- October has opened with stocks signaling a correction amid rising geopolitical tensions.

- Watch key support levels in the S&P 500 and Nasdaq 100 as futures remain mixed ahead of a crucial jobs report.

- With a Fed rate decision on the horizon, expect increased volatility.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

As October kicks off, stock markets are shifting gears, indicating the onset of a correction phase after a lengthy bull run.

The escalating geopolitical tensions in the Middle East are fueling risk aversion among investors, prompting a flight to safety as the US dollar regains strength.

Currently, S&P 500 and Nasdaq 100 futures are slightly up ahead of a crucial jobs report.

This report will influence the Federal Reserve's decision on whether to cut rates by 50 or 25 basis points in November.

If the figures align with consensus expectations, they are unlikely to alter the broader macroeconomic outlook dramatically.

Yesterday's labor market data offered further indications of a cooling trend, with weekly jobless claims ticking up slightly from the previous week.

This backdrop sets the stage for a potentially volatile trading session today. Traders should remain vigilant for fluctuations in volatility while monitoring key support levels in these major indexes.

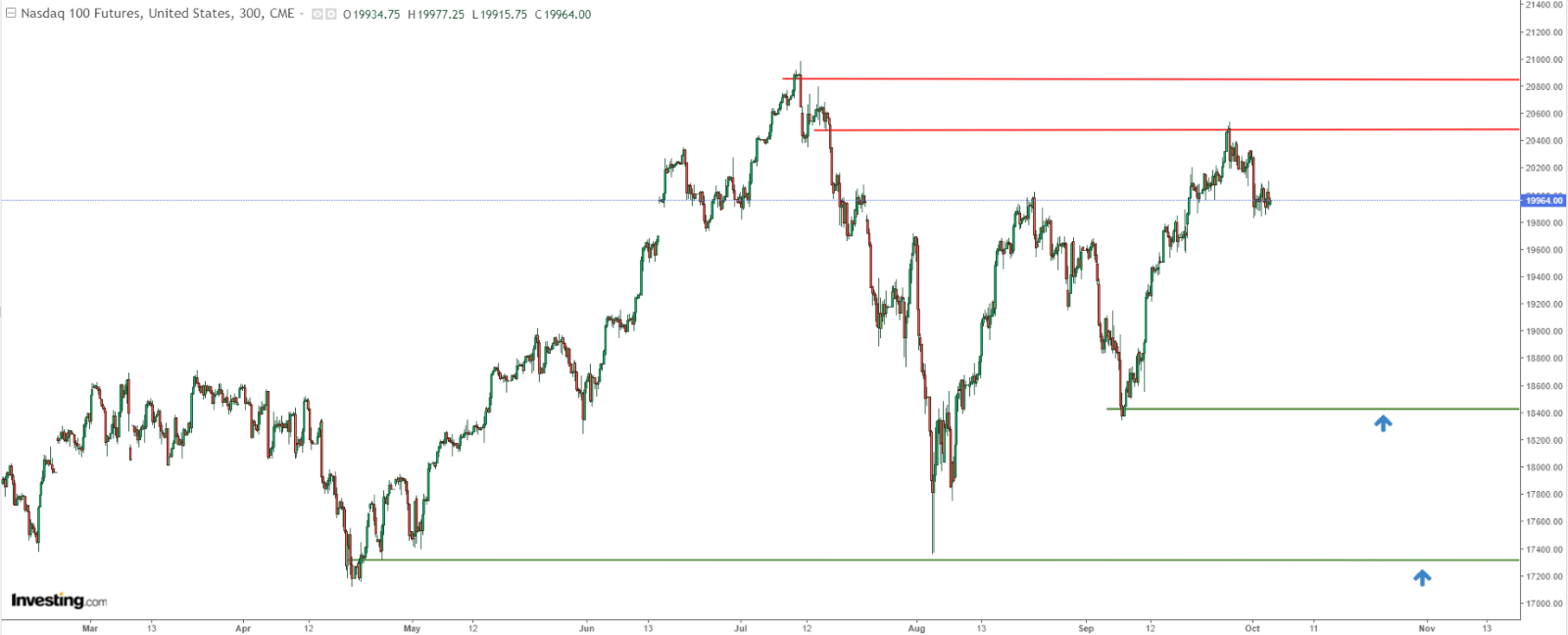

Nasdaq 100: Bulls Take a Breather for Now

After an impressive surge, the Nasdaq 100 finds itself in a corrective phase, as the supply zone around 20,500 points comes under pressure.

Although the correction has slowed, a negative scenario could see the index retreat to around 18,400 points, marking the first area of concern for traders.

A breakout above 20,500 points would signal a return to the bullish trend, likely triggering a fresh attempt to reach historical highs.

S&P 500: Bulls Hold Strong

Among the major indices, the S&P 500 demonstrates remarkable resilience, registering only a modest 1% correction in recent days. Currently, it’s resting on a support level of 5,760 points, established by previous historical highs.

If this support breaks, the index could head south toward the next target around 5,420 points, where September’s lows lie. However, the overarching bullish trend remains intact, and no significant indicators suggest a permanent reversal.

Correction Gains Momentum on DAX

The DAX, Germany's main stock index, reached new historical highs around 19,500 points, only to face a dynamic correction that has wiped out most of last week’s gains.

The index is now testing a crucial support level at 19,000 points. A breach here seems increasingly likely, which could further fuel downward momentum.

As declines gather pace, traders should keep an eye on the local lows around 18,200 points. Should demand bounce back in this area, it could present a compelling buying opportunity aligned with the long-term bullish trend.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services.