(Bloomberg) -- Australia’s consumer prices rose slightly less than forecast last quarter, suggesting the central bank is likely to keep interest rates on hold.

Key Points:

- Quarterly consumer price index climbed 0.4% vs estimate of 0.5%; annual CPI climbed 1.9% vs forecast 2%

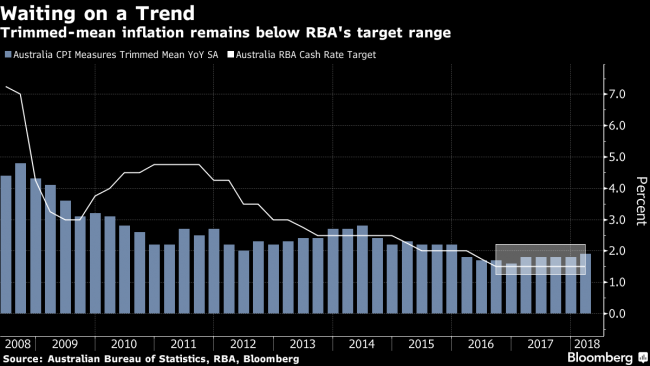

- Quarterly trimmed-mean inflation, the key core measure, rose 0.5% vs estimated 0.5%; annual trimmed mean advanced 1.9% vs forecast 1.8%

- Quarterly weighted-median gauge, also a core measure, rose 0.5% vs estimated 0.5%, while annual gauge gained 2% vs forecast 1.9%

- Aussie dollar was little changed immediately after report and bought 76.07 U.S. cents at 12:20 p.m. in Sydney

Big Picture

The data reflect Governor Philip Lowe’s view that inflation will only gradually return to the midpoint of the Reserve Bank of Australia’s 2 percent to 3 percent target amid weak price growth that’s affecting much of the developed world. Policy makers are banking on a record-low cash rate to boost hiring and tighten the labor market, which should in time spur wage growth and inflation. Traders are pricing in only about a one-in-three chance of the RBA tightening at the end of this year.

Economist Takeaways

- “The Reserve Bank won’t be touching interest rates any time soon,” said Craig James at Commonwealth Bank of Australia’s securities unit. “Inflation remains low and it is still struggling to get into the 2-3 percent target band.”

- “With no signs of an acceleration in headline inflation, and the trimmed and weighted mean also stuck at around 2 percent, the RBA is likely to stand fast at 1.5 percent for quite some time,” said Sarah Hunter at BIS Oxford Economics, which doesn’t forecast a rate hike until the fourth quarter of 2019.

Other Details

- Biggest price rises in quarter were secondary education (+3.3%), gas and other household fuels (+6%) and pharmaceutical products (+5.6%)

- Most significant falls this were international holiday travel and accommodation (-2.4%), audio, visual, and computing media and services (-6.1%) and furniture (-2.8%)

- Tradable goods prices, which are impacted by the currency and other international factors, fell 0.4% on the quarter and 0.5% from a year earlier

- Non-tradables, which are affected by domestic variables like utilities prices, rose 0.8% in the three months and 3.1% over the 12-month period