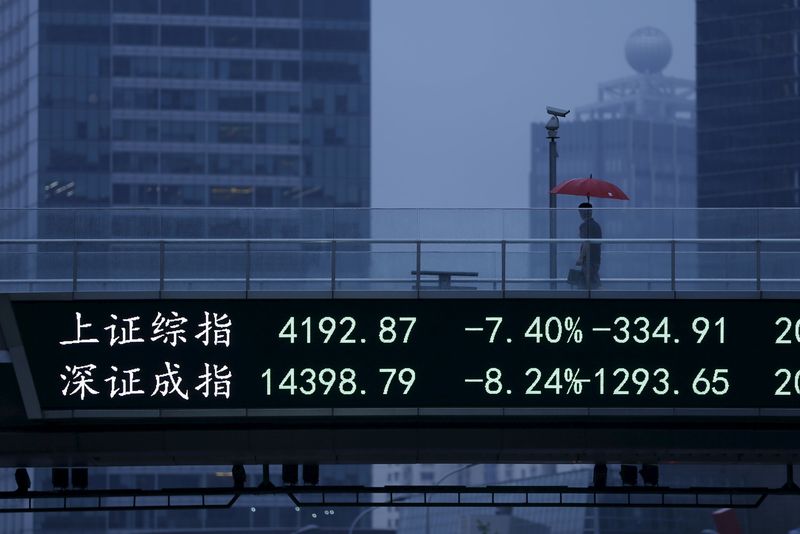

(Bloomberg) -- Chinese stocks plunged on Monday as mounting concern over a Covid outbreak at home and rising global interest rates added to persistent regulatory headwinds.

The tech sector was once again at the forefront of losses, with the Hang Seng Tech Index losing more than 4% in early Hong Kong trading. The broader Hang Seng Index was down 2.5%, while China’s benchmark CSI 300 Index also slumped as much as 3%.

Investors in Chinese equities are confronting multiple challenges at home and broad, causing the market to plunge again despite the mid-March vows from authorities to support the economy and the battered property and tech sectors. Record virus infections in Shanghai, a more-than-expected jump in China factory gate prices, concerns about tech regulations and surging U.S. yields all combined to trigger Monday’s losses.

“There’s very little to be optimistic about,” said Zhang Fushen, senior analyst at Shanghai PD Fortune Asset Management (LLP). “The shine from policy pledges of a few weeks ago is starting to wear off, especially with the situation in Shanghai. There is a gloomy atmosphere.”

The Hang Seng Tech gauge was on course for a fourth day of losses. That’s after China’s State Council issued new guidelines over the weekend on removing data monopoly at platform companies and preventing them from restricting competition.

Investors are also keenly watching for developments related to a potential delisting of Chinese companies at American exchanges as Beijing vowed to defuse risks with a radical proposal.

“China tech stocks are facing two big hurdles that haven’t been priced in the shares,” said Castor Pang, head of research at Core Pacific Yamaichi International Hong Kong Ltd., citing the uncertain pace of rate hikes in the U.S. and the delisting risks. Beijing is being cooperative, but “it’s unclear whether the U.S. Securities and Exchange and Commission will remain tough and force these companies to delist from the U.S. To me, that possibility can’t be ruled out yet.”

READ: China Traders Gear Up to Add Stocks Betting Worst Is Over

©2022 Bloomberg L.P.