By Chuck Mikolajczak

NEW YORK (Reuters) -A gauge of global stocks climbed for the first time in four sessions on Friday as equities steadied after a sharp selloff and U.S. economic data showed an improving inflation landscape, sending Treasury yields lower.

The Commerce Department said the personal consumption expenditures (PCE) price index, the Federal Reserve's preferred inflation gauge, edged 0.1% higher last month after being unchanged in May, matching estimates of economists polled by Reuters.

In the 12 months through June, the PCE price index climbed 2.5%, also in line with expectations, after rising 2.6% in May.

The data likely sets the stage for the Fed to begin cutting rates in September, as the market widely expects.

"The more recent trend is building upon the market's confidence that we are on a trajectory that would get us to 2% over the long run," said Vail Hartman, interest rate strategist at BMO Capital Markets in New York.

"This is just another month of good inflation data from the Fed's preferred measure of inflation."

The Fed is scheduled to hold its next policy meeting at the end of July. Markets see a less than 5% chance for a rate cut of at least 25 basis points (bps) at that meeting, but are fully pricing in a September cut, according to CME's FedWatch Tool.

On Wall Street, U.S. stocks closed with strong gains, as small cap stocks were once again among the best performers in a market that continued its recent rotation into undervalued names.

However, megacap names also showed signs of stabilizing and the Nasdaq gained about 1% after three straight days of declines that sent the index down nearly 5%.

The Dow Jones Industrial Average rose 654.27 points, or 1.64%, to 40,589.34, the S&P 500 gained 59.88 points, or 1.11%, to 5,459.10 and the Nasdaq Composite gained 176.16 points, or 1.03%, to 17,357.88.

Despite the gains, the S&P 500 was down 0.83% for the week. The Russell 2000, however, secured a third straight week of gains in which it has surged 11.51%, its strongest three-week performance since August 2022.

European shares closed higher, buoyed in part by corporate earnings after two consecutive sessions of declines, but still on track for a weekly decline.

MSCI's gauge of stocks across the globe rose 6.69 points, or 0.84%, to 803.47 but was on pace for its second straight weekly fall.

The STOXX 600 index closed up 0.83% but finished down 0.27% on the week. Europe's broad FTSEurofirst 300 index ended 17.10 points, or 0.85%, higher.

U.S. Treasury yields were lower after the inflation data. The yield on benchmark U.S. 10-year notes fell 6.2 basis points to 4.194% its second straight daily fall, but was slightly higher on the week.

The 2-year note yield, which typically moves in step with interest rate expectations, fell 5.6 basis points to 4.3873% for its fourth weekly decline in the past five.

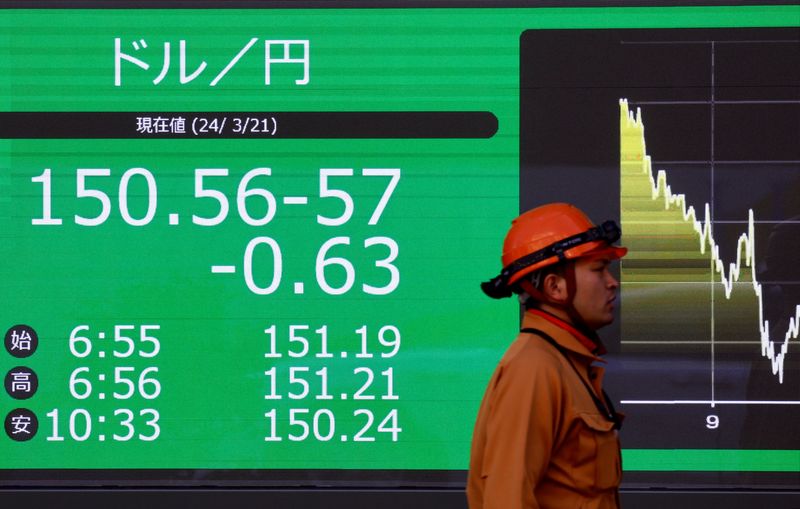

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, slipped 0.03% at 104.30, with the euro up 0.1% at $1.0855.

The greenback also weakened 0.1% at 153.78 against the yen after the inflation PCE data and was on track for its biggest weekly percentage drop against the Japanese currency since early May.

The yen has strengthened on expectations a cut from the Fed is on the horizon while the Bank of Japan is expected to begin tightening policy by raising rates and reducing its bond purchases in the coming months. In addition, suspected BOJ intervention earlier this month also supported the currency.

Sterling strengthened 0.16% at $1.2871. The Bank of England will also hold a policy meeting next week, although uncertainty surrounds what action the central bank may take with regard to rates.

U.S. crude oil settled down 1.43% to $77.16 a barrel and Brent fell 1.51% on the day to end at $81.13 per barrel on declining Chinese demand concerns and hopes of a Gaza ceasefire agreement.