(Bloomberg) -- It was a total of 102 words that erased about $1.36 trillion from global stocks this week.

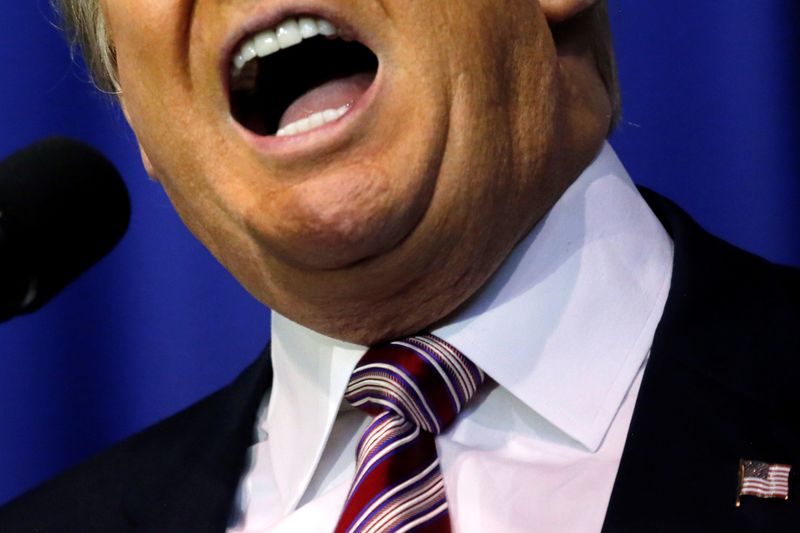

Equity markets across the world were roiled by President Donald Trump’s tweets Sunday that he would boost tariffs on Chinese goods. Not only did they spark losses, but volatility came roaring back with a vengeance, with the Cboe Volatility Index rising 50 percent in two days to breach 20 for the first time since January.

Risks surrounding U.S.-China trade relations -- which were not on investors’ radar as late as last week -- came flooding back. Markets had been lulled into a state of complacency in recent weeks as confidence grew the trade discussions were going well, major central banks were dovish and U.S. corporate earnings were coming in better-than-expected.

“The latest shift adds a new dimension of uncertainty to what most market participants were assuming was a done deal,” said Eleanor Creagh, Sydney-based Australia market strategist at Saxo Capital Markets. “Something shifted over the weekend, and it could be wishful thinking to keep drinking from the glass half full.”

All 102 words that shook global markets:

Depending on who you talk to, the events of the last two days are only a speed bump that gave back a fraction of this year’s market rally or have raised a valid question of whether the bull market can continue.

Kerry Craig, a global market strategist at JPMorgan (NYSE:JPM) Asset Management, still believes a trade deal can be reached, but it could take longer than expected. “The pull back in markets was due given how hard global equities had rallied and investors may have been looking for an excuse to take some profits,” he said.

Given the slump in shares, it’s clear some investors are repositioning.

“My feeling is that investors are lightening their portfolios as a precaution,” said Jeffrey Halley, senior market analyst at Oanda Asia Pacific.

Halley sees a “middle path” for markets with an underlying sentiment that a deal will get done. And, sparks of activity could lift growth and earnings expectations -- “I wouldn’t abandon the equity markets,” said JPMorgan’s Craig.

Furthermore, the dovish central bank pivot means its a different market now than last year when both the U.S. and China were tightening policy, according to Alex Wong, Hong Kong-based director of asset management at Ample Capital Ltd.

“Even if no deal could be reached, the impact won’t be that severe,” Wong said in a telephone interview. “I’m not that worried.”

Everything now depends on what happens this Thursday and Friday when negotiations between two of the world’s largest economies meet in Washington.

“This sets us up for a potentially very emotional week,” Oanda’s Halley said.