightening financial conditions in a high-rate regime.